Medallion Metals has reached an exclusivity agreement with IGO, targeting the acquisition of specific assets from the Forrestania Nickel Operation (FNO) in Western Australia (WA).

The exclusivity period spans nine months, with an option to extend for three additional months.

An exclusivity fee of $1m (A$1.52m) is payable to IGO within five business days of the agreement's execution.

Medallion views the potential acquisition as an opportunity, with significant value to be unlocked by integrating the FNO’s infrastructure with Medallion’s Ravensthorpe Gold Project (RGP) 160km south.

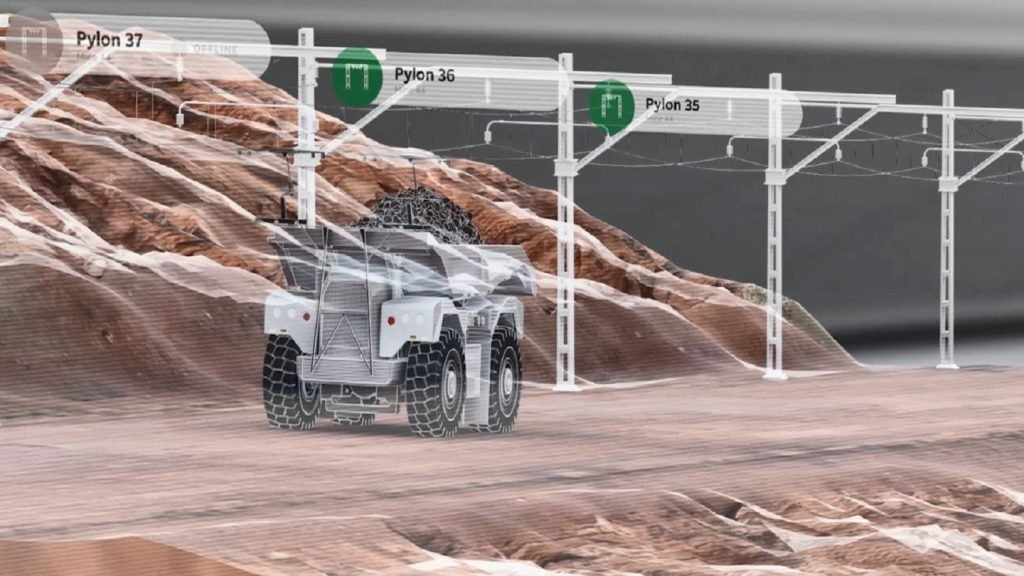

The assets in question include the Cosmic Boy processing facility and associated infrastructure, with IGO retaining priority rights for its activities at Forrestania.

The proposed financial terms include an upfront cash consideration of up to $15m, the assumption of rehabilitation liabilities and a potential deferred cash consideration, with the total not exceeding $50m.

These terms are currently non-binding and subject to formal negotiation and agreement.

In parallel, Medallion and IGO will discuss the granting of gold and silver rights across the FNO tenements, considering any pre-existing third-party rights.

During the exclusivity period, Medallion aims to complete due diligence on the FNO assets and advance legally binding transaction documentation.

Furthermore, Medallion plans to finalise an addendum to the pre-feasibility study (PFS), focusing on a sulphide-only development scenario and options analysis, leveraging recent study work to minimise costs and expedite completion.

The company also intends to deploy a drill rig to the RGP in early September to begin approximately 15,000m of drilling.

The drilling campaign will include infill drilling and various tests and studies to evaluate the development of high-grade sulphide mineral resources at the RGP.

This will also involve an options analysis to assess the feasibility of stand-alone processing at the RGP versus utilising the Cosmic Boy plant.