Decarbonising the European steel industry is seen as one of the most critical ingredients for green energy infrastructure on the continent. Europe’s plan can be examined through three lenses: carbon pressure, subsidies and financing support.

The EU Emission Trading System (ETS) and the Carbon Border Adjustment Mechanism (CBAM) will ramp up carbon costs for steel manufacturers while incentivising them to reduce their emissions. As a result, steel producers including Acciaieria Arvedi, ArcelorMittal, Liberty Steel, SSAB, Thyssenkrupp and Voestalpine have all announced large-scale investment in new production facilities. Together, they could replace more than 20 million tonnes of annual production with low-carbon steel.

Second, to lighten the burden on their domestic champions, European governments are offering significant subsidies to finance the capital expenditure (capex) associated with decarbonising steel.

Third, institutions such as Riksgälden and Euler Hermes, as well as multilateral ones such as the European Investment Bank, are deploying a mix of loans and guarantees packaged to finance these projects and to act as a catalyst for the deployment of capital from the private sector.

The ripple effect of decarbonising will be felt well beyond the steel industry, mobilising new civil projects, engineering, equipment, infrastructure, materials and studies. In total the transformation of the European steel industry is expected to trigger tens of billions in investment across many sectors of the global economy.

How will decarbonising European steel work in practice?

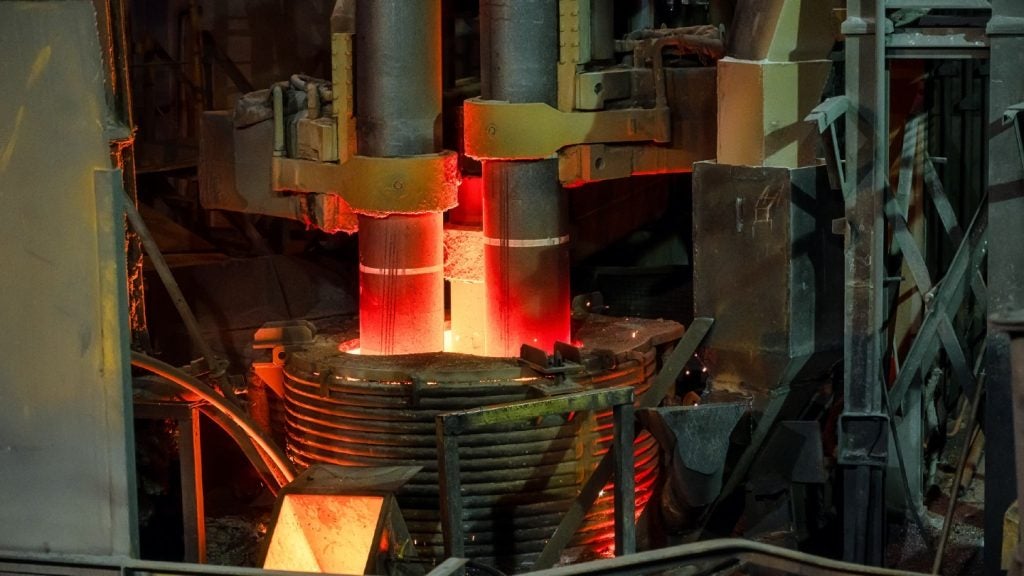

Traditional steel manufacturing using blast furnaces generates greenhouse gas emissions because oxygen contained in iron ore is removed by binding it to carbon (in the form of coal), releasing carbon dioxide (CO₂) into the atmosphere.

Europe is focused on replacing existing blast furnaces with new lower-carbon-emitting electric arc furnaces (EAFs), which recycle steel scrap. However, scrap supply is limited and not all scrap can be used to produce high-quality steel.

The alternative to scrap is direct reduced iron (DRI), which removes the oxygen from the iron ore using carbon monoxide and hydrogen, from coal or natural gas, as reducing agents.

In order to secure an adequate supply of raw material, many steel manufacturers are planning to integrate DRI and steel production by building “DRI-towers” near their new furnaces.

These new European integrated DRI-steel producers will mainly use natural gas as a reducing agent. This means they will compete directly with Middle East DRI suppliers, despite being exposed to higher and more volatile gas prices.

Importantly, reducing iron with natural gas still results in some CO₂ emissions. Carbon-free DRI can only be processed using steady flows of large volumes of green hydrogen, which cannot be produced at (nor shipped to) many of the new integrated DRI-steel projects in Europe.

Europe needs to consider additional avenues to achieve decarbonisation of its steel industry.

Breaking down the steel value chain

Historically, iron ore smelting and steel manufacturing were integrated and located in regions where coal was available. Europe has decided to maintain that approach as it builds integrated DRI-steel plants. However, this will only be successful in places where natural gas and green hydrogen are available at competitive costs.

A nascent alternative will be to separate iron reduction from the steel production geographically. DRI can be produced in places where low-cost, reliable and carbon-free electricity is available, transformed into briquettes and shipped to EAFs.

In turn, EAFs can be built in locations close to the rolling mills and where steel products are in demand. Unlike hydrogen, briquettes can be easily transported and stored at low cost.

This structural reorganisation of the industry is giving birth to a new type of independent producer that, in a way, will produce green hydrogen and sell it in the form of reduced iron briquettes.

Improving the carbon footprint of blast furnaces

DRI and EAFs alone will not be able to deliver the volumes of steel needed for the energy transition. Additionally, only a fraction of current iron ore production is suitable for making DRI.

Producing steel with a blast furnace remains an efficient process that is much less demanding in terms of iron ore supply.

Progress is being made to reduce emissions from blast furnaces. Carbon capture, utilisation and storage is also an important option to consider. Unfortunately, neither the cost nor the regulatory environment provides a sufficient incentive to make that investment decision today. This should change.

Operational vs capital costs of decarbonising European steel-making

By subsidising the capex on DRI and EAF plants, Europe is reducing the financing requirements of the steel manufacturers. However, the jury is still out as to whether there is truly a finance problem.

Until the cost of carbon-free electricity, hydrogen and carbon capture and storage comes down, most European low-carbon steel production will face international competition operating at a much lower cost level.

The EU’s CBAM may not offer sufficient protection. Even if it does, European green energy infrastructure efforts will suffer from a regional steel price that is structurally higher than in the rest of the world.

European steel producers will probably need further support to keep their operating expenses at a competitive level, at least until technology and experience reduces their decarbonisation costs.

Financing remains a challenge when the operating cash flow is insufficient, even for a small residual amount. On the other hand, there is ample capital available to finance green projects that can show a robust operating margin.

The benefits would be felt well beyond the steel industry, across the vast number of steel buyers that are building the infrastructure necessary for the energy transition.

About the author: Christophe Roux is the head of batteries mining and industries, UK, Middle East and Africa at Société Générale. With more than 30 years of experience across various regions, he has led or supervised the execution of a large number of debt arranging and advisory mandates in the natural resources sector.