The Bougouni lithium project is proposed to be developed as an open-pit mining operation in the southern part of Mali by Kodal Minerals, a UK-based lithium exploration company.

Kodal Minerals acquired the Madina and Kolassokoro concessions, which together form the Bougouni project, in August 2016 and September 2016, respectively.

The environmental and social impact assessment (ESIA) application for the project was approved in November 2019, while a feasibility study was completed in January 2020.

The feasibility study highlighted a low-cost capital investment of approximately $117m for a life of mine (LOM) of 8.5 years. The project is estimated to produce 1.9 million tonnes (Mt) of spodumene concentrate over its LOM.

The mining licence for the lithium project was granted in November 2021. It is valid for 12 years and can be extended in ten-year blocks until the resources at the mine are depleted.

Kodal Minerals signed a memorandum of understanding (MoU) with China-based engineering and construction company Sinohydro in September 2020 to collaborate on the development of the project.

Sinohydro was responsible for a third-party review of the development plan and the feasibility study. The MoU also covered an assessment of the financing options for the project.

Bougouni Project location and geology

The Bougouni lithium project is located 180km south of the capital city of Bamako and covers a 350km² area. The site can be accessed through a sealed road from Bamako.

The pegmatites within the project area are hosted within an intercalated sequence of Birimian-age pelitic metasediments and amphibolites of the Leo-Man Shield. The metasediments and amphibolites are intruded by syn-orogenic and post-orogenic granitoids.

Bougouni lithium project reserves

The indicated and inferred mineral resources of the project are estimated at 21.3Mt containing 236,500t of lithium oxide (Li₂O), grading 1.1% Li₂O.

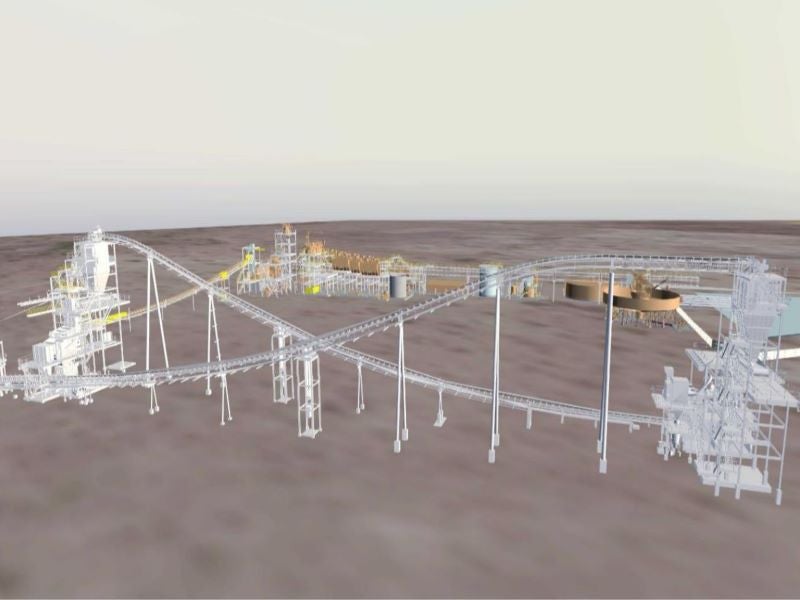

Mining and processing at Bougouni lithium project

The Bougouni lithium project is planned to be developed as a conventional open-pit mine. Mining operations will be divided across three mining areas with four individual ultimate pits.

The ore at Bougouni is present near-surface and mining operations are planned to be carried out by a contract miner.

The processing facility for the project is designed for a nominal two million tonnes per annum (Mtpa) operation with the crushing plant operating at 65%.

It will utilise a conventional flotation circuit to recover Li₂O at a 6% concentrate grade. The project is estimated to produce 220,000 tonnes per annum (tpa) of spodumene concentrate.

Automated plant control systems are proposed to be incorporated in the processing facility to reduce the continuous operator interface. The systems will also allow manual override and control when required.

The run-of-mine (ROM) ore will undergo primary and secondary crushing and the crushed ore will be transferred to a crushed ore stockpile. The crushed ore will then be introduced into a high-pressure grinding rolls (HPGR) system and wet-screened before undergoing further grinding in a ball mill.

The ground ore will then undergo magnetic separation. The non-magnetic product will undergo desliming and conditioning before being introduced into the flotation circuit, whereas the magnetic component will be transferred to the tailings thickener and stored.

The concentrate from the flotation circuit will be thickened and filtered to produce the final lithium concentrate product.

Off-take agreement

Singapore-based lithium supplier Suay Chin International (Suay Chin) owns 14.56% of the total issued share capital of Kodal Minerals. The company signed an off-take term sheet with Kodak Minerals in March 2017.

Suay Chin will have the rights over 80% to 100% spodumene production for three years from the start of commercial production from the project, subject to a formal agreement. The company is also providing technical assistance for the development of the project.