The Panda Hill Niobium Project is located approximately 26km from the city of Mbeya, in south-western Tanzania.

The project entails three mining licences, covering a combined area of approximately 22.1km². It is owned by Panda Hill Tanzania (PHT), which is a 50:50 joint venture (JV) between Cradle Resources, and Tremont Investments (Tremont).

The pre-feasibility study (PFS) for the project was completed in March 2015, and the definitive feasibility study (DFS) was completed in April 2016. The off-take agreement finalisation and securing of debt financing is expected to be realised in late-2016, with construction starting afterwards.

An estimated overall investment of $195.6m will be made to bring the mine to first production, which is expected in mid-2018. The mine is estimated to have a production life of 30 years.

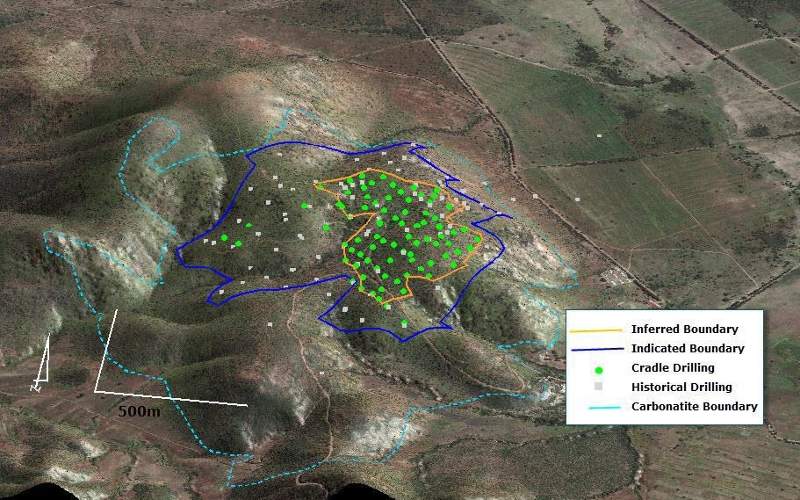

Panda Hill project geology and mineralisation

The project hosts a carbonatite-hosted niobium deposit. The majority of the mineralisation is encountered within pyrochlore, and to a lesser extent within columbite. The majority of the known mineralisation is hosted within fresh to unweathered carbonatite lithologies.

Higher-grade niobium mineralisation is also found in lesser amounts in magnetite-rich bands and flow-banding within the carbonatite and the near-surface fenite outcrops.

The Nb2O5 grades for a majority of the mineralisation range between 0.1% and 1%.

Reserves and production

As of April 2015, the project was estimated to hold combined measured, indicated, and inferred resources of 178Mt grading 0.50% Nb2O5, and containing 891,000t of Nb2O5.

The project targets 5,400tpa of contained niobium or 8,200tpa ferroniobium for 30 years. It will initially treat 1.3Mtpa of ore, which will increase to 2.6Mtpa in the fifth year.

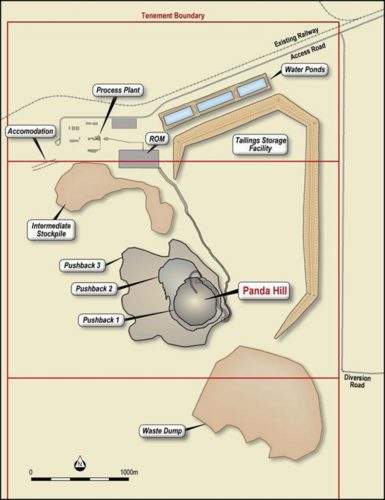

Mining and processing at the Tanzanian niobium project

The mining method envisaged for the project is conventional open-cut mining, incorporating drill, blast, load and haul operations. These will primarily use two 120t excavators and up to 18 90t haul trucks.

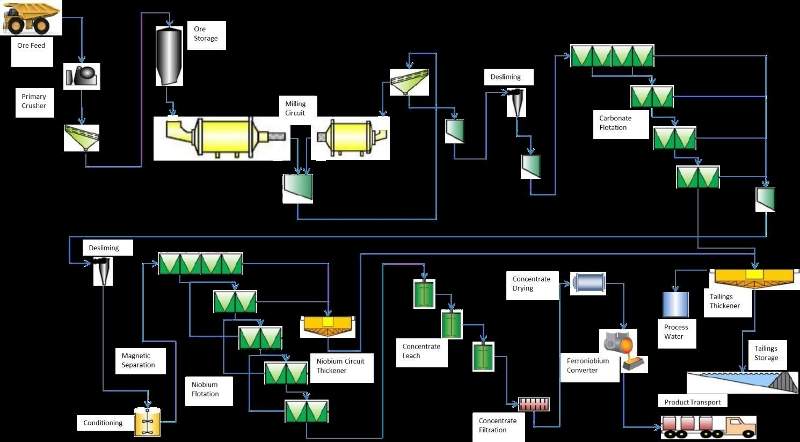

The proposed processing flowsheet includes a single-stage crushing, a semi-autogenous grinding (SAG) mill and a ball mill, as well as de-sliming, pyrite flotation and magnetic separation.

Also included is carbonate flotation, further de-sliming or dewatering, niobium floatation, further pyrite flotation and magnetic separation, as well as a two-stage concentrate leaching using acid and caustic, concentrate dryer, ferroniobium conversion, and product crushing and packaging.

Infrastructure for the Tanzanian niobium project

The project benefits from its close proximity to existing local infrastructure, including a dry port and a major fuel depot in Mbeya. The site is located 2km away from the TAZARA rail line, 8km from the Songwe Airport, and 5km from the Dar es Salaam, including the Tunduma highway and the Songwe cement factory.

It will involve the construction of a high-density thickened (HDT) tailing storage facility (TSF), and an accommodation camp.

Access to the project site will be provided by a new 8km access road, connected to the existing Dar es Salaam Tunduma highway.

The water required for the project will be initially sourced from the tailings storage facility, while additional water requirements during the later years of production will be sourced from the neighbouring Songwe River and aquifers. Two water storage dams are proposed to be constructed at the site.

The mine will initially be fed with electricity from a new heavy fuel oil (HFO) power plant. The site is expected to be connected to the neighbouring Mbeya 220kV substation in the fourth year of production.

Key players involved

The DFS was primarily compiled by MDM Technical Africa, who carried out the plant design, as well as operating cost and capital expenditure estimations.

Other consultants that collaborated in compiling the DFS were Coffey Mining for the mineral resource estimate, SRK Consulting for the geotechnical analysis and mine planning, as well as the open-pit optimisation, pit design, production scheduling, and associated cost estimates.

SGS Canada conducted the metallurgical test work, SLR Consulting conducted the tailings and water studies and associated cost estimates, whereas MTL Consulting Company carried out the environmental and social studies. Roskill Consulting Group was involved in conducting a ferroniobium pricing study for Cradle.