Western Australian (WA) exploration company Horizon Minerals has agreed to acquire all shares and options of local peer Greenstone Resources, resulting in the merger of the two companies’ Goldfields assets.

The transaction is structured as schemes of arrangement under the Corporations Act 2001.

It will see Horizon buying 100% of the ordinary shares in Greenstone and 100% of the listed Greenstone options, with each Greenstone shareholder getting 0.2868 Horizon shares for each share held and each Greenstone option holder getting the same number of Horizon options for every option held.

The swap ratio marks an 89% premium to Greenstone’s last stock close on 9 February 2024.

Upon completion, Horizon shareholders will own 63.1% of the merged entity, which will continue to operate under the Horizon Minerals brand. Greenstone shareholders will own the remaining 36.9% of the combined business.

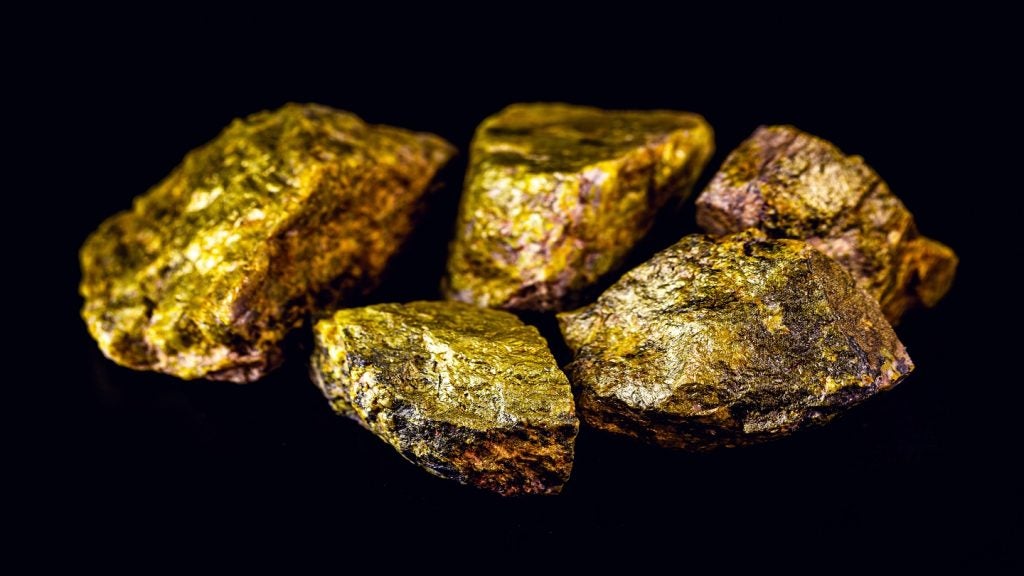

The deal will consolidate the companies' assets around the gold mining hubs of Kalgoorlie and Coolgardie, with a combined JORC (Joint Ore Reserve Committee) mineral resource of 1.8 million ounces.

This consolidation aims to enhance exploration and development opportunities, combining near-term mining prospects with larger deposits capable of becoming long-life cornerstone operations.

The new entity will emerge with a stronger market presence, supported by a cash and listed investments balance of $14.9m (A$22.87m) and a more streamlined cost base, stated the two companies in a joint announcement.

This financial stability is expected to facilitate the pursuit of an aggressive growth strategy within the gold mining industry.

The completion of the merger is anticipated by June 2024, contingent on the fulfilment of customary closing conditions.

Horizon CEO Grant Haywood said: “We believe this proposed merger represents a unique opportunity to build our resource base in the WA Goldfields with higher grade deposits near established mining and processing infrastructure.

“This really is a logical consolidation of complementary assets, which creates greater potential for Horizon to unlock the value within our longer project pipeline.

“Following a period where we divested non-core assets and brought greater focus onto a pipeline of smaller, near-term cash-generating mining opportunities, this merger with Greenstone will both add to this near-term pipeline and bring greater scale to our baseload assets with the addition of the high-grade Burbanks deposit.”