Heliostar Metals has announced a letter of intent (LOI) to secure a senior secured debt facility totalling $20m (C$27.48m), with a fixed interest rate of 10%.

This move is aimed at advancing the company's mining operations, specifically the Ana Paula deposit in Guerrero, Mexico.

The non-binding LOI with a syndicate of lenders, led by a New York-based financial institution, outlines the terms of the agreement.

As part of the facility, Heliostar will issue 17,239,668 share purchase warrants to the lenders.

These warrants will allow the lenders to acquire common shares of the company at predetermined prices within a 30-month period following the closing of the deal.

Each warrant grants the right to purchase one common share at $0.40 for half of the warrants and $0.55 for the other half.

The facility also includes a unique repayment structure where Heliostar is obliged to repay an amount linked to its gold sales, specifically $1,850 per ounce sold, after accounting for operating expenses.

Proceeds from this facility are earmarked for the development of the underground decline and to facilitate test mining that will process a bulk sample from the Ana Paula deposit.

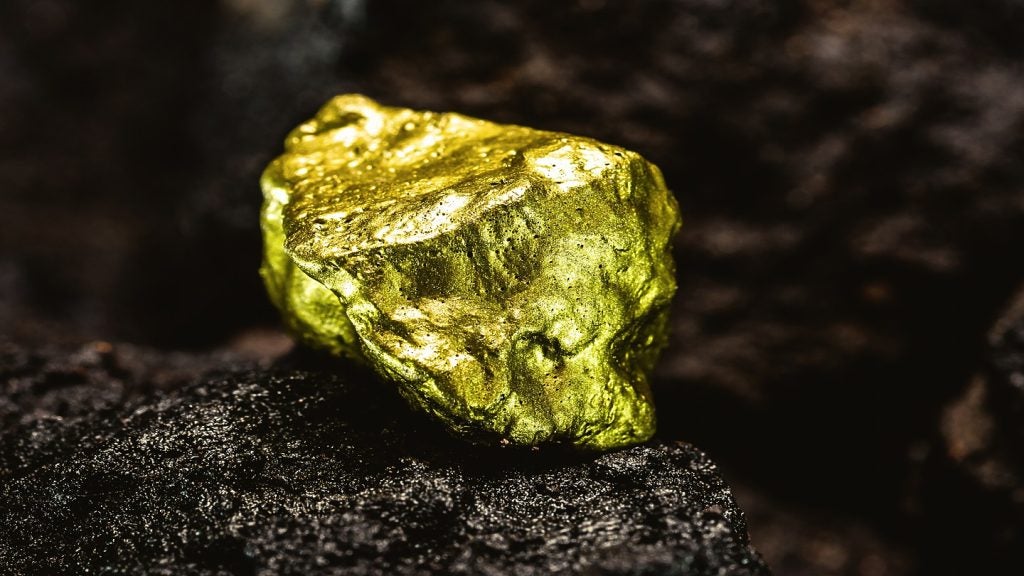

Located in Guerrero State, Mexico, the Ana Paula Project is a gold resource development project.

In March last year, Heliostar acquired the project from Argonaut Gold for a consideration of $30m.

The facility's term is set at 30 months, with the interest payable every six months.

Furthermore, the facility is expected to be secured by customary security commitments, including over the Ana Paula Project.

It also provides Heliostar with the flexibility to repay the facility early, particularly upon the sale of gold ounces.