Nature-related impacts and dependencies are the new GHG emissions. New regulations, such as the EU’s CSRD, and increasing stakeholder pressures mean many large companies must soon disclose their nature-related impacts and dependencies. But are they ready?

Research and analysis conducted by NatureMetrics suggests many companies are not.

NatureMetrics analysed self-reported assessments from 245 professionals working in nature-related roles using a proprietary organisational nature maturity assessment, developed by their in-house team of nature consultants.

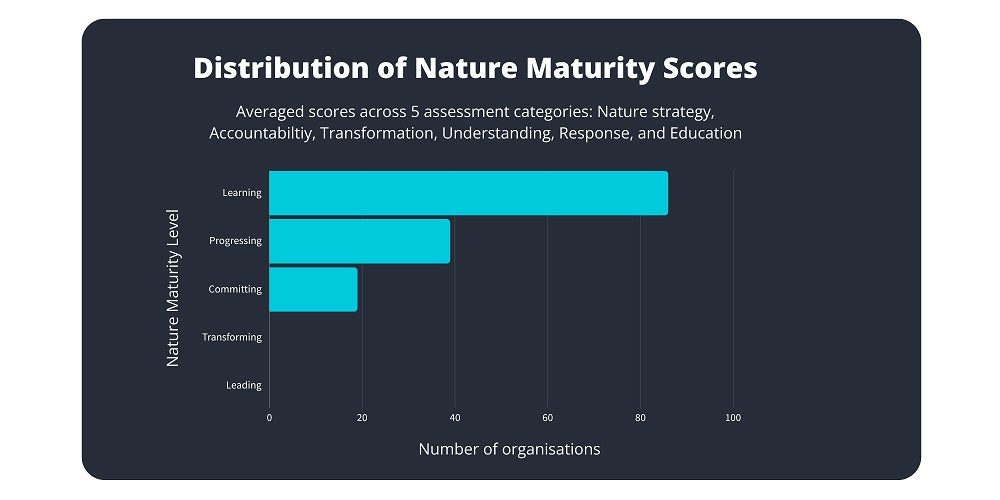

Companies were assessed against six categories – Nature Strategy, Accountability, Transformation, Understanding, Responsiveness, Education – and placed into one of five maturity levels: learning, progressing, committing, transforming, and leading.

Most companies are still learning

The average maturity level across all companies was ‘learning’, the lowest level on NatureMetrics’ model. Organisations at this level are still developing their policies and governance structures. They’re unlikely to be compliant with incoming regulations without additional work and investment.

35% of companies rank in the ‘progressing’ and ‘committing’ categories. These companies have some accountability for nature and are probably compliant. However, good practice may be siloed and there will be significant gaps in how they monitor their value chain.

No companies scored in the highest two categories, which are defined by full alignment with the Global Biodiversity Framework, robust risk screening across portfolios and value chains, and solid progress towards nature positive. This is despite the sample including TNFD early adopters and Nature Action 100 companies.

The analysis indicates significant room for improvement in nature-related practices. Considering the first cohort of companies subject to CSRD is due to disclose nature data in 2025, that improvement will need to come quickly.

Disclosure Intentions vs. Data Readiness

The mismatch between a company’s commitment to disclosure and its actual data collection practices was a key insight from the analysis. While 23% of surveyed companies expressed a strong desire to disclose their environmental impacts and strategies, they frequently lacked the robust data collection and analysis systems necessary to support these commitments.

There is a risk that this gap could lead to incomplete or unreliable reporting, potentially undermining the credibility of their sustainability efforts and raising concerns about greenwashing. This mismatch could affect everything from regulatory compliance and investor confidence to operational efficiency and stakeholder trust.

Conversely, 77% of respondent companies have no or minimally compliant disclosure commitments despite investing in sophisticated environmental data collection systems and processes.

The assessment didn’t explore the motivations for these companies’ reluctance to commit to disclosure. However, we can assume competitive concerns, fear of negative publicity, or misalignment of internal priorities play into this.

This misalignment is a problem. The hesitance of high-performing companies to fully commit to disclosure is a missed opportunity for leadership at a time when best practice leadership is urgently needed.

To address this mismatch, companies should look to:

- Conduct a gap analysis between disclosure commitments and data capabilities.

- Develop a roadmap to align data collection with disclosure goals.

- Invest in training and technology to improve data collection and analysis.

- Engage with stakeholders to understand their information needs and prioritise disclosure efforts.

- Collaborate with industry peers to develop standardized metrics and reporting frameworks.

- Implement integrated reporting systems that connect financial and non-financial data.

Risk Blindness

Another insight with significant implications is the gap between companies’ understanding of their impacts on nature versus their dependencies on it. Respondent companies scored higher in comprehending their environmental impacts (2.1 – Progressing Stage) compared to their reliance on natural resources and ecosystem services (1.7 – Learning Stage). This discrepancy points to a blind spot in corporate environmental strategies.

Companies that underestimate their dependence on nature may overlook risks associated with resource scarcity and ecosystem degradation. This has multiple implications.

In strategic planning, companies should integrate both impact and dependency assessments to create more comprehensive and effective long-term strategies. Inadequate awareness of dependencies may result in strategic gaps with long-term consequences for business sustainability and risk management. There is also the risk of regulatory non-compliance.

Addressing this disparity requires a multifaceted approach. Companies should invest in developing new methodologies for quantifying their dependencies on natural capital. This probably means working with external nature strategists, investing in new technology, and staff development.

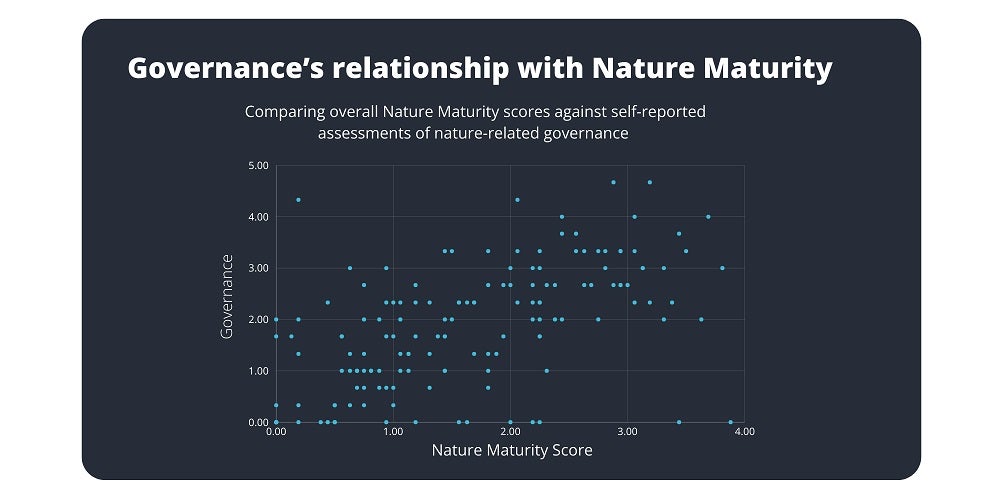

Executive sponsorship matters

The research uncovered a disconnect between Nature Strategy and Transformation scores. Many companies score higher in strategy development but lower in actual implementation, indicating challenges in putting plans into action.

A related finding was a positive correlation (0.63) between better governance and higher overall nature maturity scores. Companies where biodiversity is a board-level issue tended to score higher across all categories of the assessment, including implementation. This suggests that effective executive sponsorship plays a crucial role in advancing a company’s biodiversity and nature-related initiatives.

This underscores the importance of top-down leadership in driving nature-positive strategies. When executives and board members champion biodiversity initiatives, it often translates into more robust commitments, allocation of resources, and integration of nature considerations into core business strategies.

The data implies that companies with high-level accountability for nature are more likely to set ambitious targets, engage in comprehensive disclosure practices, and prioritise nature in their decision-making processes.

It can also help explain the reason for the gap between strategy and implementation. Many companies may be developing effective nature strategies, championed by middle managers or functional leads. However, without effective executive sponsorship, these strategic commitments are unlikely to translate into concrete actions and measurable outcomes.

To address this, companies should look to:

- Strengthen Executive Engagement: Companies should continue to elevate biodiversity concerns to the highest levels of governance, as this correlates with better overall performance.

- Align Incentives: Consider tying executive compensation to specific, measurable biodiversity outcomes to ensure that high-level commitment translates into concrete action.

- Operationalise Commitments: High-level support should be leveraged to break down operational silos and invest in the systems, tools, and expertise needed for effective data collection and monitoring.

- Invest in Capacity Building: Beyond setting strategy, executives should champion investments in employee training and capacity building to ensure the organisation has the skills needed to implement biodiversity initiatives.

- Embrace Adaptive Management: Given the evolving nature of biodiversity management, companies should adopt flexible approaches that allow for learning and adjustment as best practices emerge.

- Build Cross-functional Teams: To bridge the gap between strategy and implementation, companies should form cross-functional teams that include both strategic decision-makers and operational experts.

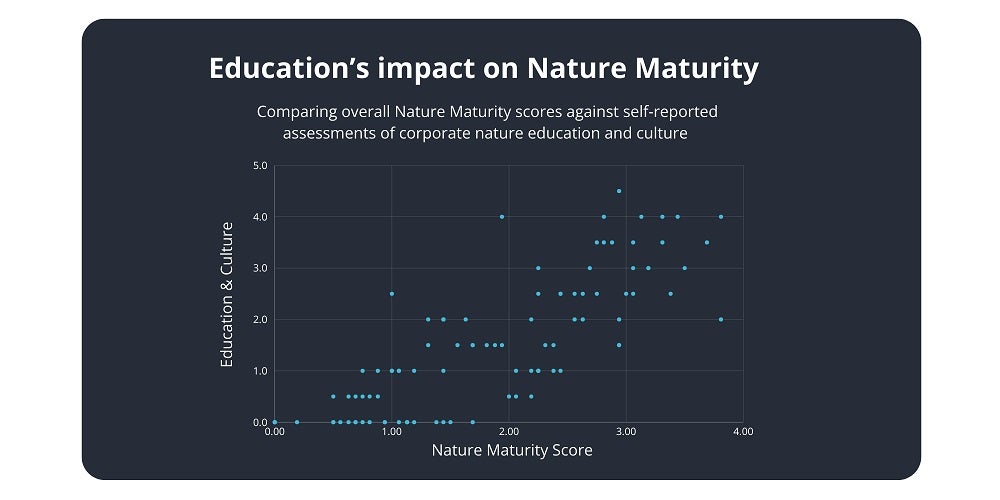

Education matters

Perhaps unsurprisingly, the research found a strong positive correlation (0.78) between organisations investing in education and cultivating a nature-aware culture and more consistent and comprehensive progress across all categories.

A strong foundation in environmental education may foster a culture where sustainability is not just a compliance issue but a core value. This cultural shift can drive more consistent implementation of environmental practices across different departments and geographic locations.

Organisations with higher education scores typically displayed a more balanced understanding of their impacts on nature and their dependencies on ecosystem services. Therefore, increasing corporate education programmes around nature could be a partial solution to the ‘risk blindness’ that was flagged above.

The “Education Effect” underscores the importance of ongoing learning and development in corporate sustainability efforts.

By investing in environmental education and fostering a nature-aware culture, companies can bridge the gap between understanding impacts and dependencies, leading to more effective and comprehensive environmental stewardship.

This approach not only benefits the organization in terms of risk management and innovation but also contributes to broader societal goals of environmental conservation and sustainable development.

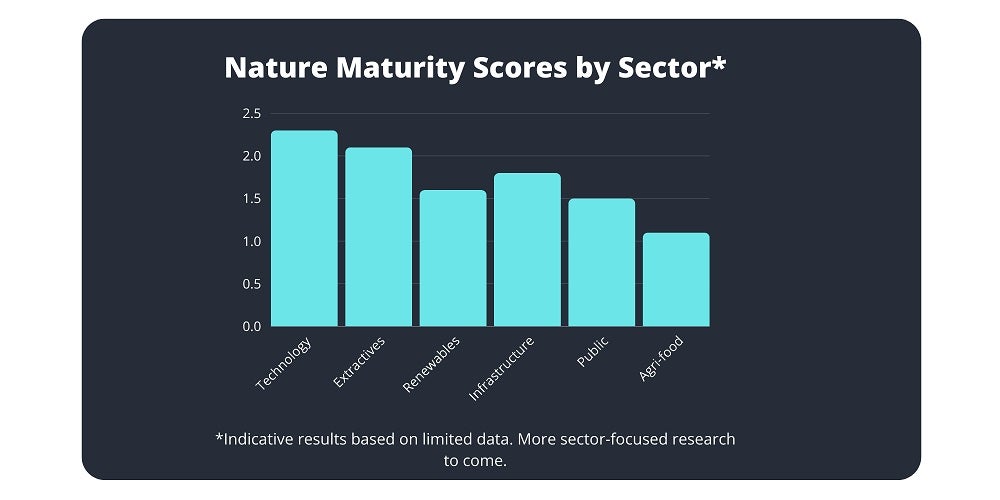

Sector insights

These sector findings should be treated with some caution as sample sizes for each sector are relatively small. Deeper research into each sector’s performance is a future ambition for this research.

Despite this, initial insights broadly align with expectations, with sectors subject to nature regulations reporting higher maturity than those who aren’t. However, there are some notable surprises.

Technology Leadership: The technology sector shows the highest average maturity score (2.38), particularly excelling in the ‘Understanding’ category. It’s worth highlighting, however, that this sample included responses from a number of relatively small nature-tech companies. Smaller operations, simpler value chains, and fewer inherent nature-related risks and dependencies may give some tech companies an advantage when climbing the maturity ladder.

Extractives Progress: This sector included companies operating in the oil & gas and mining sectors. These companies showed the second-highest average maturity score (2.19). They particularly stand out in the ‘Transformation’ category, suggesting proactive efforts to manage their environmental impact. This makes sense when one considers their regulatory obligations and the widespread adoption of the mitigation hierarchy in this sector.

Renewable Paradox: Interestingly, the renewable energy sector scores lower than might be expected considering the pre-existence of regulations and the moral imperatives inherent in the industry (1.63 average). This could suggest a focus on climate issues at the expense of broader biodiversity concerns.

Agri-food Budding: This sector included a spread of organisations operating across the agri-food value chain, including fast-moving consumer goods (FMCG) brands. They scored a 1.1 average maturity score. This makes agri-food the lowest-scoring sector tested, with half the score of the extractives industry. These scores reflect a lack of pre-existing regulatory obligations around nature for this sector and the complexity of agri-food supply chains.

Recommendations

Based on this analysis, organisations impacted by new nature regulations or with nature positive ambitions should look to:

- Prioritize nature-related education across all levels of the organisation.

- Enhance data collection practices, particularly focusing on understanding dependencies on nature.

- Align nature strategies with global frameworks like the UN’s Global Biodiversity Framework.

- Bridge the gap between strategy development and implementation through concrete action plans.

- Establish robust governance structures with clear accountability for nature-related issues at board level.

- Leverage synergies between climate and biodiversity initiatives for a more holistic approach.

- Improve nature-related disclosure practices and align them with actual data collection capabilities.

Conclusions

While overall maturity scores indicate significant room for improvement, sector-specific strengths and the positive impact of governance and education provide clear pathways for enhancement.

As regulatory frameworks like TNFD and CSRD evolve, companies must prioritise nature-related strategies, data collection, and disclosure practices to meet future requirements and contribute to global biodiversity goals.

As corporate leaders descend on New York Climate Week this is an important topic of debate and more importantly – action. How do organisations match their ambitions with their readiness to disclose?

Tools that enable gap analysis and benchmarking, like the NatureMetrics maturity assessment, will help meet these goals.