The Matilda gold project involves combined development of the Regent, the Matilda and Williamson gold mines, as well as deposits at the brownfield Wiluna mine. The project covers a tenement area of approximately 860km² in Western Australia.

It is wholly owned by Blackham Resources. Located at the tenement area’s centre, the project was acquired from Apex Gold in January 2014. The brownfield mine has produced more than 4.3Moz of gold, with the existing processing facility at Wiluna being in operation for approximately three decades.

In December 2014, the scoping study was completed, with the pre-feasibility study (PFS) finished in October 2015, and the definitive feasibility study (DFS) done in February 2016.

The Australian gold project began production in October 2016, with an initial mine production life estimated to be more than seven years and the annual average production is estimated to be 101,000oz.

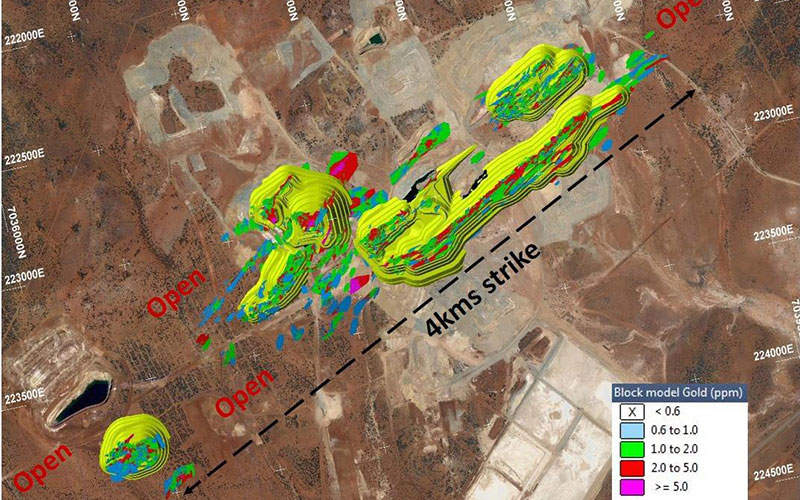

Matilda gold project geology

Gold deposits at the project site, characterised as orogenic gold deposits, are located within the Matilda Domain of the Wiluna greenstone belt hosting amphibolite metamorphic rocks.

The Matilda Domain comprises a monotonous sequence of highly sheared basalts. Mineralisation is soft and deeply weathered with approximately 7km of stacked loads that often repeat along strike and are open at depth.

Reserves of Blackham Resources’ flagship gold project

As of February 2016, the Matilda gold project is estimated to hold combined proven and probable reserves of 6.097Mt grading 2.5g/t, containing 481,000oz of gold.

The project is estimated to hold combined measured, indicated and inferred resources of 48Mt grading 3.3g/t, containing 5.1Moz of gold.

Mining and processing at the Australian gold project

Mining at the Matilda, Williamson and Galaxy deposits is proposed to be performed using open-pit method integrating standard truck and excavator operations, as well as conventional drill, blast, load and haul. The open-pits are located within a 20km radius of the existing processing facility.

The deposits at the Wiluna site are being mined primarily using the top-down mechanised longhole open stoping method and a bottom-up modified Avoca method, including unconsolidated backfilling in rare cases. Access to the underground deposits will be provided by existing portals and declines.

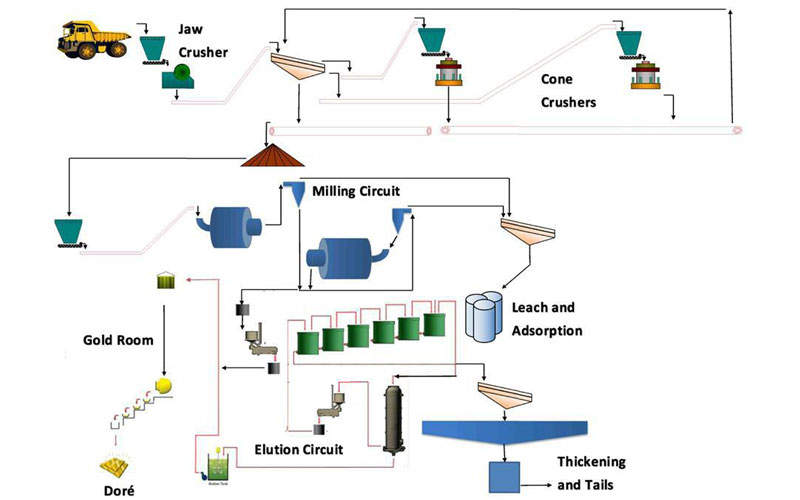

Following upgrades and modifications to the existing 1.3Mtpa processing plant, it primarily integrates a crushing circuit incorporating a jaw crusher and cone crushers, a milling circuit, a leach and adsorbtion circuit, a Biox carbon-in-leach circuit, an elution circuit, a gold room to produce gold doré, and a tails thickener.

Infrastructure at the Matilda gold project

The project benefits from the presence of existing infrastructure including accommodation facilities for 350 people, a sealed airstrip, access roads, borefields, and a 12MW gas-fired power plant. All the existing tailings storage facilities (TSF) will be integrated into a single facility, as part of the project.

Key players involved

Geotechnical assessments were performed by Peter O’Bryan and Associates, the crushing circuit and the milling circuit were modelled by Orway Mineral Consultants, the leach circuit was modelled by Curtin University and Gold Technology Group, while the thickening testwork was performed by Outotec.

The design for the TSF was provided by Knight Piésold and the engineering studies for refurbishment of the processing plant were conducted by Como Engineers. The inferred resource estimate for the project was reviewed by Entech.

PYBAR Mining was awarded a contract for the development of underground mining, and production for a period of five years.

MACA received a contract from Blackham to provide open pit mining services for the gold project. The contractual scope includes drilling and blasting, loading and hauling services.

Cater Care is responsible for providing integrated facilities and operations management services for the project.

Financing and off-take agreement

The overall investment to bring the project into production is estimated to be A$32m ($23m approximately). Orion Mine Finance is providing an A$38.5m ($27.5m approximately) funding facility for the project. Orion Mine Finance has further signed an agreement to offtake 50% of the gold produced from the project.