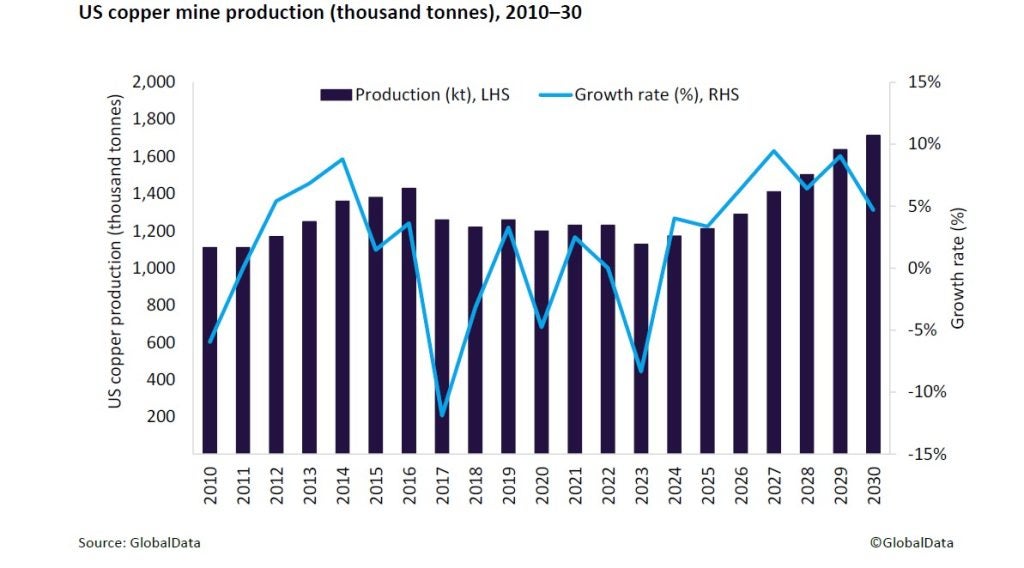

US copper mine production is expected to increase by 4.0% in 2024 to 1,172.8 thousand tonnes (kt) from 1,127.5kt in 2023.

This growth will be primarily supported by an expected increase in production from the Robinson mine as mining moves to a more copper-rich zone. In the first quarter of 2024, the Robinson mine produced 14.3kt of copper, up from 7.6kt in the

same period of 2023, mainly due to higher recovery rates, greater copper content in the ore, and increased ore extraction.

Additionally, production is expected to rise at the Pinto Valley mine due to the mill throughput expansion and optimisation. The ongoing ramp-up of the Pumpkin Hollow project, which resumed its processing mill operations in October 2023, will also contribute to this increase.

Furthermore, a strong and consistent supply from the nation's largest mines, including the Morenci, Kennecott, and Safford mines, will support supply growth in 2024.

Copper output in the US is expected to remain robust in 2025, with an anticipated annual growth rate of 3.4%, driven by the commencement of the Florence Copper, and the Johnson Camp and Mineral Park restart projects.

On July 31, 2023, the US Department of Energy included copper metal in its list of critical minerals for the first time, providing the eligibility for tax credits under the Inflation Reduction Act (IRA) of 2022.

The addition of copper to the critical minerals list will provide smooth regulations and support rapid development of new supply sources to meet future demand.

Looking ahead, the country’s output is expected to grow over the forecast period (2025-30) by a CAGR of 7.2% to reach 1,714.5kt in 2030, supported by the expected starts of several projects including the Arctic and Copper Flat (2027),

White Pine North and Zonia (2028), Cumo, Copper Creek and Van Dyke projects (2029).