The Ngualla Rare Earth Project is located approximately 4.5km north of the village of Ngwala, and 147km from Mbeya in the edge of the East African Rift Valley, southern Tanzania.

The project is wholly owned by PR NG Minerals, 87.5% of which is owned by Peak Resources, while the remaining stakes are held by Appian Natural Resources Fund and International Finance Corporation (IFC).

The preliminary feasibility study (PFS) for the project was completed in March 2014 and the same was updated in March 2016. The bankable feasibility study (BFS) is scheduled for completion in late 2016.

Construction on the project is expected to start in 2017, and first production is anticipated between 2018 and 2019. The total investment to bring the project into production is estimated to be $330m.

The rare earth mine is estimated to have an initial production life of 31 years. The project aims to recover 6,720t a year (t/y) of rare earth oxide (REO), including 2,300t/y of neodymium (Nd) and praseodymium (Pr) oxides.

Ngualla rare earth project geology and mineralisation

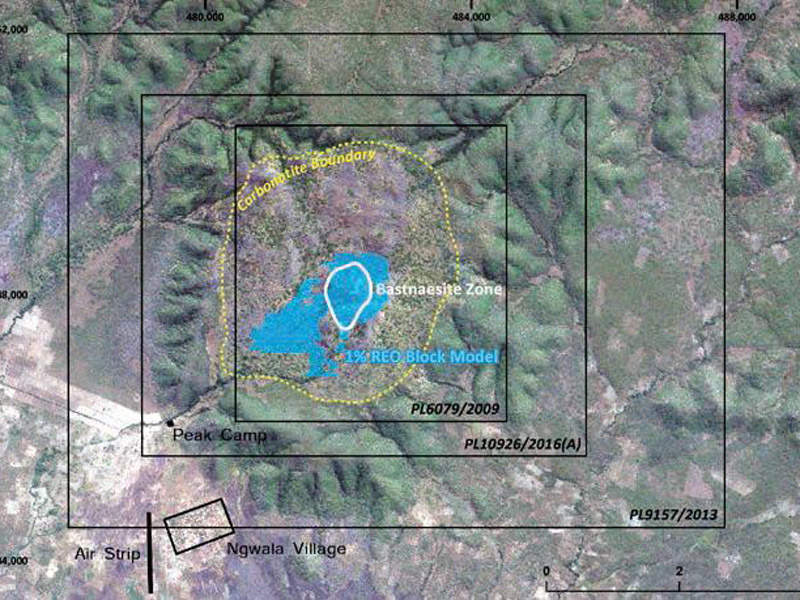

The project incorporates two granted prospecting licenses, PL6079/2009 and PL9157/2013, and the PL10926, the application for which is pending.

The project is hosted within the Ngualla Carbonatite, a Proterozoic (1bn year old) volcanic pipe, discovered by Peak Resources in 2010.

It contains a variety of mineralised zones, with the current project involving the development of the weathered Bastnaesite Zone (WBZ), which hosts an iron oxide and barite-rich weather-beaten zone above an irregular karstic surface. The weathered mineralisation occurs from surface and extends to depths of approximately 140m.

Reserves

As of February 2016, the WBZ was estimated to hold combined measured, indicated and inferred mineral resources of 19.9Mt grading 4.90% rare earth oxide (REO), containing 980,000t of REO. The WBZ accounts for approximately 22% of the mineral resources contained at the project site.

As of March 2014, the project was estimated to hold combined proven and probable reserve of 20.7Mt grading 4.54% REO, containing 941,000t of REO.

Mining and processing for the world-class rare earth project

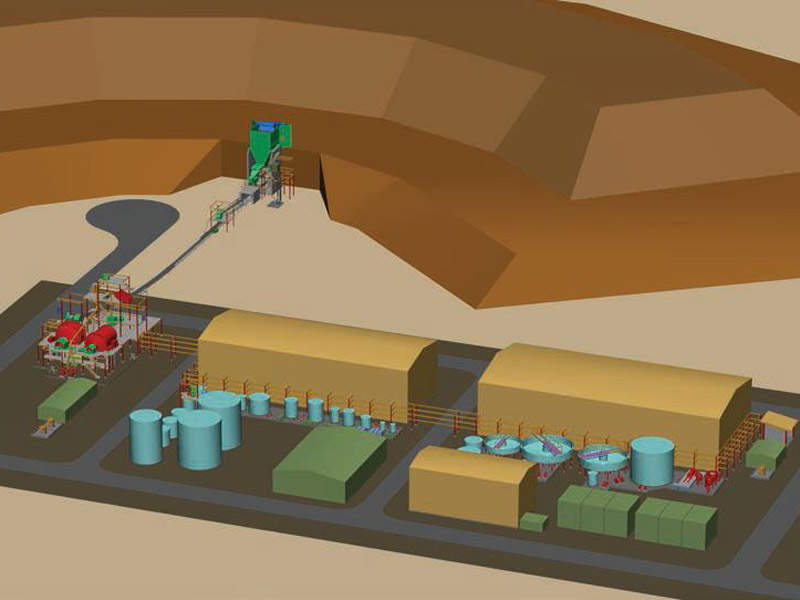

The mining method envisaged for the project is the conventional open-pit mining method integrating load, haul and dump operations, primarily deploying a 70t excavator and seven 40t, six-wheel drive articulated dump trucks.

The processing facility for the project will incorporate a beneficiation plant, a recovery plant and a final solvent extraction (SX) separation plant.

The beneficiation plant will integrate a comminution circuit for crushing and grinding the ore, a Barite pre-flotation circuit, a regrind stage, and a rare earth flotation circuit. The recovery process will integrate an alkali roasting facility, a water wash area, a low-temperature hydrochloric acid leach facility, and a purification plant.

Infrastructure for the Ngualla rare earth project

Major infrastructure for the project will include an on-site accommodation camp for 216 people, a tailings storage facility (TSF) constructed using the overburden waste from the mine, an effluent treatment plant, a run-of-mine pad, and an explosives storage facility.

The electricity required for the project will be supplied by both diesel and heavy fuel oil (HFO) fired generators. An option to install a solar farm at the project site is also being weighed.

The required water will be sourced from a borefield and an existing creek, while the water from the TSF will be recycled for use within the process plant. A freshwater tank is also proposed to be constructed onsite.

The products from the project will be transported by third-party contractors through existing roads to the port of Dar es Salaam for subsequent export by ships.

Key players involved with the Tanzanian rare earth project

Amec Foster Wheeler served as the lead engineer during the PFS stage and for the subsequent update studies. The engineering, plant design and infrastructure studies were performed by MDM Engineering, Knight Piésold, and Golder Associates.

ANSTO Minerals, ALS Metallurgy, Nagrom, Independent Metallurgical Operations (IMO), and Janike and Johanson were involved in the metallurgical and pilot plant studies. The resource definition and mineralogy studies were performed by SRK Consulting, SGS, Dr Wally Witt, and Dr Roger Townend and Associates.

Orelogy Consulting conducted the mine planning studies, while the environmental and social studies were performed by Align Environment and Risk Management, and Paulsam Geo-Engineering.