Embattled Canadian gold miner Monarch Mining has announced binding agreements to sell three of its properties.

The company is set to divest the Beaufor and McKenzie Break properties to Probe Gold, and the Swanson property to Bullrun Capital.

This move comes as a result of a court-approved sale and investment solicitation process overseen by PricewaterhouseCoopers.

The asset purchase agreement with Probe Gold encompasses both the Beaufor and McKenzie Break properties.

Beaufor is immediately adjacent to the company’s Novador project and consists of 23 claims covering 6.9km².

The McKenzie Break property is situated only 20km north of the company’s Novador Project.

For this acquisition, the company agreed to pay a consideration in a combination of cash and common shares of the company.

Meanwhile, the agreement with Bullrun Capital is for the sale of the Swanson mining asset.

Monarch has highlighted that these transactions are contingent upon the approval of the Superior Court of Quebec in the CCAA Proceedings.

The company also emphasised the confidentiality of the consideration payable under these transactions. This measure is to maintain the integrity of the Sale and Investment Solicitation Process, should any conditions precedent not be met.

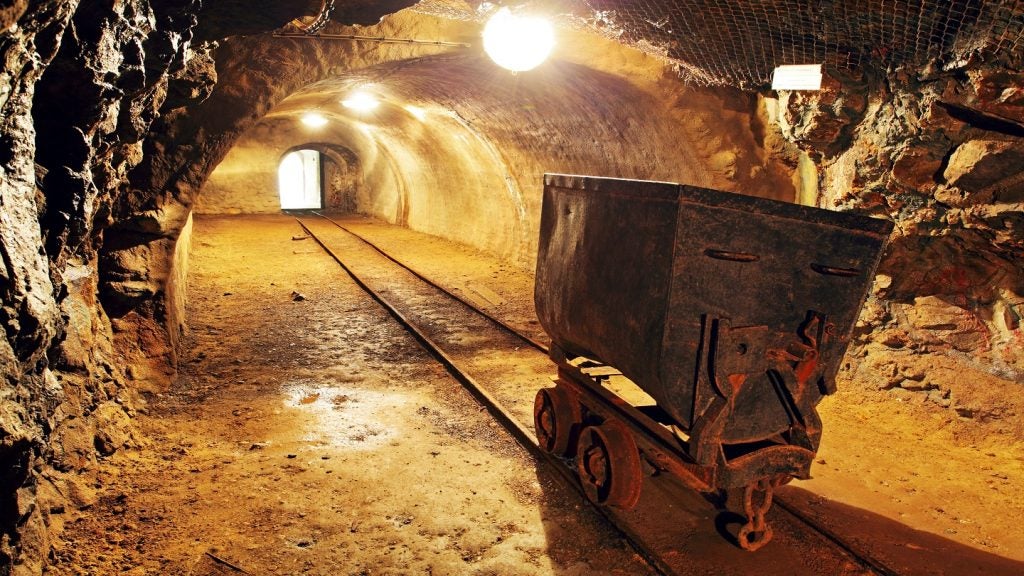

In September 2022, Monarch Mining stopped operations at the Beaufor underground mine east of Val-d’Or, Quebec, in Canada, due to operational and financial hurdles.

The mine, placed on care and maintenance for an indefinite period, produced more than one million ounces of gold during the past 30 years.