As somebody who works on the delivery of carbon capture, utilisation and storage (CCUS) projects every day, it’s fair to say I’m quite familiar with the criticisms levelled at the sector. From questions of financial viability, delivery challenges and scaling up, right through to the ‘get out of jail free’ accusation as it relates to fossil fuels, these criticisms range widely, both in their subject and ferocity.

However, the conclusion of many critics – that CCUS should be resisted as an option – is outdated. To remain aligned with the IEA’s target indicator for its sustainable development scenario, 5,635 megatons of carbon dioxide will need to be captured globally per year by 2050, more than total US CO2 emissions in 2023. So, if CCUS projects are critical to reaching global net zero goals, the real question to be asked is not of the technology, but rather: how is this going to happen?

Agnostic and effective

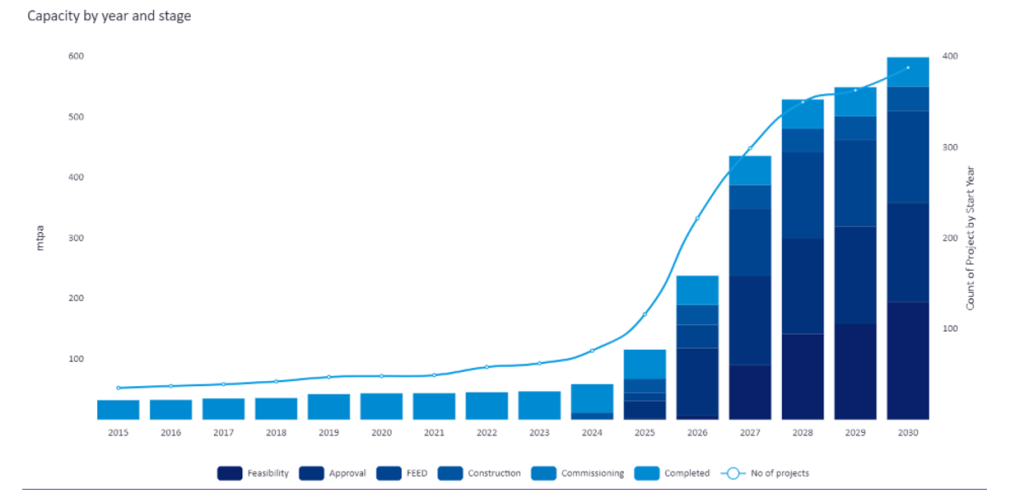

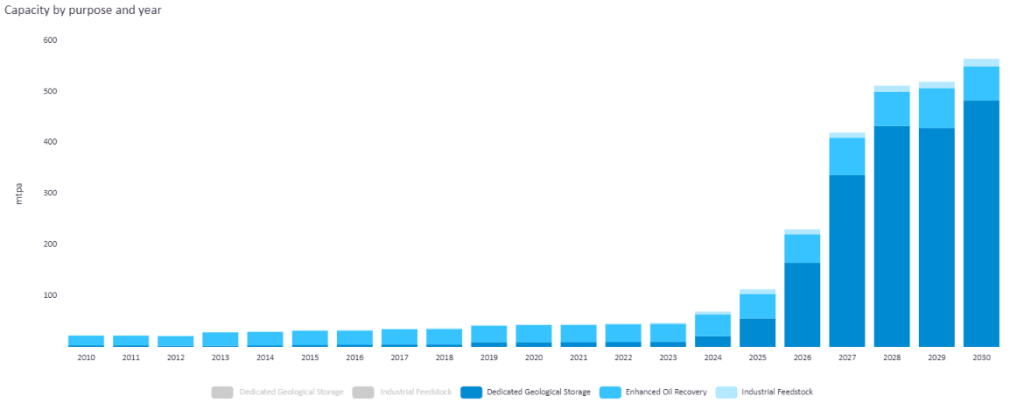

According to GlobalData, CCUS projects are expected to increase significantly by 2030. There are currently 388 projects at various stages from feasibility studies to completion within the next six years. If all these projects are successfully completed, they will collectively have the capacity to capture nearly 600 million tons of CO2 annually.

With a range of industries, technologies, and end uses for captured carbon, the first step to take is adopting a technology-neutral approach. However, while the number of successful projects executed by the industry is growing, this sector is still relatively embryonic. So, we need to stay open-minded as we continue to test the capabilities and use cases of CCUS technologies.

Companies involved across the full value chain of CCUS possess an in-depth understanding of the range of components required for project delivery. Applying that understanding enables project teams to think in a joined-up way, connecting the dots between different components and approaches.

Of course, everyone in the industry is looking for those game-changing developments, whether that’s direct air capture or simply more efficient practices, and it’s vital we are ready to embrace new technologies and approaches as they become available.

As an example, we are working with VPI Immingham, a UK power company, to deliver carbon capture and storage capabilities to their existing combined heat and power plant. Once completed, it will be one of the world’s largest post-combustion carbon capture plants. However, carbon capture technology hasn’t been used at this scale before. So, de-risking the project was a key focus for the team.

Consistent with a technology-neutral approach, the team carried out technology validation studies for each of the key technologies. Looking at how the technologies were going to be integrated with the existing plant, their required specification, and how that compares to how they’ve been implemented elsewhere. This also included vendor research and engagement to confirm that the design and equipment specifications were suitable.

These sorts of validations and risk assessments allow project teams to understand their complexities better and identify any potential gap between existing technology and the proposed application. This encompasses both proven technologies from prior projects and newer innovations.

Standardising supply chains?

But even the most carefully devised FEED will be affected if supply chains can’t keep up. Currently, for critical equipment, like compressors and non-metallic pipes, technology licensors are struggling to keep up with the demand from new applications and projects to design and trial different CCUS concepts.

This is where standardisation, modularisation and replication will be important. This approach has proved its value beyond doubt for the broader energy sector, particularly in oil and gas, and is a logical next step for CCUS.

The CCUS-related industry should look for opportunities to design and build modules at scale, with speed and for lower costs. They should then be rolled out as required across the full range of CCUS applications. While the need for expertise and careful project planning will never be replaced, if project developers can work with an increasingly familiar toolbox of standardised offerings, the process will become more familiar and streamlined.

Going back to the well

The basic technologies of CCUS aren’t new. In fact, they’re anything but. Enhanced oil recovery has been a well-known practice within oil and gas since the 1970s. Many of the resources being used in CCUS find their roots in the oil and gas sector, from towers and exchangers to pumps and pipes.

A key challenge facing the sector right now is the effective rollout of CO2 pipelines. Here, the insights gained from designing, building, and operating gas pipelines hold immense value. By translating the principles we’ve long employed in the oil and gas field, such as sophisticated leak detection and rigorous safety protocols, we can establish a solid solution for the reliable and streamlined transport of captured carbon dioxide. We have also established a thorough understanding of CO2 flow assurance and phase characteristics that support proper pipeline design.

In today’s industry, it largely makes commercial sense for capture technology to be attached to existing assets, so shared facilities are a must. This means that whether work is taking place at a cement factory, petrochemical facility, or power plant, ensuring that our staff have the experience of integrating equipment like cooling water, power and control systems is critical to uninterrupted operations.

Navigating the global landscape

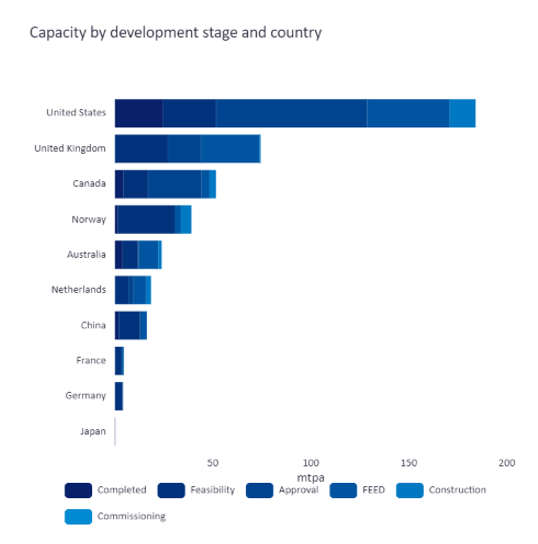

Undoubtedly, regulation is critical to the pace of CCUS rollout in each region. The impact of the IRA and the 45Q tax credit in the US has been significant, propelling genuine momentum within the region. In the US, an estimated 236 CCUS projects have either been completed, are underway, or in the planning stages.

Simultaneously, following the introduction of the Net Zero Industry Act by the European Union in March 2023, we can expect to see a similar push in that region as well.

By having in-house teams proactively researching and engaging in discussions surrounding policy and incentives, service companies can provide the insight needed to get a jump start on the industry. Moreover, they can provide global clients with informed perspectives on the viability and profitability of pursuing projects across different regions.

Outside of centres of excellence in the US and Europe, we can see the global momentum behind CCUS, with work underway across all global regions and in a variety of applications. South East Asia and Australia are notably active. The Middle East also holds particular significance in shaping the future of CCUS as a strategic hub with a confluence of skills, technology, and geology that position it as a potential CCUS powerhouse.

Evidencing this, we recently worked on the Kasawari CCS project in Malaysia, one of the world’s largest offshore CCS endeavours. This project aspires to capture over three million tons of carbon annually and will be the first of its kind in Malaysia.

Grappling geology

Some regions are blessed with ideal geology for CO2 injection, whereas others will be forced to look at transportation or finding alternative uses for carbon. By 2030, GlobalData predicts that dedicated geological storage will be the dominant end-use within CCUS. From approximately 550 million tons per annum of captured CO2, almost 500 million tons will be sequestered in 486 dedicated storage projects.

Enhanced oil recovery has been the main use of CCUS since 2010. However, enhanced oil recovery is unlikely to increase to anywhere near the levels of dedicated storage projects, with GlobalData figures suggesting a staggering 5,300% rise between 2020 and 2030.

In the UK, depleted reservoirs in the North Sea make for a perfect injection opportunity, where existing offshore infrastructure can even be retooled to support. However, in the US, there just isn’t the same option for a rural cement factory and alternatives to offshore storage are crucial.

Similarly, countries like Japan and Korea simply lack the geology for in-country storage and must look at transportation to locations like Indonesia, Malaysia or Australia. In these cases, the captured carbon will need to be loaded onto vessels for transportation, which brings a variety of technical and investment challenges.

Here, there is much that can be learned from the LNG industry. While the temperatures and pressures are different, the concept is similar and study work has been done to understand how LNG facilities can be leveraged to support in this area.

As the world strives to capture and store unprecedented amounts of carbon to achieve net-zero targets, technology neutrality, collaboration, standardisation and the incorporation of lessons from existing projects will be essential for success. By fusing engineering acumen, global cooperation, and insights to navigate the landscape of evolving regulations, the delivery of a thriving CCUS industry emerges as not just a possibility, but a critical necessity in shaping a sustainable future.

To learn more about CCUS solutions and capabilities, download the document below.