Mining companies have called for a green price premium to be introduced for sustainably produced nickel traded on the LME as the global sector scrambles for recovery.

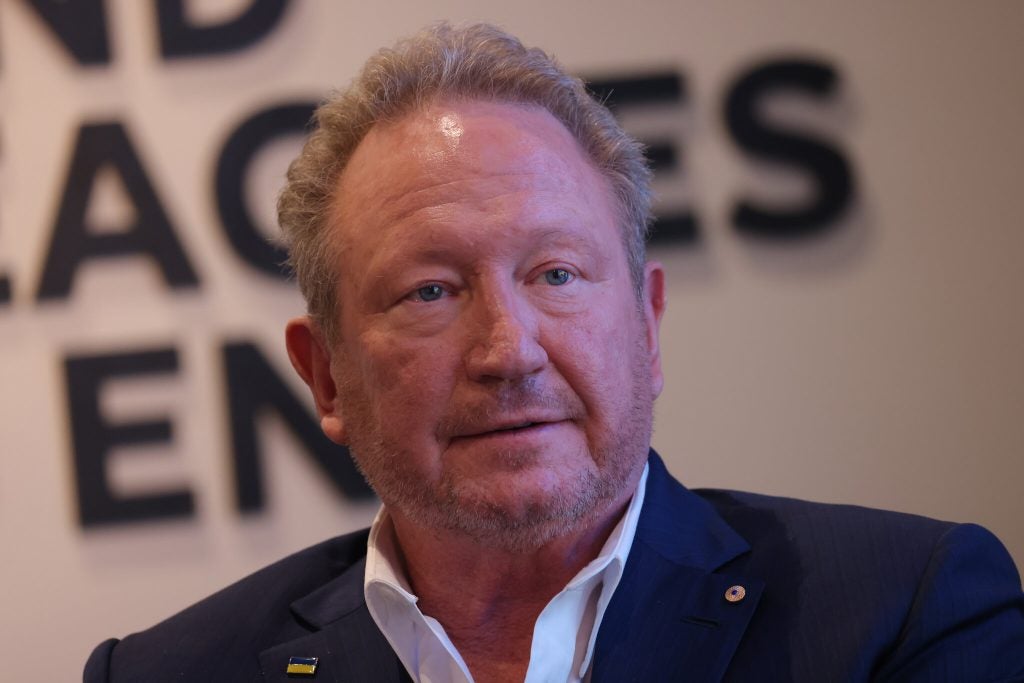

Australian mining major BHP and metals magnate Andrew Forrest, the Australian billionaire that owns miner Wyloo Metals, have been pushing the LME to formally distinguish between poor-quality nickel and cleaner supplies.

“We have got to differentiate between dirty nickel and green nickel. The LME must differentiate between dirty and clean. They are two different products, they have two vastly different impacts,” Forrest told reporters at a briefing in Australia.

The move comes as the sector tries to combat an ongoing price crisis arising from an abundance of low-quality, cheap supplies from Indonesia. However, now miners in the country are looking to list their metal as high quality.

On Tuesday, Chinese-Indonesian nickel producer PT CNGR Ding Xing New Energy applied to have its metal supply listed as a ‘good delivery brand’ on the LME for the first time in history, sparking discomfort among western producers.

The LME is likely to approve the request as part of its recovery plan for the nickel market, which is also still reeling from a price crash in 2022.

Last month, BHP chief executive Mike Henry said on an earnings call with reporters that it would “seem sensible” to see a price premium for sustainably sourced nickel. A spokesperson for the miner has said that “an increasingly well-known range of ESG [environmental, social and governance] and responsible sourcing challenges currently exist” in Indonesia.

The Australian market in particular has suffered. Several major miners have suspended or pulled out of nickel operations as a direct result of the drawn-out price slump and subsequent poor profits. Last month, BHP announced plans to shut down its nickel operations in Western Australia citing a lack of hope that prices will recover sufficiently in the short and medium term.

In January, miner First Quantum announced that it will cut production at its Australian nickel mine and slash its workforce amid poor profits. Mining giant Glencore also announced last month that it will sell its entire stake in the Koniambo Nickel SAS joint venture in New Caledonia, which has never turned a profit despite funding interventions from the French Government.

Global miners are now worried that Indonesia’s low-cost nickel supply will wipe out rivals within the next few years and could eventually account for more than three-quarters of the world’s high-quality nickel, if listing on the LME is to go ahead.

The LME told the Financial Times it supports the industry on “several sustainability measures to ensure transparency throughout the supply chain”. It added that low-carbon nickel is listed on its Metalshub platform and “the transaction data supports identification of a credible ‘green premium’ to the LME price”.