Mining companies are progressing towards their interim greenhouse gas (GHG) reduction targets. Australia-based BHP [the Broken Hill Proprietary Company], as an example, confirmed in a recent decarbonisation investor presentation that it was on track to reduce its operational GHG emissions (Scopes 1 and 2 from its operated assets) by at least 30% by the financial year 2030 (FY2030) from FY2020 levels.

For BHP, much of its success has come through a switch to renewable power, with the company also looking at the electrification of its mining fleets in the coming years. Its first electric truck fleet is expected to be adopted by FY2028, with further roll-outs by the end of the 2020s, with the use of trolley-assist trucks to help in delivering the FY2030 target for operational GHG emissions.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

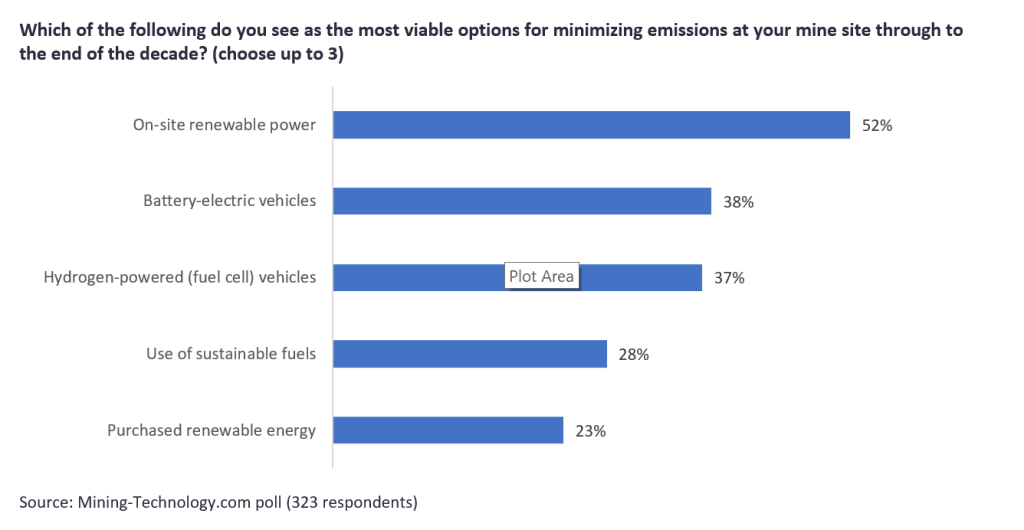

By GlobalDataRespondents to a recent Mining-Technology.com poll identified on-site renewables as the primary way in which emissions reductions would be achieved up to 2030. This was followed by battery-electric vehicles, which were marginally ahead of hydrogen (fuel cell vehicles). Interestingly, purchased renewable energy was only chosen by 23% of respondents, but has already been a very effective way for many miners to achieve GHG reductions and move towards their interim targets. Some miners, such as Harmony Gold, utilise a mix of purchased and on-site renewable power to achieve significant reductions, with the company targeting a 20% reduction in GHG emissions by 2026: 40% by 2031 and 60% by 2036.

In the case of battery-electric vehicles, many miners have begun trialling battery-electric equipment, and have further plans on the horizon. Glencore is planning to make its Onaping Depth nickel mines in Canada fully electric, while Vale and Newmont already have battery-electric equipment up and running at underground mines in Canada. For surface mines, developments are slower due to the size of the machines, but Teck has plans to run a fleet of battery electric 300t Caterpillar trucks by 2030.

Anglo-American is investing in hydrogen power, and Fortescue is aiming for “real zero” by 2030 at its Australian iron ore operations, which means removing all scope 1 and 2 emissions and not resorting to offsets. Amongst other things, it will be replacing its current diesel-fuelled fleet with battery-electric and green hydrogen-powered haul trucks. In March 2024, GlobalData identified 239 trolley-assist trucks and 129 battery-electric trucks operating on surface mines, and 260 electric loaders and 69 electric trucks operating in underground mines.

Hydrotreated vegetable oil can simply replace fossil diesel

The fourth-ranked option, the use of sustainable fuels, is being considered by several leading miners, particularly as an interim solution as they gradually shift from diesel to electric up to 2038. This allows for technology advancements, particularly for surface trucks, and for the introduction of the necessary infrastructure. The primary option is renewable diesel, which is hydrotreated vegetable oil (HVO), a drop-in fuel that can be used as a straight replacement for fossil diesel.

In May 2023, Rio Tinto’s Boron operations in the USA became the first open pit mine to globally transition its heavy machinery to 100% renewable biofuel, with the Kennecott Copper operations in Utah switching to renewable diesel in 2024. Rio Tinto has stated that “biofuels are critical to ensuring we meet our 2030 Scope 1 and 2 emission targets, and we are exploring short and medium-term commercial biofuel options to rapidly reduce our reliance on diesel.” Meanwhile, BHP is trialling the use of HVO in mining equipment at its Yandi operations, to see how renewable diesel can be used as part of the company’s operational decarbonisation plan.