Canadian company Solaris Resources has voluntarily terminated its plan to divest a minority stake to Zijin Mining Group, which was intended to support the expansion of the Warintza Project in Ecuador.

The deal, valued at C$130m ($97.2m), was announced in January this year, and would have given Zijin approximately a 15% stake in Solaris on a fully diluted basis.

Solaris decided to withdraw from the agreement after failing to secure approval from Canadian regulatory authorities within four months.

It also highlighted that the transaction was initially priced at a 14% premium, but since then, its share price has surged by more than 35%, rendering the terms of the deal less reflective of the current market value.

Despite the termination of this deal, Solaris assures stakeholders that it remains well-funded for its 2024 and 2025 baseline programmes at Warintza, with an additional $40m available through an offtake financing package announced in December.

The company is on track with its project timeline, expecting to deliver an environmental impact assessment in the second half (H2) of 2024 and a pre-feasibility study in H2 2025.

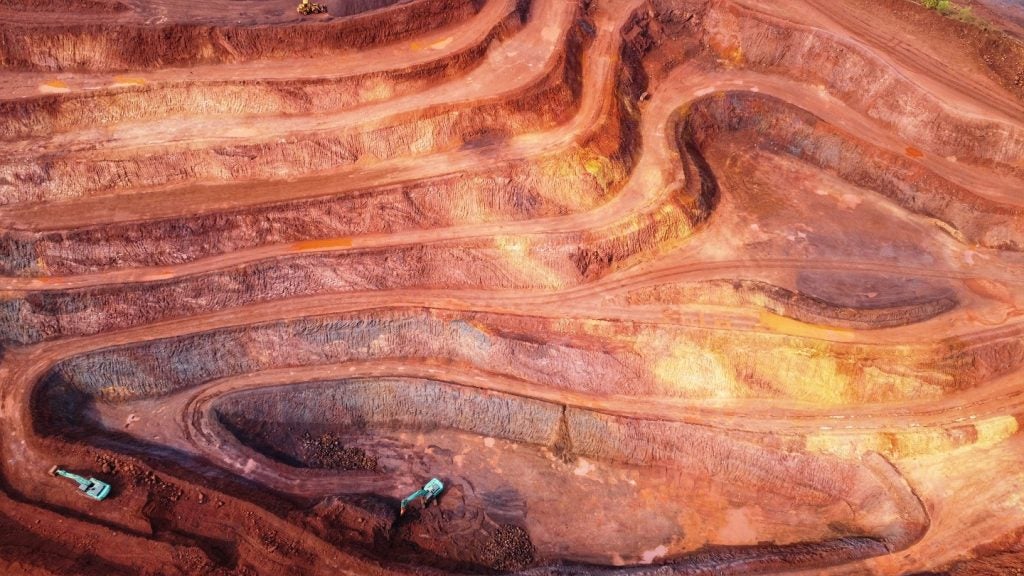

Furthermore, Solaris is actively pursuing the acquisition of a 40,000ha area adjacent to the Warintza site.

Fieldwork has already commenced on a target that exhibits geological and geophysical characteristics similar to the Warintza cluster, known for its "bullseye" geophysical signature.

Solaris president and CEO Daniel Earle said: “This transaction represented a minority equity investment from a well-known and respected, publicly-listed foreign company where the proceeds were intended to be used for the growth of a Canadian-controlled company’s principal asset in a foreign jurisdiction.

“That this transaction cannot be completed in a reasonable time frame signals that Canada’s critical minerals policy is counterproductive in relation to foreign assets.

“We intend to deliver a strategy focused on the growth and de-risking of the Warintza Project by 2026 and maximise long-term shareholder value with enhanced strategic flexibility.”