The Omagh gold project, situated in Crown Estate prospecting licence OM 1/03, covers an area of about 189km2, straddling the counties of Tyrone and Fermanagh in western Northern Ireland.

Omagh Minerals Ltd (OML), a wholly owned subsidiary of Canadian company Galantas Gold Corp, owns the freehold to the site as well as the prospecting and mining rights, planning consent and infrastructure.

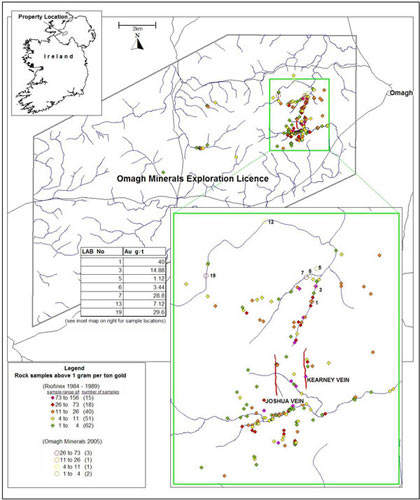

Following the discovery and exploration of vein gold at Curraghinalt in the Sperrin Mountains by Ennex International in the mid-1980s, Riofinex North Ltd began exploration of the geological inlier known as Lack, named after a local village. Riofinex discovered the gold-bearing Kearney vein structure – the current focus of production – and the surrounding swarm of gold veins during the course of an exploration and resource delineation programme.

In 1990, the project was transferred to OML, which was acquired in 1997 by Ontario-based European Gold Resources. In 2004, the company was renamed Galantas – Gaelic for ‘elegant thing’.

The $20m project has been funded through a series of stock issues. The payback period is estimated at 2.7 years from July 2008.

Geology

The licence includes a 72km2, partly fault-bounded, Lack inlier of upper Proterozoic age and upper Dalradian metamorphic rocks, surrounded by lower Palaeozoic rocks. The Dalradian of the eastern half of the Lack inlier, where most of the exploration work has been done, consists mainly of a series of quartz-feldspar-muscovite-chlorite schists of varying composition.

Mineralisation within the structures consists of quartz veins up to a metre wide with disseminated to auriferous sulphides, predominantly pyrite and galena, with accessory arsenopyrite and chalcopyrite.

Resources

The mine consists of several veins of varying ore grades. May 2008 estimates put total measured and indicated resources at 104,000oz Au and inferred resources at 295,800oz Au. The resources are independently reported to CIM code and Canadian National Instrument 42-101 standard. Extraction of only two of the veins, of which Kearney is the largest, is expected to give a mine life of 4.6 years.

Production

The Kearney vein is being mined by open-pit methods. The rock is sufficiently naturally fractured that blasting is not required.

There are two types of overburden within the pit: peat and glacial till. Both are being stockpiled for use in later restoration. Below the till lies bedrock, both barren country material and mineralised gold resource. The ore is being mined using a narrow excavator bucket then taken to a nearby processing plant by dump truck.

Processing

The processing plant uses conventional crushing, grinding and flotation to produce a lead sulphide concentrate. The ore is crushed in three stages (two-stage for the smaller pieces) and ground with water in a ball mill to fine sand, about half of which is less than 75 microns. Some of the ground material is treated by gravity methods but most of it is mixed with water, foaming and flotation agents, then passed to froth flotation tanks. The foam is then taken from the top of the cell, cleaned and dewatered and the resultant concentrate packed for shipment and sale.

First concentrate was shipped in February 2007. Concentrate enhancement experimentation is taking place. Froth washing has so far proven more effective than use of a regrind circuit.

During 2007 Galantas processed ore containing 6.24g/t gold and achieved a recovery of 89%. This improved during the year such that, after May 2007, the average recovery was 90% and the average after November 2007 was 92%.

Recovery for January and February 2008, at 83g/t, was similar to the 2007 average but the average for March and April 2008 rose to 106g/t.

The concentrate is sold via an offtake agreement with Xstrata subsidiary Falconbridge, of Canada, while part of the recovered gold is designed and sold by Galantas Irish Gold through retail channels such as Galantas-branded 18ct gold jewellery.

Power is provided by a 1,000kVA genset, a 400kWA genset and an 80kVA genset, although not all are in use at any one time. Galantas anticipates that mains electricity will be provided in due course.