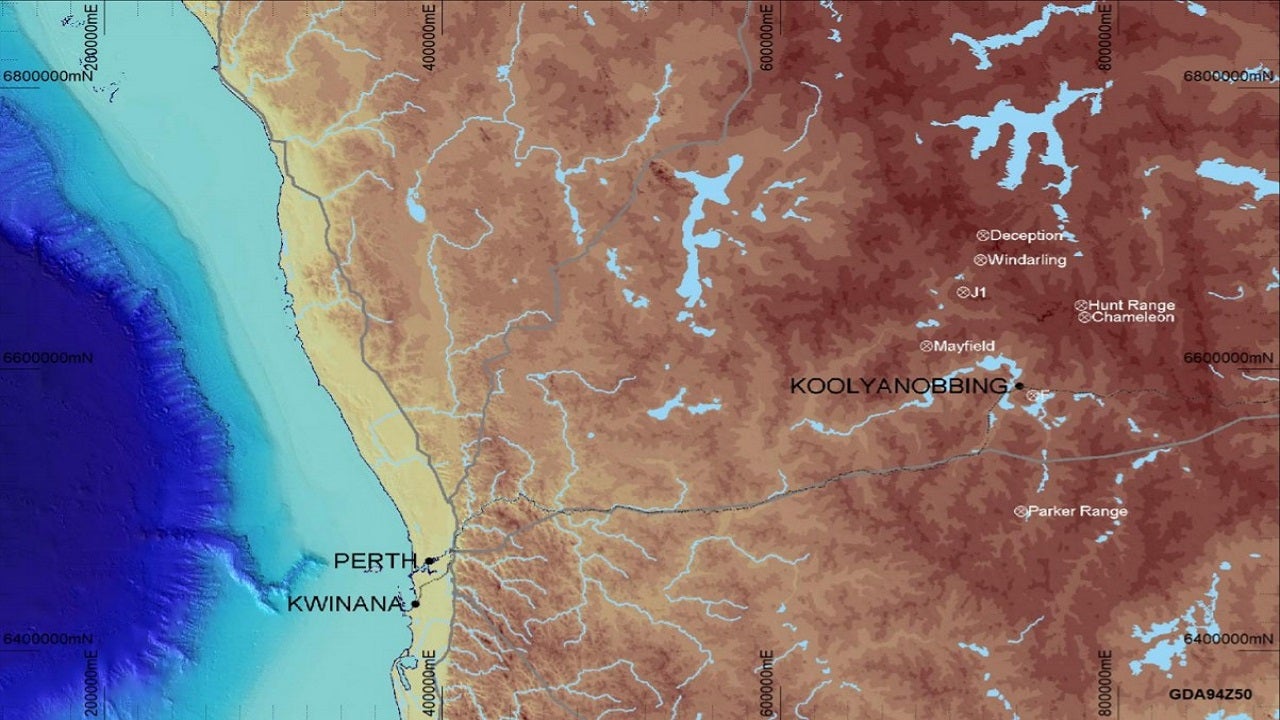

The Koolyanobbing iron ore mine in Yilgarn region of Western Australia is owned and operated by Mineral Resources Limited (MRL). It is situated 50km north of Southern Cross and 400km east of Perth.

MRL gained ownership of the mine following its acquisition from Cliffs Asia Pacific Iron Ore in July 2018.

Geological surveys in the area in 1952 demonstrated the presence of iron ore deposits. Mining activities at the operation ceased in 1983 due to economic reasons and recommenced in 1993. The mine was inoperative for some months following its acquisition by MRL and the company resumed mining and crushing in November 2018 and shipping in December 2018.

In February 2020, SilverStream, doing business as Vox Royalty, signed a preliminary purchase agreement to acquire a 2% royalty over a part of the mine.

The iron ore mine is estimated to have a life of five to six years with potential for extension through further drilling and exploration.

Koolyanobbing operations will generate 285 direct jobs across the mine and related infrastructure, along with 415 indirect jobs.

Koolyanobbing iron ore mine reserves

Ore reserves at Koolyanobbing are found in three pit stages across its F1, F2 and F3 deposits.

Koolyanobbing is part of MRL’s Yilgarn operations which also includes Parker Range, Windarling, and Deception deposits.

The combined proven and probable reserves at the deposits are estimated to be 40.8 million tonnes (Mt) at 58.2% Fe, 4.9% SiO2, 2.0% Al2O3, 0.097% P and 8.2% LOI, as of November 2019. The probable reserves at the F pits are estimated to be 4.9Mt.

The Koolyanobbing mine produced 2.5Mt of iron ore during the period between April and June 2020.

Mining at Koolyanobbing

The Koolyanobbing project employs conventional open-pit methods such as drill and blast, haul truck, and excavator. The current mining fleet includes a Hitachi EX2600 excavator, as well as 150t and 205t dump trucks.

The design of the mine involves detailed life of mine pit, stockpile and waste dump designs. Minimum mining widths have been included in pit designs and the final pit designs are based only on measured and indicated resource classifications. The mining model was optimised using the Whittle 4X Optimisation software.

Mineral Resources started mining at the Mt Jackson pits in March 2020 and transitioned the Deception and Jackson pits to lower-strip ore delivery phases by June 2020. The F3 pit is reaching the bottom of the orebody while access works and site clearing began on the F1 pit.

Mining at the Koolyanobbing operation was undertaken at a rate of six million tonnes per annum (Mtpa) until late 2019. The mining rate was increased to 8Mtpa, followed by further increases to 11Mtpa through enhanced rail capacity and commissioning of additional dump trucks. The mine achieved an annualised run rate of 12.7Mtpa in June 2020.

Processing at Koolyanobbing iron ore mine

The Koolyanobbing ore processing plant is situated 10km away from the mine site. Processing includes conventional dry crushing and screening to produce ore lump and fines products. The processed ore is shipped directly without beneficiation.

The plant throughput was increased from 8.5Mtpa to 11Mtpa through multiple upgrades at the mine in 2020.

The plant was added with a primary crushing area with a new run of mine (ROM) wall, a ROM bin, a primary jaw crusher and crushed ore conveyor, and apron and grizzly feeders. A new screening area installed with a double-deck banana screen and three discharge conveyors, as well as a new secondary crushing area, was also created as part of the plant upgrades. The product conveyors and transfer chutes at the plant were also modified.

Infrastructure

The processed ore is transported by rail to the port at Esperance for export. Rail and shipping services were also enhanced ahead of the scheduled ramp-up.

As part of the deal with Cleveland-Cliffs, MRL also acquired existing infrastructure at the Port of Esperance, including a rail car dumper and two large storage sheds.

Contractors

Onyx Projects was contracted by Cliffs for the upgrades to raise the mine’s throughput to 11Mtpa. Hermann Constructions was the mining contractor until 2018.

Perenti Group was contracted by MRL for surface mining, production drilling and blasting works.

BGC Contracting is responsible for off-road haulage services and mining operations. The company secured a five-year contract extension worth A$520m ($368.18m) in 2016.