Mining is the bedrock of modern Australia, in no small measure thanks to the gold rushes of the mid-1800s. In the two decades on from 1851 – as the global industrial revolution was culminating – Australia’s population rocketed from 470,000 to more than 1.7 million, largely the result of migrants seeking to capitalise on the bounty of precious metals the ‘Lucky Country’ was built on.

With its population now a pinch over 26 million, Australia continues to rely on mining, which accounted for 13.6% of gross domestic product in 2023. The country’s government wants more, recognising its critical role it plans to enhance its mining science technology capability, bolster its workforce and even pivot the model to process more domestically.

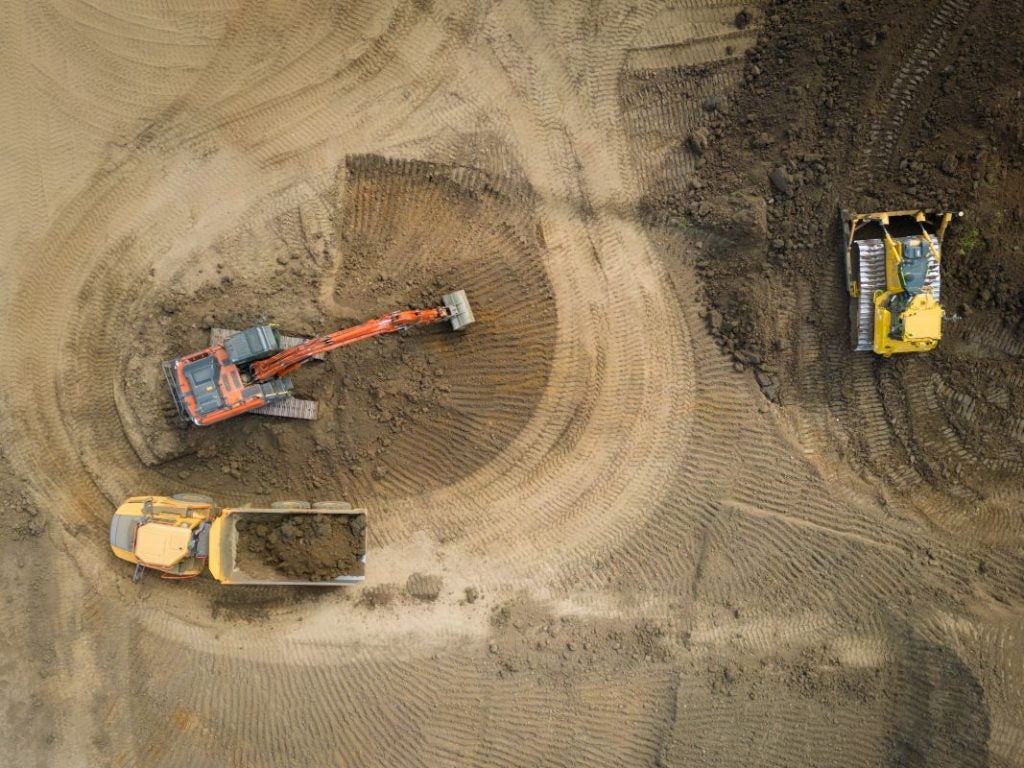

Those ambitions offer an abundance of opportunity, as the US International Trade Administration (US ITA) highlighted in an early-2024 briefing. The government-funded export and inward investment advocate for US businesses and markets, part of the Department of Commerce, said offering trading potential is the fact that the “high cost of labour in Australia” means there is strong interest in automation technology. This includes, it went on, driverless vehicles such as trucks and trains, drills and excavation equipment.

But Australia is not alone in its desire to automate some of its mining equipment. Boasting a projected compound annual growth rate (CAGR) of 2%, market analysis and insight provider GlobalData says the total number of active machines is forecast to rise to 176,543 internationally by 2030.

At the end of 2023, it estimates the total active surface mining equipment fleet was 153,277, comprising mining trucks, which account for 61%, hydraulic excavators at 11%, dozers 14%, motor graders accounting for 7%, wheel loaders at 5.5% and electric shovels 1.5%.

In 2023, the active mining truck population, excluding those at mines in care and maintenance, was estimated to be 94,207 and forecast to rise to 108,281 by the end of 2030, matching the CAGR at 2%.

GlobalData says of all mining trucks, the largest shares are at coal mines (51%), followed by iron ore (14%) and gold (13%), with coal particularly dominant in Asia-Pacific and North America.

It lifts the lid on another potentially fascinating trend too: by truck payload size, 71% are below or equal to 100 tonnes (t) and 29% greater than 100t, indicating that mining trucks with smaller payload capacities and shorter lifespans are more widely used than larger ones.

Australia leads in automation of mining equipment

“Out of the total global fleet, Australia accounts for around 7%,” explains David Kurtz, director of mining and construction at GlobalData. This includes “an estimated 5,994 trucks, 1,956 dozers, 1,064 excavators, 868 motor graders, 747 wheel-loaders and 47 electric rope shovels,” he says.

Like other parts of the global sector, and as suggested by the US ITA, Australia is looking to innovative technologies. Kurtz, speaking more broadly, offers some insight on what those innovations might be: “Over the past 5–10 years, we have seen increasing adoption of new technologies at mine sites in order to improve productivity, reduce cost and improve safety. Amongst the trends are a rise in autonomous equipment, which is occurring both at major surface and underground mines.”

GlobalData is currently tracking more than 2,000 autonomous or autonomous-ready haul trucks at surface mines – more than a four-fold increase since 2020.

The figures support that view. Kurtz says the expectation is there are more than 1,000 tele-remote control and autonomous underground mining trucks and loaders, haulers and dumpers (LHDs) in operation. GlobalData says it is currently tracking more than 2,000 autonomous or autonomous-ready haul trucks at surface mines – more than a four-fold increase since 2020.

One such site is Western Australia’s South Flank iron ore mine, owned by BHP, which last year announced it had completed its autonomous haulage transition, coinciding with its fifth autonomous operating zone (AOZ) going live at the US$3.6 (A$5.42bn) mine.

BHP said a collaboration with Komatsu had seen it convert 41 930E haul trucks and around 185 pieces of ancillary mining equipment including dozers, excavators, front-end loaders, water trucks and other site vehicles, meaning its primary haul fleet was able to operate safely around the site's five AOZs. The 290t haul trucks, automated with Komatsu’s FrontRunner AHS, have Schlam Hercules bodies and six Liebherr 600t R 9600 shovels.

The programme to transition to autonomous haulage was launched at the beginning of 2022, with that April marking the start of the conversion. Just over a year later and the project was complete; other functions and networks at the mine had been upgraded and adapted to work with an autonomous fleet and all employees had been retrained or upskilled. BHP says the ambitious project was completed ahead of time and below budget.

GlobalData’s market analysis shows BHP has the largest number of operational autonomous vehicles globally to November 2023, with 368. Likewise, Australia’s mining sector led the world in autonomous vehicles, boasting 882. Some distance behind was China with 326, Canada with 250 and Chile with a fleet of 132.

Electrification of mining trucks

While autonomy is a key driver of market growth, so too is electrification and battery operation. Published at the end of 2023, GlobalData’s Global Surface Mining Equipment: Populations & Forecasts to 2030 report revealed this was an increasingly popular area. As of November, GlobalData was tracking 230 trolley assist and 101 battery electric trucks operating at surface mines globally.

Zambia, Namibia and Panama were leading the way in trolley assist trucks, while China was by far the biggest investor in battery-powered trucks, with 68 known to be operational. The Chinese mining sector was also leading the way on small-scale battery-powered trucks, something the report says is burgeoning.

However, the spotlight will perhaps shift from China a little as, says the report, large-capacity, battery-powered surface electric truck prototypes are being tested in Australia and South Africa.

With the growing appetite for more sustainable fleets and an increasing focus of the sector to cut emissions, it seems more is to come. “The use of electric and battery-electric equipment is increasing, being driven in part by the need to reduce scope 1 emissions at mine sites, but also supporting reduced maintenance and other operational costs,” says Kurtz.

“While many miners are looking at the next decade for more comprehensive adoption of electric vehicles,” Kurtz adds, “there has been widespread trialling and some initial adoption of electric and battery-electric equipment, particularly underground.”

GlobalData has identified more than 400 trolley-assist and battery-powered surface trucks in operation, as well as over 330 electric trucks and or LHDs operating underground. This may just be the start, with BHP, Rio Tinto, Newmont, Teck and Freeport-McMoRan among those hoping to develop the next generation of zero-emission trucks though collaborations with Caterpillar (CAT).

Working with CAT, in 2021, Rio embarked a project to deploy what both said would be the world’s first fleet of CAT 793 zero-emissions autonomous haul trucks. It said that its then under development $2.6bn Gudai-Darri iron ore mine in Western Australia would receive the fleet of 35. The mine, situated in the Pilbara region approximately 35km north-west of Rio’s Yandicoogina site, had already been selected for fully autonomous CAT 789D water trucks, which Rio hoped would help further increase productivity.

Market shift expected by 2030

It seems there is a major shift coming to mining, in particular the fleets it operates and the skills needed to do so. Miner and OEM collaborations are helping to facilitate that, resulting in machinery that is not only increasingly sustainable but now more customised than ever before.

Of the projected 176,543 active global mining machines by the end of the decade, GlobalData says trucks will make up the lion’s share. It believes the most popular payloads will be 50–99 tonnes (36%); 35% will be below that, and then numerous dozers accounting for 14% and hydraulic excavators and shovels at 11%. The need for trucks will continue, but right now it is the innovation they bring that catches the headlines.

GlobalData estimates that electric-powered LHDs will rise from just 1% in 2023 to almost 9% by 2030.

“As well as the current count of 2,095 autonomous haul trucks in operation, plans revealed by miners show at least another 300 to be added by 2026,” Kurtz reveals. “Where electric vehicles are concerned, a steady increase is expected over the remainder of the decade as more existing mines trial battery-electric machines and a small number of new mines commence operations with significant numbers of battery-electric machines from the outset.”

Here is the eye-catcher: as a proportion of the total fleet, GlobalData estimates that electric-powered LHDs will rise from just 1% in 2023 to almost 9% by 2030, before a faster acceleration in the next decade. It seems the energy transition that mining is critical to facilitating has indeed reached one of the oldest industries itself – clearly the ‘Lucky Country’ will take a leading role.