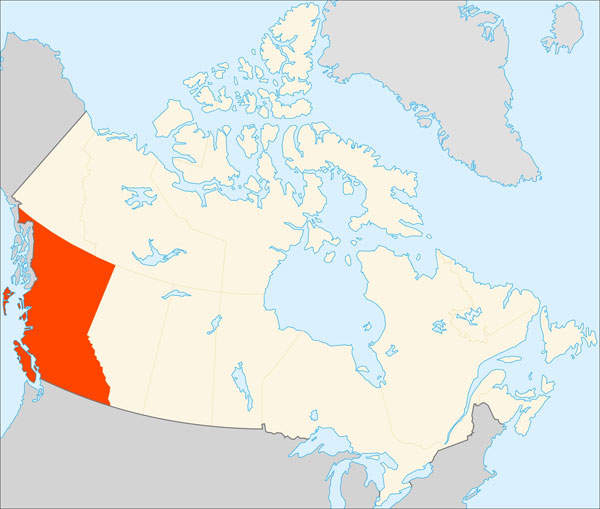

Kitsault molybdenum mine is a high-grade resource located 140km from Prince Rupert in British Columbia, Canada. Owned and operated by Avanti Mining, the mine is considered to be one of the world’s top five molybdenum projects.

The Kitsault mine was discovered in 1911 and the first diamond drilling programme at the mine was carried out by Kennco Exploration in 1959. The mine produced 9.3Mt of ore between January 1968 and April 1972.

In 1976, a feasibility study was conducted to explore options for reopening the mine. Production resumed between 1981 and 1982. Avanti acquired the Kitsault property in October 2008. All necessary permissions for the mine’s development are in place. A new environmental assessment was only needed for tailings disposal.

A feasibility study of the mine, undertaken by AMEC, was completed in late 2010. Avanti entered into an agreement with five lenders in April 2012 to provide up to $640m of financing for the mine’s development.

In May 2012, the Environmental Impact Statement for the mine was accepted for review by the Canadian Environmental Assessment Agency. The project received environmental approval from the Canadian Government in June 2014.

Construction on the Kitsault site began in the same month and is expected to create 700 jobs at the peak. The project will operate at a mill throughput of 45,500t/d over 14 years of mine life, according to the feasibility study.

Geology and reserves at British Columbia’s mine

Kitsault mine consists of three deposits, namely Kitsault, Bell Moly and Roundy Creek. The deposits are part of the Bowser Lake Group in the Intermountain tectonic belt of the Coast Plutonic Complex.

As of February 2013, proven and probable reserves at the Kitsault mine were estimated to be 228.2Mt grading 5.3g/t Ag and 0.083% Mo.

Mineralisation of the Kitsault, Bell Moly and Roundy Creek deposits

Mineralisation at the Kitsault, Bell Moly and Roundy Creek deposits occurs in metamorphosed interbedded argillite and greywacke of the upper Jurassic to lower Cretaceous Bowser Lake Group.

The mineralisation zones are annular in plan. Intrusives of molybdenum mineralisation include diorite, quartz monzonite and felsic units.

Mineralisation at the Kitsault deposit occurs in a hollow, steeply-dipping, annular shape in the central Lime Creek Intrusive Complex. Bell Moly consists of molybdenum mineralisation in the form of a south-west zone intrusive and the Clary Creek stock.

Molybdenum mineralisation at the Roundy Creek deposit includes composite quartz monzonite stock disrupted by faulting.

Mining methods used at the Canadian molybdenum mine

Molybdenum from the mine is planned to be recovered through open-pit operations. Shovels, loaders and haul trucks will be used for the mining. Benches will be drilled in an 8m x 8m pattern for recovering the ore.

The mine will be equipped with a processing plant consisting of a 40,000t/d concentrator to process the recovered ore. The plant will use conventional processing technology. The project is located near existing infrastructure, with road and sea access enabling easy product transportation.

Ore processing at Avanti Mining’s Kitsault mine

Run-of-mine ore will be crushed and sent to the stockpile. From the stockpile, the ore will be sent to a semi-autogenous grind (SAG) mill. Crushed ore from the SAG mill will be passed over a vibrating screen, which will separate out larger ore pieces. These pieces will be sent to the pebble crusher for further crushing.

A discharge screen will separate any coarse material, which will be sent further to a cyclone pack where it will be crushed in a ball mill. From the cyclone pack, the crushed ore will be sent to the rougher-scavenger bulk flotation circuit where molybdenite and some pyrite will be recovered.

The concentrate from the rougher circuit will pass through a series of cleaning steps and the final concentrate will be sent to the thickener.

After thickening, the concentrate will be sent to the leaching circuit where it will be treated with hydrochloric acid. Leached material will be filtered, washed and dried before being shipped.

Tailings from the rougher circuit will be sent to the de-pyritisation flotation and will either be used for dam construction or discharged into the tailings management facility. The facility is designed to enable secure disposal of 233Mt of tailings, which can be expanded up to 300Mt.

Financing

The estimated cost of the project is $1bn. As of May 2015, Alloycorp secured commitments for $225m in financing for the project.