Excelsior Gold’s flagship, the Kalgoorlie North Gold Project, is located approximately 45km north of Kalgoorlie in Western Australia, covering 134km² of granted mining tenements.

The pre-feasibility study (PFS) for the project was completed in March 2014. Mining was initiated in November 2015 and first production is anticipated in 2016. The initial mine life is estimated at 7.5 years, based on the PFS.

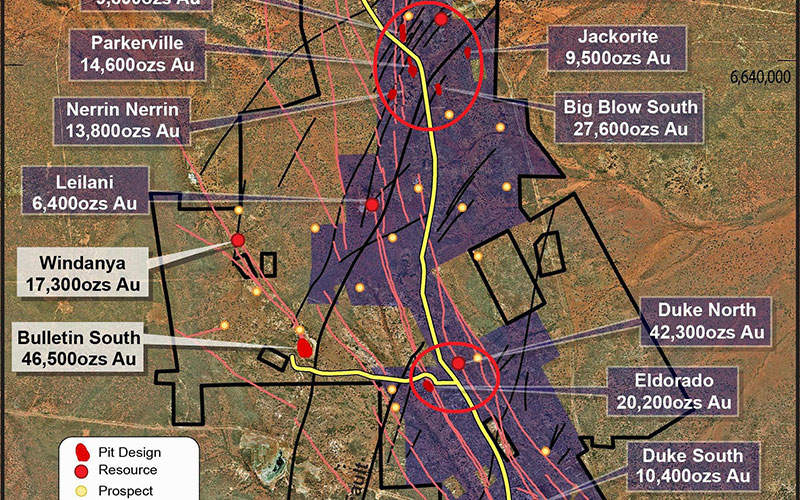

The Australian gold project involves the development of three main areas, namely the Central Mining Area consisting of the Zoroastrian and Excelsior deposits, the Bardoc South Area consisting of multiple satellites, and the Bulletin Mining and Exploration Area.

Kalgoorlie North Gold project geology and reserves

The project is located at the intersection of two major gold mineralising structural systems namely the north-west trending Bardoc Tectonic Zone (BTZ) and the north-east trending Black Flag Fault (BFF).

The mineralisation is related to the neighbouring Norton Goldfields’s Paddington gold mine to the immediate south, Mount Pleasant gold mine to the west, and Aphrodite Gold’s Aphrodite deposit to the north.

The BTZ consists of deformed Archaean succession of mafic-ultramafic volcanic rocks, felsic volcano-sedimentary rocks, felsic-intermediate porphyry intrusions and differentiated mafic-ultramafic intrusions.

As of June 2015, the mine is estimated to hold combined measured, indicated and inferred resources of 24.53Mt graded at 1.76g/t Au, containing 1.385Moz of gold.

The total proven and probable ore reserve as of July 2015 is estimated at 7.55Mt graded at 1.98g/t Au, containing 481,200oz of gold.

Mining and processing at Excelsior Gold’s flagship project

The project will initially involve the development of the Castlereagh, the Jackorite and the Big Blow South satellite open-pits in the Bardoc South Area prior to the mining of the large Zoroastrian Central open-pit. The pits will be mined until mid-2018, followed by the Bulletin South open-pit, the Zoroastrian underground and the large Excelsior open-pit.

The open-pits will be mined using an excavator and truck fleet, whereas underground mining will employ the longhole open stoping (LHOS) method using sill pillars.

The ore will be treated at Norton Gold Fields’ subsidiary Paddington Gold’s mill. A minimum of 500,000t and up to 650,000t a year of the project’s ore is expected to be processed at the Paddington treatment plant for five years, with an additional five annual extension period.

Infrastructure

The project benefits from existing infrastructure such as cleared land, dumps, open-pits and underground workings from the development of the Bardoc Mining area by Aberfoyle Gold between 1987 and 1991.

The mine’s location close to the Goldfield-Menzies Highway provides easy accessibility to power and water sources. The construction of the site-office and a 20km haul road, connecting the project’s open-pit deposits to the Paddington Mill is in progress.

Financing for Excelsior Gold’s Australian project

Based on the DFS, the capital cost for the project was estimated at A$76.73m ($56m approximately). The capital cost has further been reduced by $12.5m as a result of the completion of an ore treatment agreement in October 2015, which exempts Excelsior Gold from providing capital contributions to the Paddington Mill upgrade.

The project received a $12m loan and a $3m gold hedge facility from Macquarie Bank in July 2015. The latter was used to refinance the $4m convertible loan facility provided by Macquarie in May 2014 for the completion of the DFS. Excelsior Gold further completed the raising of A$4.55m ($3.3bn approximately) from sophisticated and institutional investors in October 2015.

Key players involved

The mining contractor for the project is Hampton Transport Services. The haul road is being constructed by McAleese Resource, who is also responsible for haulage of the ores to the Paddington Mill.

The underground and open-pit mine designs were provided by Mining Plus and Auralia Mining Consulting respectively. Peter O’Brien and Associates provided geotechnical advice for both.

ALS Ammtec, under the supervision of Daniel Schwann Consulting, performed the project’s metallurgical testwork.

The tenement management services are being provided by Central Tenement Services, whereas Toucan Resources and Mt Vetters Pastoral Company are providing field support. Redmond Drilling and Westralian Diamond Drillers provided drilling services for the project.