The Nyanzaga gold project, located in the Lake Victoria Goldfields of Tanzania, is being developed by OreCorp.

In September 2015, OreCorp and Acacia Mining reached an agreement, according to which the former would take over management of the project for a period of three years. OreCorp has the opportunity to earn a stake of up to 51% in the project upon satisfaction of certain conditions.

OreCorp completed the scoping study for the project in August 2016, while the pre-feasibility study (PFS) was completed in March 2017. The definitive feasibility study (DFS) commenced in April 2017 and will be focused on the optimisation of open-pit and underground mining.

With an annual average production rate of 213,000oz of gold, the project is expected to produce approximately 2.56Moz of gold over its estimated life of 12 years. The project development is estimated to take 18 months for completion.

Details of the earn-in joint venture with Acacia

Pursuant to the earn-in joint venture agreement with Acacia, OreCorp will pay $1m initially to gain 5% ownership of the project. The successful completion of scoping study, pre-feasibility study, and definitive feasibility study will earn OreCorp an additional 5%, 5% and 10% respectively.

Acacia will optionally hold a 75% stake in the project until it receives a development decision. It holds the option to retain its interest and resume the project management if the DFS assures a net present value (NPV) of more than $200m.

Acacia will pay a multiple of the earn-in expenditure incurred by OreCorp in a lump sum that will be calculated on a sliding scale method.

If either Acacia declines to exercise its option or the NPV is less than $200m, OreCorp can exercise its option to acquire an incremental 26% ownership (taking its total stake to 51%) by making an additional payment of approximately $15m.

Nyanzaga gold project geology and mineralisation

The Nyanzaga gold project is made up of 27 adjacent prospecting licences, and two applications spread over 291km² in north-west Tanzania.

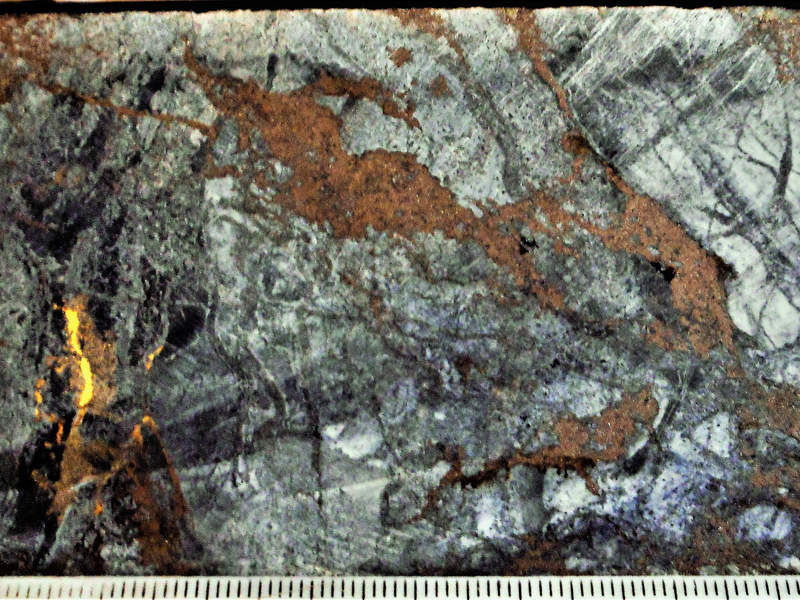

Hosted within a series of folded Nyanzian sedimentary and volcaniclastic rocks, the deposit consists of three mappable units, which are folded into the north-northwest plunging Nyanzaga Anticline. The three units identified are Nyanzaga Upper Volcaniclastic Formation, Nyanzaga Central Formation, and Nyanzaga Lower Volcaniclastic Formation.

Orogenic gold mineralisation, mostly within a northerly trending antiform, is found at Nyanzaga.

Broad zones of mineralisation with downhole intercepts were identified with a thickness of up to 60m. The rocks found at the project display a strong association with silica, quartz veining, pyrite, and pyrrhotite and arsenopyrite.

Nyanzaga mine reserves

The project is estimated to contain JORC 2012-compliant mineral resources of 23.7Mt at a grade of 4.03g/t, while contained gold is 3.072Moz, according to September 2017 estimates.

Mining at Nyanzaga

A concurrent open-pit and underground mine schedule has been preferred to be the ideal mining sequence for the project.

Conventional open-pit method of mining, using drilling and blasting followed by trucking and shovelling, will be used. An estimated 1.75Moz of gold will be recovered from the mineralised material, at an average grade of 1.5g/t gold, through the mine life.

Continuous retreat sub-level open stoping method with paste fill is proposed to be applied at the underground mine.

The underground development is expected to commence one year after the start of the open-pit operations, from a box cut external to the open-pit. The underground operations are anticipated to recover approximately 1.16Moz of gold.

Ore processing at Nyanzaga

The project is expected to recover gold at 88% through a conventional 4Mtpa carbon-in-leach (CIL) processing plant.

The ore will pass through the primary crushing circuit, which is equipped with a gyratory crusher, to produce a coarsely crushed product, which will be forwarded to the semi-autogenous ball mill crushing (SABC) circuit.

The SABC milling circuit will comprise a semi-autogenous grinding (SAG) mill operating in closed circuit with a pebble crusher and a ball mill in closed circuit with hydrocyclones.

The ore will then undergo gravity concentration and the coarse gold and silver will be recovered from the milling circuit. The resultant product will pass through intensive cyanidation and electro-winning to recover gold as doré.

The milled slurry will be passed through pre-leach thickening in order to increase the slurry density feeding the CIL circuit. The CIL circuit will leach and adsorb gold and silver from the milled mineralised material onto activated carbon.

Gold from the loaded carbon will be recovered through elution circuit, electro-winning, and gold smelting processes to produce doré.

Infrastructure facilities at Nyanzaga

Grid power will be supplied through a new 35km-long transmission line, while water for the mining operations will be sourced from Lake Victoria, located 7km to the east of the project.

Contractors involved

MTL Consulting (Tanzania) prepared the environmental impact assessment (EIA) in May 2017, with support from PaulSam Geo-Engineering.

Lycopodium Minerals, a company based in Perth, was engaged as the Project Managers/Engineering Group for preparing the DFS, while Mining Plus was engaged as the mining engineering consultant for the study.

CSA Global was engaged to prepare the resource estimates for the DFS, while Knight Piesold was engaged to study the tailings management.

Consultants Outotec is responsible for the first phase DFS paste-fill test work programme.