SSR Mining has completed the sale of its San Luis project in Central Peru to Highlander Silver.

The transaction was completed following the receipt of all required regulatory approvals and satisfaction of all closing conditions.

Initially announced last year, the deal includes a $5m cash payment to SSR Mining, which could also receive up to $37.5m in contingent payments payable in cash.

The contingent payments are structured to be disbursed in five instalments, with the first payment triggered by the initiation of a drilling programme at the San Luis project.

The final payment is due on the second anniversary of the project's commercial production.

In addition to the payments, SSR Mining has secured a 4% net smelter return (NSR) royalty on the project, which was issued concurrently with the transaction's closing.

Under the agreement, Highlander Silver has the option to repurchase half of the NSR royalty for $15m in cash at any point before the construction begins.

The sale is part of SSR Mining's broader strategy to rationalise its portfolio, having realised more than $300m from the divestment of non-core assets since early 2021.

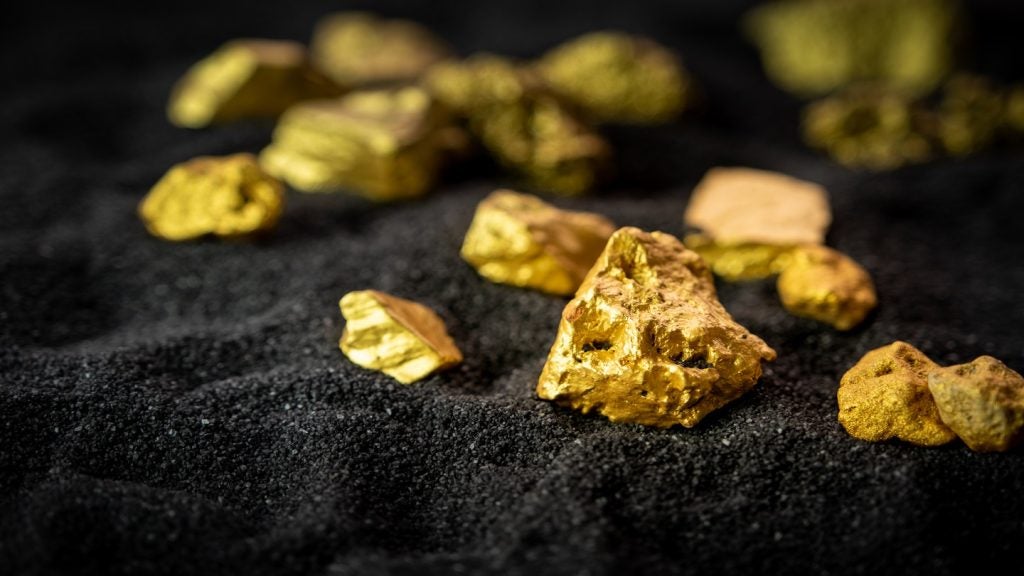

The San Luis project, located in the Ancash department, approximately 500km north-west of Lima, is a greenfield gold and silver development project.

Discovered in 2005, it spans 23,144ha across 31 concessions. This divestiture marks a significant step in SSR Mining's ongoing efforts to optimise its asset base and focus on its core operations.