The Tuvatu gold project is a low-cost, high-grade, underground mine located on the west coast of Viti Levu, Fiji, approximately 17km from Nadi International Airport.

It is owned by Canada-based development and exploration company Lion One Metals.

The mine is expected to produce 262,000oz of gold (Au) grading 15.3g/t in the first three years of production and 352,931oz of gold grading 11.3g/t Au over its estimated mine life of approximately seven years. The project is expected to create more than 200 local jobs.

The cash cost of the project is estimated to be $567 an ounce while the estimated all-in sustaining cost is $779 an ounce.

The project is estimated to generate a net cash flow of $112.66m and an internal rate of return (IRR) of 52% at a gold price of $1,200 an ounce.

Tuvatu gold project history and development details

The underground exploration and development of the Tuvatu gold project was performed by its previous owners in 1997 and a feasibility study of the project was completed in 2000. The project was acquired by Lion One Metals from Emperor Gold Mines of Australia in 2011.

Lion One Metals commenced processing plant studies at the mine site in 2014 and reached a 21-year surface lease agreement with the iTaukei Land Trust Board in the same year. The project was approved by the Fiji Government in 2015 while the environmental licence was granted in January 2016.

Construction on the project began in November 2017 while commissioning is planned for the second quarter of 2019.

Tuvatu gold mine geology and mineralisation

The Tuvatu underground gold mine is spread over 5ha within a 385ha mining lease. It lies within the Viti Levu Lineament in Fijian Islands with a northeast-southwest lineament accompanied by several alkaline volcanic centres.

The Fijian Islands are located along the margins of the south-west Pacific Rim oceanic tectonic plate, which hosts epithermal gold-silver and porphyry copper-gold deposits such as Porgera, Misima, Ok Tedi, Lihir, and Bougainville.

The Tuvatu deposit is a low-sulphidation epithermal gold-vein deposit situated along an eroded Navilawa volcanic centre. It also hosts porphyry copper-gold and volcanic-hosted massive sulphide (VMS) type mineralisation.

Tuvatu gold project reserves

The Tuvatu gold project is estimated to contain indicated resources of 1.101Mt of ore grading 8.46g/t and containing 299,500oz of gold. Inferred resources are estimated to be 1.506Mt grading at 9.67g/t and containing 468,000oz of gold at a cut-off grade of 3g/t.

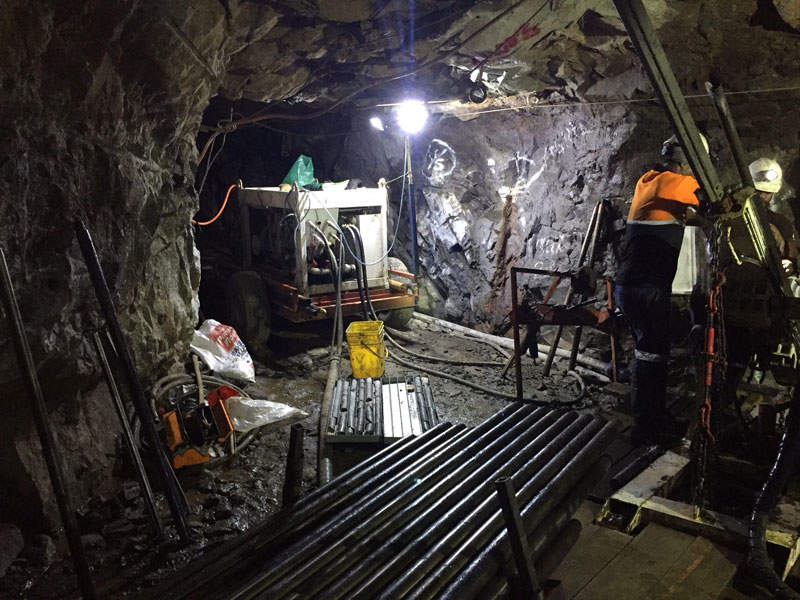

Mining and ore processing

Mining at the Tuvatu mine will be carried out using the manual shrinkage stoping method for steep-dipping lodes and breast mining method for flat-dipping lodes.

The processing plant has a capacity of 219,000t/y with a 600t/d feed. Ore processing facilities include a primary crusher coupled with a secondary crusher that operates at a capacity of 1,000t/d. The crushed material will be carried by conveyors to a reclaim stockpile with a 600t live capacity.

The reclaimed ore will be processed through a grinding circuit consisting of a primary ball mill, a secondary ball mill, and gravity circuit. The output of the grinding circuit will be thickened and treated in a carbon-in-leach (CIL) circuit to extract and absorb solution gold onto carbon particles.

The tailings from the processing plant will be conveyed to the tailings storage facility. Gold will be recovered through elution of carbon and electro-winning.

Construction and infrastructure facilities at Tuvatu gold mine

Major works at the Tuvatu gold mine include mill site bulk earthworks such as excavation and fill capabilities for mine ore stockpile, a processing plant, a maintenance building, a crushing plant

A 7MWp sun2live solar/ diesel hybrid power plant is planned to be constructed 3.5km from the project.

The works also include the construction of a mill site road, a lined stormwater detention pond, a leach pad to set-up an engineered fill crushing plant, a pad to establish the mine maintenance shop and mine dry, and straightening of Tuvatu creek to open up the additional site area required.

Construction of a geochemical assay and metallurgical laboratory building located company’s Fijian headquarters is in the final stage.

Other planned infrastructure facilities include an office complex, mine site offices, warehouse, a dry area, a workshop for light vehicles and heavy underground machinery, as well as conference facilities.

Key players involved

Sinosteel was awarded the engineering, procurement and construction (EPC) contract while Baiyin was selected as the doré off-taker, along with a debt financing of a $40m facility for the mine’s development and construction of the processing plant.

Fiji-based A.R. civil contractor Quarry and Concrete (ARQC) was engaged by Lion One Metals in November 2017 to undertake engineering, procurement and construction activities at the mine.

Canenco Canada, AMC Consultants, Knight Piésold, and Mining Associates performed the preliminary economic assessment for the project.

Canadian process engineering firm Canenco Consulting was selected to perform front-end engineering design (FEED).

China-based Yantai Jinpeng Mining Machinery provided detailed engineering designs for the mine, tailings dam and surface infrastructure.

Gekko Systems was employed by Lion One Metals to conduct metallurgical test work at the site.