The Blacksmith iron ore project, situated in Western Australia’s (WA) Pilbara region will be developed as a direct shipping ore (DSO) project.

Red Hawk Mining, an iron ore exploration and development company, is spearheading the project’s development.

The scoping study for the project was finalised in October 2023, and the pre-feasibility study (PFS) was concluded in May 2024.

The project is estimated to yield an annual production of five million tonnes per annum (mtpa).

The mine is anticipated to have a life of mine (LOM) of 23 years with a capital investment estimated at A$217m ($141m).

The Blacksmith iron ore project is expected to achieve its first production in the final quarter (Q4) of 2025.

Project location

The Blacksmith iron ore project is located about 70km north-west of Tom Price in Western Australia and encompasses the mining lease M47/1451.

The project covers a total area of approximately 112km².

Geology and mineralisation

The project is situated in the Hamersley province, which encompasses an area of roughly 80,000km².

The project is characterised by Late Archaean to Palaeo-Proterozoic rocks from the Mount Bruce Supergroup.

This includes the Fortescue, Hamersley, and Turee Creek groups, with remnants of the Wyloo Group superimposed upon them.

Mineralisation at the Blacksmith iron ore project includes canga (hematite) with iron content exceeding 60%, underlain by the Dales Gorge Member hardcap (goethite), with a minor contribution from detrital materials.

Blacksmith iron ore project reserves

The Blacksmith project is estimated to contain a probable reserve of 46 million tonnes, grading 60.5% iron (Fe), as of May 2024.

Mining method and ore processing

The Blacksmith mine will be developed using a conventional open-pit mining method, following a standard drill, blast, load, and haul cycle.

Mining operations are planned to be undertaken by a mining contractor.

The mine plan was developed considering a maximum total material movement of 16mtpa for a long-term production rate of 5mtpa.

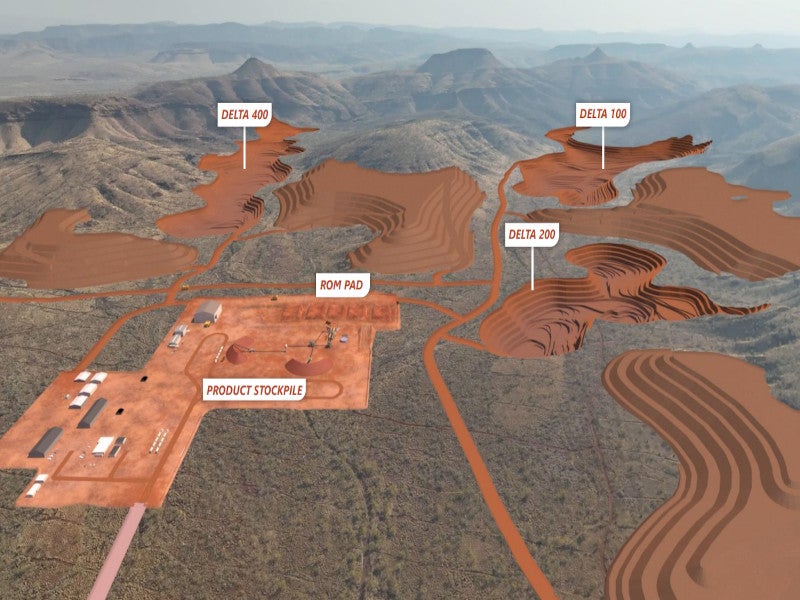

Mining operations will commence at the Delta deposit followed by the Paragon deposit. Mining will then transition to the Blackjack and Champion deposits.

The Blacksmith iron ore project is expected to produce a DSO fines product with a LOM average grade of 60.5% Fe.

The mining fleet will consist of Cat 6015 excavators and Komatsu HD785-7 or Cat 785 haul trucks, along with suitable support vehicles.

The run-of-mine (ROM) ore will be accumulated on a ROM pad before being fed into a primary crusher.

The primary crusher product will be screened and undergo further closed-circuit, secondary, and tertiary crushers. The final product will be stockpiled and loaded out as DSO.

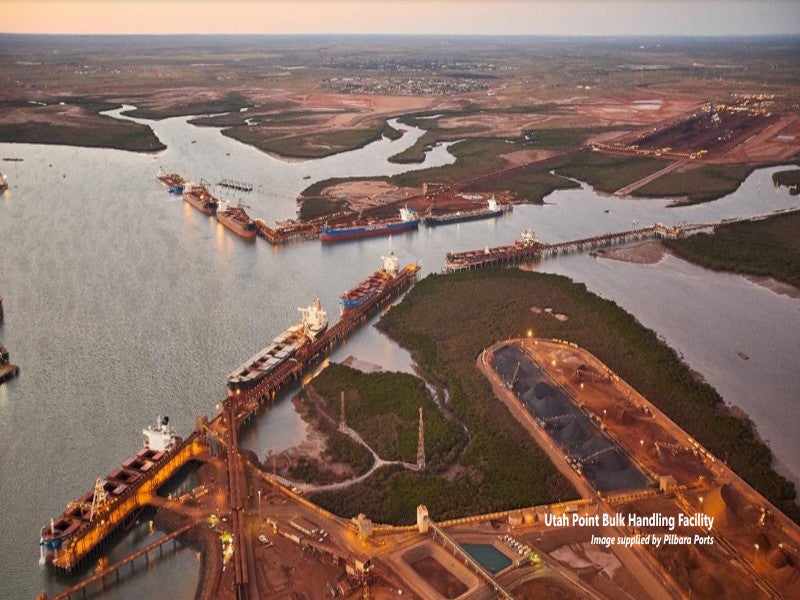

Iron ore will be transported using a mix of private and public roads, passing through a Whim Creek staging facility to the Utah Point bulk handling facility in the Port of Hedland.

Site infrastructure

A 23km access route will be constructed to connect the mine site to the Manuwarra Red Dog highway.

The Manuwarra Red Dog highway will be used to connect to Port Hedland for logistics purposes.

This includes 332km on the Manuwarra Red Dog Highway to Whim Creek and another 114km on the Northwest Coastal Highway and Great Northern Highway to Port Hedland.

Red Hawk is collaborating with Pilbara Ports to secure an allocation through multiuse bunkers at Utah Point in Port Hedland for the export of its iron ore products.

A staging facility will be constructed at Whim Creek with stockpile capacity to facilitate rapid haulage to Utah Point.

Electrical power will be provided by diesel generators, with capacities of 500kVA and 750kVA, respectively.

Raw water for operations will be sourced from bore fields at Delta, which will also be processed through a potable water treatment plant to make it suitable for drinking.

Accommodation village facilities will be constructed at Blacksmith and Whim Creek, initially housing 120 and 150 personnel, respectively.

Contractors involved

Ausenco, an engineering, procurement, construction management, and operations service provider, was engaged for the process plant, infrastructure, and road intersection designs.

The company also provided cost estimates, scheduling, risk assessments, and development plans.

Environmental Resources Management, an environmental, health, safety, risk, and social consulting services provider, was responsible for geological studies and mineral resource estimates.

Global business advisory company, FTI Consulting provided financial and economic analysis for the project.

Hypercube Scientific, a simulation modelling specialist, was responsible for optimising transportation systems to improve efficiency and reduce costs.

MGM Bulk, a transport and logistics provider, and Pastin, a logistics company, are providing transportation services for the DSO product.

NeoMet Engineering, a metallurgical consulting services provider, was responsible for providing metallurgical services and marketing expertise while Orelogy, a consultant, was responsible for the mine planning and ore reserve estimation.

Preston Consulting, a consulting company, assisted with the approvals and environmental issues for the project.

SME Geotechnical, an engineering business, was responsible for the geotechnical assessment services, particularly for the open pit mining operations.

Worley, a global engineering company, provided their expertise in hydrology and hydrogeology.

Engineering professional services consulting company, WSP, was responsible for plant site geotechnical engineering.