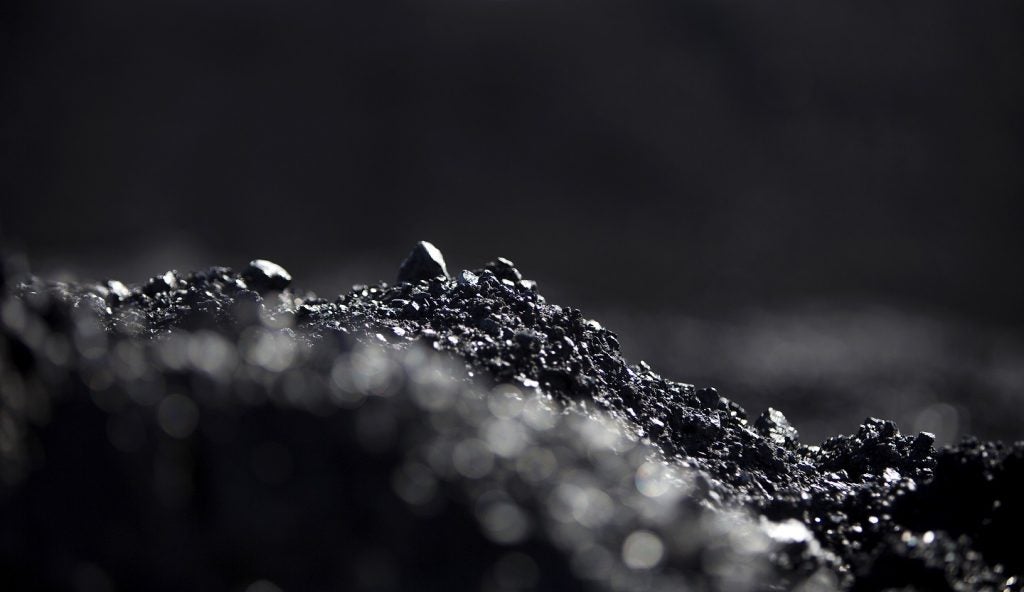

Australian company Stanmore Resources has sealed the acquisition of the remaining 50% stake in the Eagle Downs (ED) metallurgical coal project and a 100% interest in the Eagle Downs South (EDS) tenements in Queensland, from Aquila.

The company agreed to pay $15m (A$22.79m) for Eagle Downs and $2m for Eagle Downs South at closing. Additional payments of $20m and $10m are due upon extraction of the first 100,000 tonnes of coal from each site, respectively.

The upfront consideration for both ED and EDS will be funded through Stanmore's existing liquidity.

Consideration for ED also includes a capped royalty stream of up to nearly $150m based on coal price thresholds.

This move significantly expands Stanmore's portfolio of metallurgical coal assets, positioning the company for increased production capacity.

In February, Stanmore reached a deal to acquire the initial 50% interest in Eagle Downs from South32.

Stanmore executive director and CEO Marcelo Matos said: “In acquiring 100% of the Eagle Downs assets Stanmore has full control over the development plan and is able to streamline management and fully leverage its strong technical capabilities, as well as unique infrastructure and logistics portfolio to unlock the value of the asset to its full extent.

“Stanmore will seek to optimise the development plan and take a capital efficient approach to any future development decision.”

The deal is due to close in the second half of this year, subject to certain conditions such as regulatory approvals.