Australian battery minerals producer Liontown Resources has announced a debt funding package and an equity raise totalling A$1.13bn ($718.4m).

Liontown secured the commitment from a syndicate of banks and government credit agencies for A$760m in debt financing.

The lending syndicate includes ANZ, CBA, HSBC, NAB, Société Générale and Westpac.

Export Finance Australia and the Clean Energy Finance Corporation have agreed to provide the financing with a ten-year term and seven-year term, respectively. These debt facilities will replace the existing A$300m debt with Ford.

Furthermore, Liontown will carry out an equity raise of A$376m ($239). This includes a fully underwritten institutional placement to garner A$365m ($232m), which will see the issuance of around 203 million new shares.

An additional A$10.8 ($6.8m) will be raised through a non-underwritten conditional placement to Liontown chairman Timothy Goyder, with the issuance of six million shares.

The shares will be priced at A$1.80 ($1.14) each, marking a 35.5% discount to the stock’s last close of A$2.79 ($1.7) a share on 13 October 2023.

Liontown CEO and managing director Tony Ottaviano said: “The execution of this credit-approved term sheet and the launch of the equity raise are critical achievements in de-risking the development of the Kathleen Valley project. These initiatives ensure we are funded to first production and beyond.”

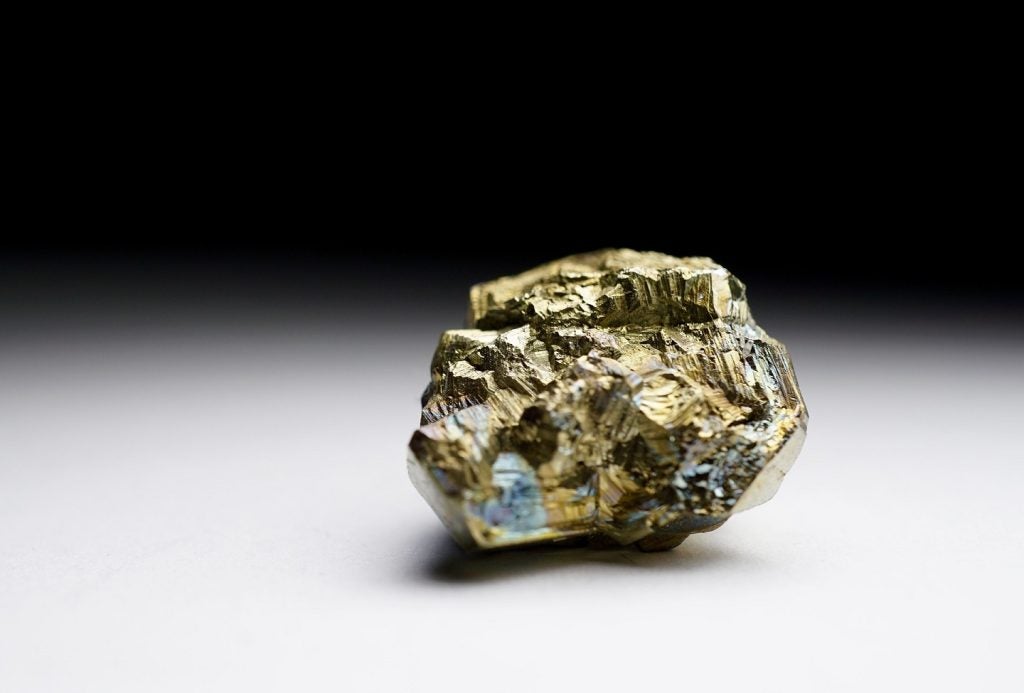

The company plans to use the funding to support its flagship Kathleen Valley lithium project near Perth in Western Australia.

This project is located on the western edge of the Norseman-Wiluna Greenstone Belt within the Archaean Yilgarn Craton and hosts lithium mineralisation within spodumene-bearing pegmatite dykes.

The funding will be used for capital costs at the project, including early mine development and to build preproduction stockpiles.

It will also be used to cover corporate costs and working capital requirements and provide prudent liquidity through to first production and beyond.

The financing has been secured at a time when US chemical company Albemarle ditched its $4.3bn buyout bid for Liontown, owing to complexities associated with the deal.

Albemarle's move comes close on the heels of Australian billionaire Gina Rinehart's mining company Hancock Prospecting building up its stake in Liontown to 19.9%.