Upstream mining and exploration company Madison Metals has agreed to acquire what it believes to be one of Canada’s largest undeveloped antimony deposits in a Hemlo gold camp setting in Ontario.

Madison Metals signed binding letters of intent (LOI) with three separate entities to acquire a 100% interest in the project covering 13,990 hectares over 697 claims. The move significantly expands the company’s presence in the critical minerals sector.

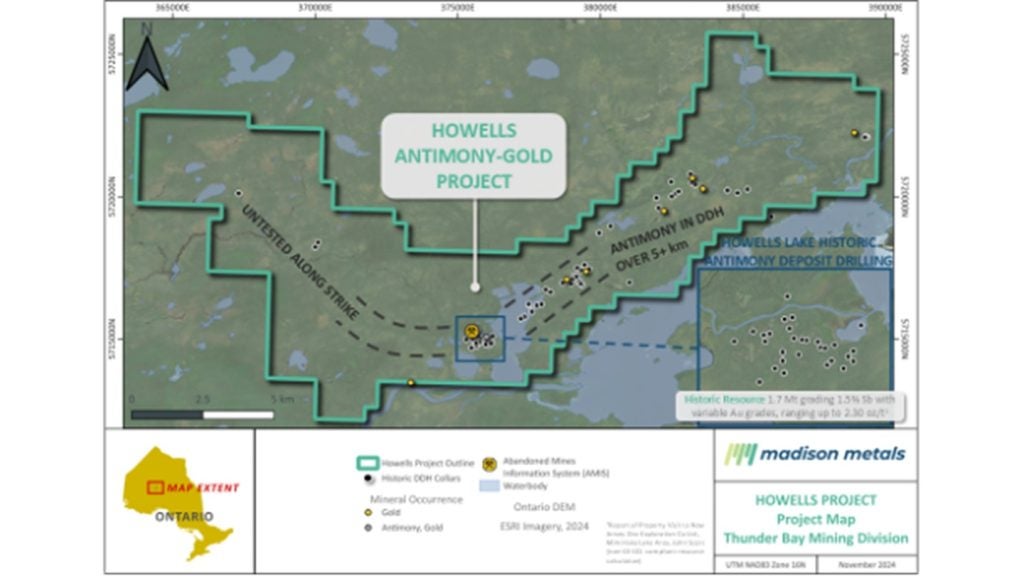

The Howells Lake antimony gold project is located in the Thunder Bay Mining Division and offers Madison Metals one of the few historic antimony resources.

Antimony, whose price has tripled in the past year, is considered a highly attractive critical mineral.

Madison Metals chairman and CEO Duane Parnham said: “Micro-cap companies rarely, if ever, have the opportunity to obtain complete control of a large, belt-scale asset like the Howells Lake Project, covering such an extensive area of known mineralisation that seems to have been overlooked for decades.

“The Howells Lake Project has enormous potential to have real economic significance, and Madison is seizing this rare opportunity to discover new areas of antimony-gold mineralisation as well as define the known areas of antimony and gold mineralisation on this very large, underexplored land position.

“We believe we can drive real shareholder value creation as soon as we get exploration under way on the project.”

Madison Metals will pay the first vendor 50,000 common shares and a 2% net smelter return (NSR), with an option to repurchase 1% of the NSR for C$1m ($712.17m).

The second vendor will receive C$25,000, 125,000 common shares on signing and three subsequent equal anniversary payments, along with a 2% NSR and a 1% NSR buyback option for C$1m.

For the third vendor, Madison Metals will issue two million common shares on signing, 1.5 million shares on the first anniversary and one million shares on the second anniversary of the final agreement.

The company will additionally engage the third vendor group through consulting contracts for drilling, geophysical surveys and geological services.

Madison Metals will grant the third vendor a 2% NSR, retaining the option to repurchase 1% of the NSR for C$2m.

A historic mineral resource estimate at the project reported 1.7 million tons (t) grading 1.7% antimony. In addition, gold mineralisation has been documented, with grades reaching up to 2.3oz/t.