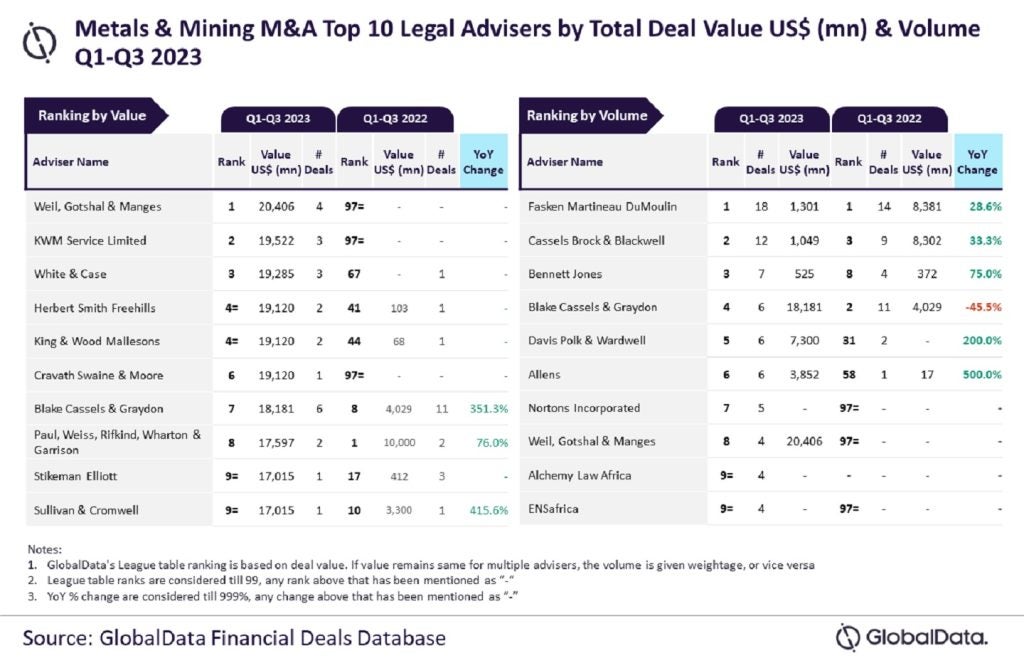

Weil, Gotshal & Manges and Fasken Martineau DuMoulin have occupied the leading positions as legal advisers by value and volume, respectively for mergers and acquisitions (M&A) in the metals & mining sector in the first three quarters (Q1-Q3) of 2023, revealed GlobalData’s latest league table.

According to the data and analytics company’s Financial Deals Database, Weil, Gotshal & Manges took the top spot, by value, after advising on $20.4bn of deals.

KWM Service Limited, which advised on deals valued at a total of $19.5bn, secured the second rank.

White & Case took the third position after advising on deals worth $19.3bn. It was followed by Herbert Smith Freehills and King & Wood Mallesons, each of which advised on deals worth $19.1bn.

Fasken Martineau DuMoulin advised on 18 deals during Q1-Q3 of 2023 to top the list, by volume.

Cassels Brock & Blackwell was ranked second by advising on 12 deals, while Bennett Jones came third with seven deals.

It was followed by Blake Cassels & Graydon and Davis Polk & Wardwell, each advising on six deals.

GlobalData lead analyst Aurojyoti Bose said: “Fasken Martineau DuMoulin was the top adviser by volume in Q1-Q3 2022 and also managed to retain the top spot by this metric in Q1-Q3 2023 as well. Interestingly, it was among the only two advisers with double-digit deal volume during Q1-Q3 2023.

“Meanwhile, Weil, Gotshal & Manges witnessed a significant jump in its ranking by value during Q1-Q3 2023. In fact, it was the only adviser to surpass $20bn in total deal value during Q1-Q3 2023.”

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.