Utilisation is integral to the long-term viability of CCUS to help reach net zero targets and decarbonize heavy industries around the world.

Within CCUS, there is a clear distinction between carbon capture and storage (CCS) and carbon capture and utilisation (CCU).

With storage viewed as a lower risk solution for emissions, the many benefits of utilisation should not be overlooked. Amid increasing restrictions on emissions originating from fossil fuels to meet environmental commitments, utilisation offers an essential means of providing a circular demand for carbon through more sustainable processes.

GlobalData estimates suggest that the global CCUS market could be worth $4trn by 2050. Utilisation needs to be a substantial contributor to this total, given what many consider to be a significant untapped market across a range of different industries.

Any progress should be viewed as a positive step, especially given the possible commercial value and multiple use cases available from CCU.

“While storing CO2 has its place, utilisation creates a lasting impact. It can reduce our reliance on raw materials and create new markets for captured carbon. Overall, you have much more market potential available from utilisation,” says Bojan Popovic, Group Vice President of Low Carbon Fuels at Worley, a professional services company of energy, chemicals, and resources experts.

As governments and corporations face a race against time to eliminate carbon emissions to meet net-zero commitments, there is a risk of prioritising CCS rather than CCU – missing out on the considerable market opportunities available.

“Every project that uses carbon dioxide as a feedstock for creating sustainable products should be seen as a breakthrough. It’s a minor breakthrough at this time as emerging utilization technologies are being scaled up, but it’s still a step forward for the industry,” adds Popovic.

Industrial uses of captured carbon

According to the International Energy Agency (IEA), approximately 230 million tonnes of CO2 is used every year, with around 130 million tonnes of this total needed for fertilisers (urea-based) and an estimated 80 million tonnes required for enhanced oil recovery (EOR). The use of CO2 as feedstock for fertilizers and as the working fluid for EOR is not new and it has served its useful purpose for many decades. However, the utilization context has changed. It is no longer sufficient for CO2 to create value, but such value also needs to be sustainable.

The CO2 utilised for the production of fertilizers eventually find its way back to the atmosphere when urea-based fertilisers are applied to the soil. The CO2 used in EOR results in production of additional CO2 of fossil origin being re-released into the atmosphere by combustion of the recovered oil.

For a CO2 utilisation pathway to be fully sustainable, the lifecycle of a CO2 molecule needs to be circular. All plants on Earth utilize CO2 via photosynthesis. While Industrial processes cannot imitate plants, they can mimic them to some degree – through the capture of CO2 and conversion to fuels as energy storage, or by storing carbon in materials that do not re-release the gas into the atmosphere as a part of their lifecycle – such as in plastics.

The desire for fully circular CO2 has led has led to a classification of CO2 sources into biogenic CO2 (e.g. from fermentation, anaerobic digestion and biomass power capture), fossil fuel-derived CO2 (e.g. from gas, oil and coal power generation capture) and other non-biogenic capture (e.g. cement calcination and steel off-gas). The appetite for making synthetic fuels and other products from these different sources is already showing geographic variations, with the long-term impacts still to play out.

In the short to medium term, synthetic natural gas – a manufactured substitute for natural gas derived from captured CO2 and low carbon hydrogen – could represent a promising market area for utilisation. A key advantage is that synthetic natural gas can be used in existing equipment – such as gas turbines or boilers and distributed to the final consumer in the existing infrastructure with no adaption required. The same is true for other synthetic fuels such as e-gasoline, e-methanol, and e-SAF.

“To me, synthetic natural gas produced using captured CO2 and low carbon hydrogen, is the most logical utilisation pathway replacement for fossil fuels in terms of its reach for potential consumers that are everywhere, in every household, and every industry,” says Popovic.

Promising CCU projects

There are other highly promising utilisation projects underway that are also proving the viability of technologies for end users.

One project making progress in utilisation is FlagShipONE in Sweden, which is set to be the first commercial-scale Power-to-X facility operated by Orsted and capable of producing 50,000 tonnes of methanol from renewable energy a year.

Fuel will be produced by capturing approximately 70,000 tonnes of carbon dioxide from a biomass-fired power plant. Separately, an electrolyser powered by renewable electricity will split water into its two chemical elements – oxygen and hydrogen. The captured carbon and green hydrogen from both sources will then be mixed at a specialist facility, with the resulting e-methanol potentially used as fuel by marine transportation – which could slash vessel emissions by 90%.

Another promising project is ArcelorMittal’s plant in Ghent, Belgium. Instead of CO2, this project is using carbon monoxide captured from waste gas in blast furnaces and converting it into bioethanol. This Steelanol project has an annual bioethanol production capacity of up to 80 million litres and is the first type of such a project in Europe.

“The innovative gas fermentation process was developed by LanzaTech and involves microbes feeding on carbon-rich gas – converting gases into ethanol. We worked closely on the concept, and basic and detailed engineering for this project with both ArcelorMittal and LanzaTech. The intention is to use the low-carbon ethanol produced as a fuel for transport, with other potential applications to produce plastics and chemicals,” says Popovic.

Market growth for synthetic fuels

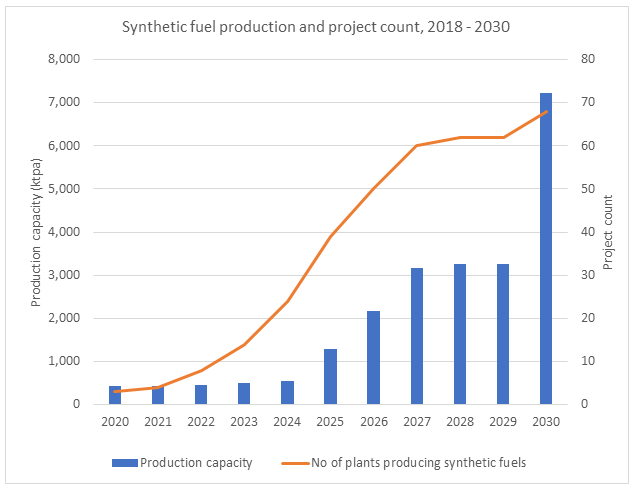

Substantial growth is projected for synthetic fuel projects and global production over the next six years. Synthetic fuel projects have been relatively low in recent years but are predicted by GlobalData to increase every year between now and 2030. According to projections, the latter year will see a noticeable spike, with new projects more than doubling from just over 30 in 2029 to reach upwards of 70 just 12 months later – amounting to fuel production of over 7,000 kilotons per annum (ktpa). For context, an estimated 400ktpa of synthetic fuel was produced in 2020, with no noticeable rise predicted until 2025.

In addition, e-SAFs are particularly significant for CCU as they can be made by combining carbon captured from industrial processes and green hydrogen to produce low-carbon “drop-in” fuels that can help to decarbonise aviation without requiring any adaptions to existing aircraft engines.

Government support for CCUS projects

With utilisation in the early stages of development, costs are a major barrier to its roll-out and the wider implementation of CCU and S technologies.

What could help to significantly bring down costs is the increase in CCUS projects and investment over the next decade – specifically, government support. “Because the products are so expensive, utilisation and storage strictly depend on government incentives,” says Popovic.

According to GlobalData’s database of active and announced wider CCUS projects, global carbon capture capacity is expected to grow strongly at a CAGR of 38% between 2023 and 2030 to reach up to 506 million tonnes per annum. Within this total, there will be opportunities for CCU.

There are also signs that governments are implementing the necessary support measures to advance CCUS. The US currently leads GlobalData predictions on countries with the highest global CCUS capacity by 2030, with 171.5 million tonnes per annum. This is followed by the UK with a CCUS capacity of 91.9 million tonnes per annum by 2030.

This predicted progress is backed by government support announced in recent years. The US 2022 Inflation Reduction Act featured notable rises to the 45Q tax credits for CCUS. The Act supports CCU by providing tax credits of $60 per tonne of CO2 sourced from utilisation.

Laws and funding supporting CCUS development

A further significant move came in May 2023, when the US Government also announced the Clean Fuels & Products Shot. The intention is to provide support for alternative processes to contribute to a planned 85% reduction in the intensity of emissions from fuels and chemicals by 2035, with CO2 utilisation included within this.

In addition, the UK Government announced funding of £20bn for early-stage CCUS projects in the 2023 Spring Budget.

In May 2024, European Ministers endorsed the Net-Zero Industry Act (NZIA). The NZIA will lay the foundation for a new green industrial policy in the EU, as it will create favourable conditions for investments in green technologies. NZIA will support the deployment of CCS projects through a 50 million tonnes storage capacity target by 2030. CO2 utilisation has been added as an eligible strategic net zero technology in the final agreement.

The NZIA will also complement other EU efforts mandating the deployment of CCU for hard-to-abate sectors, including the revision of the Emissions Trading System (ETS), Renewable Energy Directive (RED III), ReFuelEU Aviation and FuelEU Maritime, and prepare the ground for new rules to use captured carbon for the production of chemicals. As one example, the European Union passed legislation for ReFuelEU Aviation in April 2023, setting targets for blended fuels used by aircraft to rise from 0.7% in 2030 to reach 28% by 2050. Furthermore, in 2022, three CCU projects producing synthetic fuel were awarded funding from the EU Innovation Fund.

Back in North America, the Canadian Government passed a budget in 2022 featuring investment tax credits available for CCUS projects up to 2030 – amounting to 37.5% of added value for utilisation equipment.

The future success of CCU

There is a sense that more government investment is required to support further CCU advances. Despite the policies and measures announced, the IEA suggests that progress with CCUS and CCU is not on track to help avert global temperature rises by 2050. Nevertheless, there is optimism that targets can still be met, with the initial CCU projects pivotal to future success.

“If the first few utilisation projects come online and begin to prove the commercial viability of CCU, it could start to turn the tide. Despite all the challenges ahead, I’m optimistic that government support can help establish the utilisation market, which will be increasingly important when carbon extraction starts to reduce around the world as net zero targets grow closer,” says Popovic.

If there is only longer term appetite for using biogenic CO2 as a source for CO2 utilisation, then availability is likely to be a major issue – and biogenic CO2 will command a price premium. So far, only the EU has shown a strong preference for using biogenic sources in its renewable fuel legislation. Yet the EU has still left the door open for non-biogenic sources up to 2040. Delivering the promise of CCU requires industry partners with high levels of expertise.

Worley is currently involved in more than 35 CCUS projects worldwide, which have an estimated combined CO2 capture capacity of 95 million tonnes per annum. Worley has access to more than 100 CCUS subject matter experts – including specialists in CCU – who have helped to develop CCUS solutions for some of the hardest-to-abate sectors.

To learn more about Worley’s expertise as a key enabler in CCUS projects, download the document below.