The Ana Paula mine is an advanced-stage gold exploration project located in the north central part of the Guerrero State in southern Mexico.

The mine was previously owned by Newstrike Capital, which was completely acquired by Mexican gold producer, Timmins Gold in May 2015. Newstrike is now a wholly-owned subsidiary of Timmins Gold, which owns two mines in Mexico including Ana Paula gold project and the Ejutla gold / silver project.

The preliminary economic assessment (PEA) for the project was completed in August 2014 and was further updated in February 2016.

In August 2016, the project received approval to initiate a pre-construction programme including a feasibility study. The $9.2m pre-construction programme will include feasibility work, infill drilling, metallurgical test-work, environmental studies and construction permits.

The feasibility study is expected to be completed by the third quarter of 2017. Construction is expected to commence by the first quarter of 2018 after receiving all necessary permits.

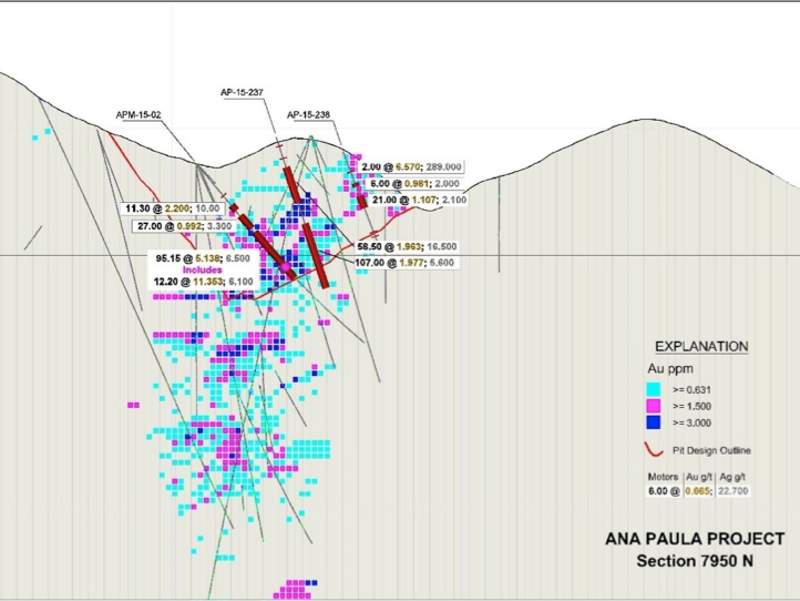

Ana Paula mine geology and mineralisation

The project is located in the highly prospective Guerrero Gold Belt (GGB), which hosts a number of significant gold discoveries and operations. It is located along the northwesterly trend of the GGB, where it occupies a boundary between two older tectonic sub-terranes – a volcanic-volcaniclastic arc assemblage to the west and a thick carbonate platform sequence overlain to the east.

Mineralisation in the GGB is categorised as a skarn porphyry mineralisation. Gold mineralisation at Ana Paula is associated with arsenopyrite and pyrite hosted in a high-grade hydrothermal breccia. The dominant mineralisation occurring at the project is epithermal with brecciation appearing at contact zones.

Ana Paula gold mine reserves

Measured resources at the mine are estimated to be 22,767kt, grading 1.608g/t AU, containing 1.177Moz of gold and 3.587Moz of silver. Indicated resources are estimated at 18,243kt, grading 1.163g/t AU, and containing 683,000oz of gold and 3.489Moz of silver.

The inferred resources are estimated to be 1,904kt, grading 1.113g/t AU, and containing 68,000oz of gold and 664,000oz of silver.

Mining and processing at the gold mine

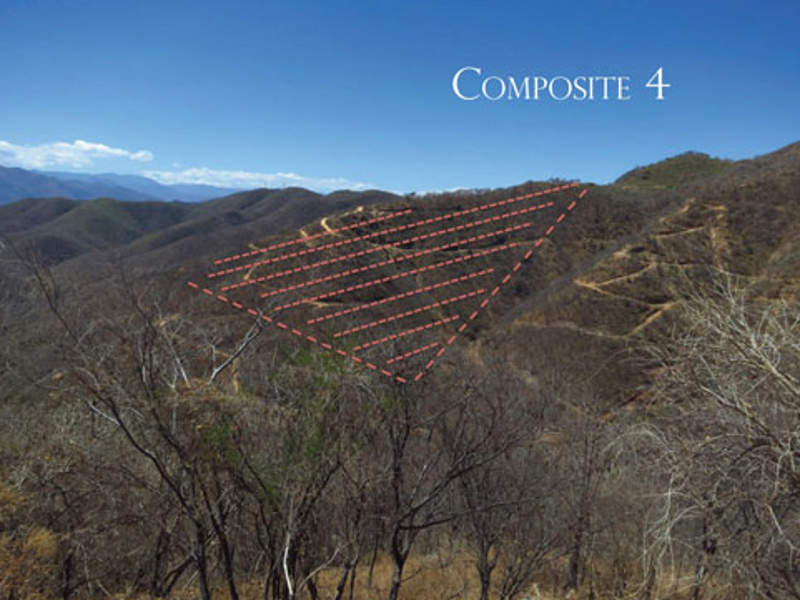

Open-pit mining techniques will be used to mine the project with the help of conventional truck and shovel production equipment. A total of 9.5 million tonnes per annum (Mtpa) of material is expected to be mined.

The primary production fleet for the project will include five conventional 90t class haul trucks, one 12.5m³ class hydraulic shovel and one 12.5m³ class wheel loader for back-up. A single rotary machine capable of drilling 200mm diameter holes will be used for drilling.

Flotation concentration and cyanide leaching will be used for processing the ore. The processing will include crushing followed by closed-circuit ball mill and gravity concentration.

Cyclone overflow will report to flotation, the concentrates from which will be reground before moving to the oxidation preparation stage. Following oxidation, the re-ground concentrates will be subject to carbon-in-leach for 48 hours. Gold will then be collected on carbon, which will be separated from the pulp and precious metals will be recovered through electro-winning.

The processing plant will have a throughput capacity of 6,000t a day. It will include basic utilities, air and water systems and a fire water system. The plant is expected to achieve an average recovery to dore of 75% for gold and 50% for silver.

Infrastructure at Ana Paula gold mine

A gravel roadway from Cuetzala del Progreso is being used to access the mine. The existing gravel road north of the site will be improved for better access during the mine construction and operations.

The electricity required for the project will be sourced from the line power, available within approximately 1.5km of the plant site. A new substation, which will receive supply from the power line, is planned to be constructed at the project site.

The project is estimated to require 2,400gal of fresh water a minute, which is planned to be harvested from groundwater sources through a series of well clusters.

Other major infrastructure at the site will include a lined tailings storage facility, a rock management facility and mine support facilities. Support and ancillary buildings will include equipment maintenance plant, administration offices, fuel storage / dispensing system, truck scale and a warehouse.

Key players involved

Timmins Gold appointed JDS Energy & Mining (JDS) to update the PEA of the project in accordance with the Canadian Securities Administrators’ National Instrument standards. The original PEA was also compiled by the same company.