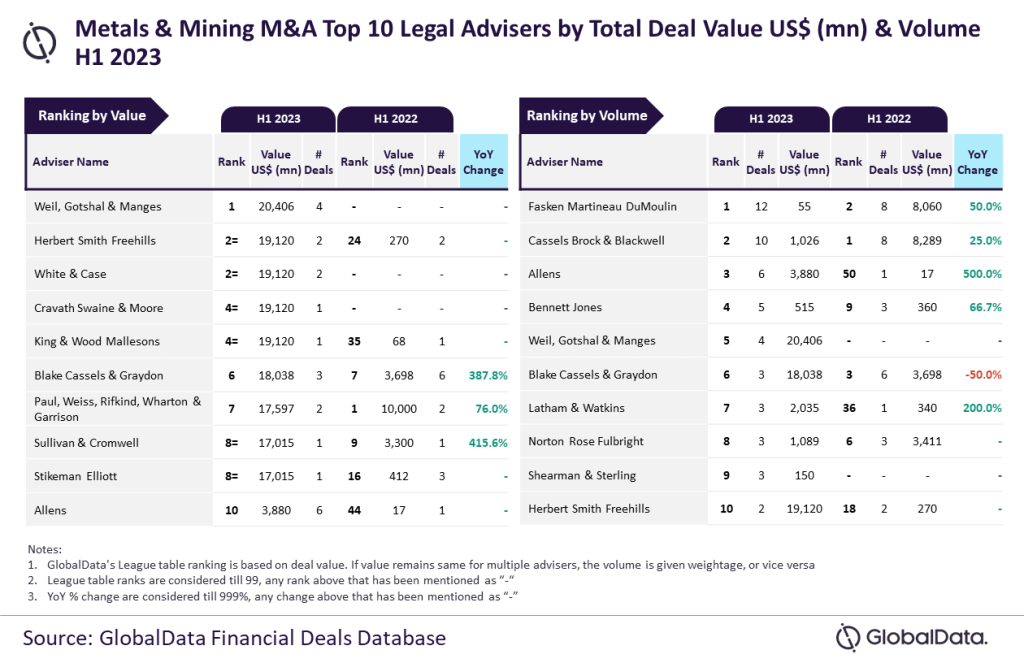

Analytics company GlobalData, the parent company of Mining Technology, has found that US multinational law firms Weil, Gotshal & Manges and Fasken Martineau DuMoulin (Fasken) were the top legal advisers for mergers and acquisitions (M&A) in the mining sector during the first half of 2023.

When examining the data for M&A in H1 2023, GlobalData found that Weil, Gotshal & Manges led all legal firms in the mining sector for cumulative value of M&A advised, with $20.4bn of deals advised, while Fasken was the leader in regards to deal volume, advising on 12 deals. Fasken has risen to this spot from second place in H1 2022. Weil, Gotshal & Manges, meanwhile, did not place in the top 100 for total deal value in H1 2022.

GlobalData lead analyst Aurojyoti Bose said of the findings: “Fasken Martineau DuMoulin was among the only two firms with double-digit deal volume in H1 2023. However, despite leading by volume, it lagged in terms of value and did not feature among the top ten by value.”

“Meanwhile, Weil, Gotshal & Manges, despite advising on less than half the number of deals advised by Fasken Martineau DuMoulin, managed to top the chart by value due to involvement in big tickets. Weil, Gotshal & Manges advised on a $19bn deal, which helped it lead by value.”

Following Weil, Gotshal & Manges, Herbert Smith Freehills and White & Case jointly came in second place for H1 2023, each advising on approximately $19.1bn of deals. Herbert Smith Freehills was ranked 24th, with a comparatively small $270m of deals in H1 2022.

King & Wood Mallesons and Cravath Swaine & Moore both also advised on $19.1bn of deals in H1 2023; however, they jointly occupied fourth place on the list as the two companies sharing second each advised on two deals, while the pair in fourth each only advised on one. Paul, Weiss, Rifkind, Wharton & Garrison, which held first place on the H1 2022 table, dropped to seventh spot with one $10bn deal.

On the volume table, immediately following Fasken is Cassels Brock & Blackwell, which advised on ten deals. While this was an increase on the eight deals it conducted when it held first place in the table in H1 2022, it was not as many as Fasken added in the year since. Behind them came Allens in third, a rise from 50th place in H1 2022, and Bennett Jones in fourth.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available in the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness of the data, the company also seeks submissions of deals from leading advisers.