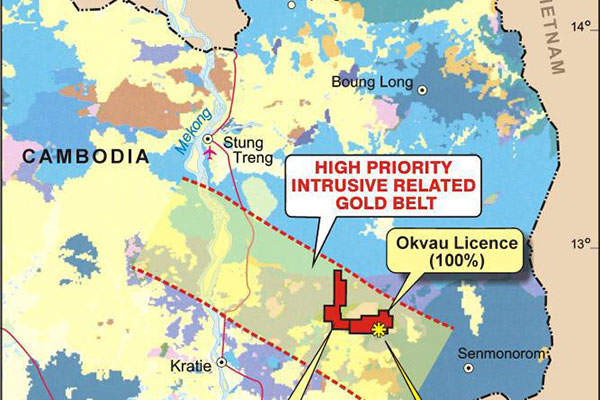

The Okvau Gold Project involves the development of the Okvau Deposit, which is located in the Mondulkiri province of eastern Cambodia, approximately 275km north-east of the capital city, Phnom Penh.

The project is wholly-owned by Renaissance Minerals through its subsidiary Renaissance Minerals (Cambodia). The project was acquired from OZ Minerals in February 2012.

The project scoping study was completed in October 2014, while the pre-feasibility study (PFS) was completed in July 2015. The pre-production capital cost for the project is estimated to be $120m.

The project aims to recover 100,000oz gold a year during the estimated initial eight-year mine life, with a targeted average production rate of 91,500oz a year, integrating a 1.5 million tonne a year (Mt/y) throughput processing plant.

Okvau gold mine geology and reserves

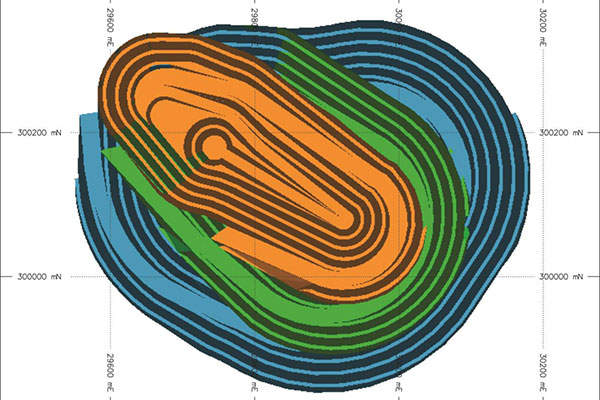

The Okvau deposit, interpreted as an intrusive-related gold system, is hosted primarily in Cretaceous-age diorite, surrounding Triassic meta-sedimentary host rock to a lesser extent, with the highest grade intersections generally occurring at the diorite meta-sediments contact. The mineralised vein system of the deposit has a current strike extent of 500m, across a width of 400m.

As of July 2015, the project is estimated to hold a combined indicated and inferred resource of 15.8Mt, containing 1.13 million ounces (Moz) of gold.

Mining and processing at Renaissance’s Cambodian gold mine

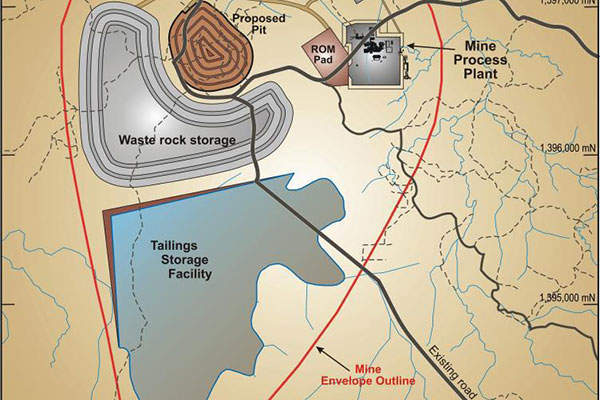

The project will involve the development of a single open-pit mine in three phases, employing conventional drilling and blasting of ore and waste, and load and haul operations. The proposed mining fleet will primarily include a 220t Komatsu PC3000 excavator, 90t Cat 777G dump trucks and Atlas Copco ROC D9 drill rigs.

The development of the open-pit in phases is expected to reduce waste stripping in the initial years, which will lead to a reduced mining cost. The first two stages combined will account for approximately 70% of the mine’s overall mill feed, which is equivalent to the overall mill feed required for the initial five years of operation.

The proposed processing plant for the gold project will incorporate a three-stage crushing process, a primary grinding circuit integrating a single stage ball mill, a flotation circuit, a pre-oxidation circuit, agitated leach tanks, a conventional cyanidation circuit, carbon-in-pulp (CIP) and carbon-in-leach (CIL) circuits, an elution column, and electrowinning facilities.

The resulting cathodes following electrowinning will be washed, and the sludge will be filtered and dried before being conveyed to the smelter for production of dorè bars. The processing plant is expected to have a gold recovery rate of roughly 85%, with no intensive oxidation required.

Infrastructure at the Cambodian flagship gold project

The tailings storage facility (TSF) is proposed to be constructed in two stages, with the second stage commencing at the end of the second year of operations. Ancillary project infrastructure at the site will include a waste rock storage facility, a permanent accommodation camp for 350 people, a temporary construction camp for 150 people, a fuel storage facility, administrative offices, and maintenance workshops.

Power will be sourced from the National Electricity Grid facilities, which are being extended to the town of Kratie, via a new 75km-long, 66kV transmission line. Water will be sourced from a new water harvesting and storage facility at the site, which will harvest rain, and additionally source water from the neighbouring Prek Te River.

The project will further involve the upgrade of approximately 30km of existing access roads.

Key players involved

The key players involved in the PFS preparation were GR Engineering Services for the study of the plant design, infrastructure, capital and processing costs, International Resource Solutions for the mineral resource estimate, and MineGeo Tech for the study of the geotechnical, optimisations, mine design and scheduling aspects.

Earth Systems Environmental performed the environmental studies, the metallurgical test work was conducted by Metpro Consultants in collaboration with Bureau Veritas Minerals, and the TSF was designed by GHD.

Groundwater Resource Management performed the hydrology and hydrogeology studies, the mining cost study was conducted by RP Mining, and the financial modelling studies were performed by Optimum Capital.