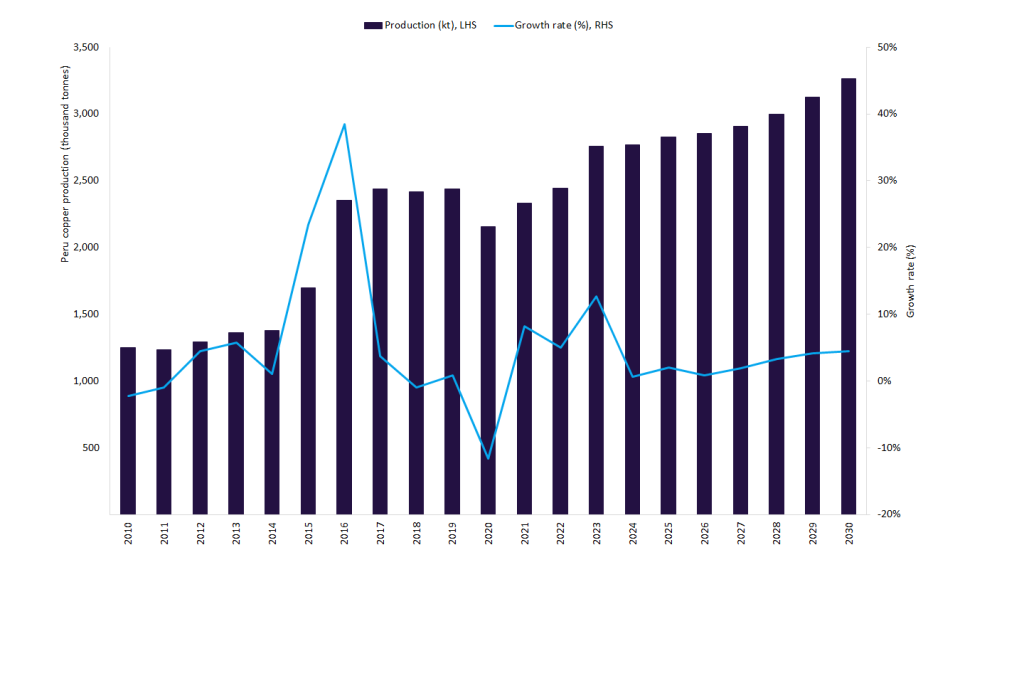

Peru ranks as the world's second-biggest copper producer, after Chile. Following three years of significant growth, Peru's copper production to grow at a marginal 0.6% in 2024. This can be attributable to disruptions in mining operations caused by blockades and unfavourable weather conditions.

For instance, China’s MMG is currently developing the Chalcobamba pit at its Las Bambas mine in Peru. However, the site was blocked by local indigenous communities who are objecting to the expansion. The blockade was lifted on 11 April. In addition, the Las Bambas mine produced 56 kilotonnes (kt) of copper in the first quarter of 2024, down by 4% over the same period in 2023. Production was impacted by lower ore milled grade, as well as adverse weather conditions.

However, this will be completely offset by the commencement of Aluminum Corporation of China’s Toromocho Expansion project this year. The project has an annual output of 75kt of copper and a mine life of 24 years. In addition, the expected increase in production from Toquepala, Cuajone, Quellaveco and Antamina mines, will further contribute to the growth. During the first quarter of 2024, combined production from these mines increased to 280kt from 238.2kt during the same period in 2023. Overall, Peruvian copper mine production increased by 3.6% year-on-year in the first quarter of 2024.

Looking ahead, in the short-term, Peruvian copper mine production is predicted to expand modestly until 2027, then rise sharply from 2028. The sharp increase in production is due to the start of several projects, including Canariaco Norte, Chalcobamba, Trapiche and Antilla projects in 2028. In addition, ramp up of projects such as Toromocho Expansion, Tia Maria and Zafranal projects, will also contribute to this growth.

Peru’s copper mine production is expected to grow at a forecast-period CAGR of 2.8% to reach 3,262.8kt in 2030.