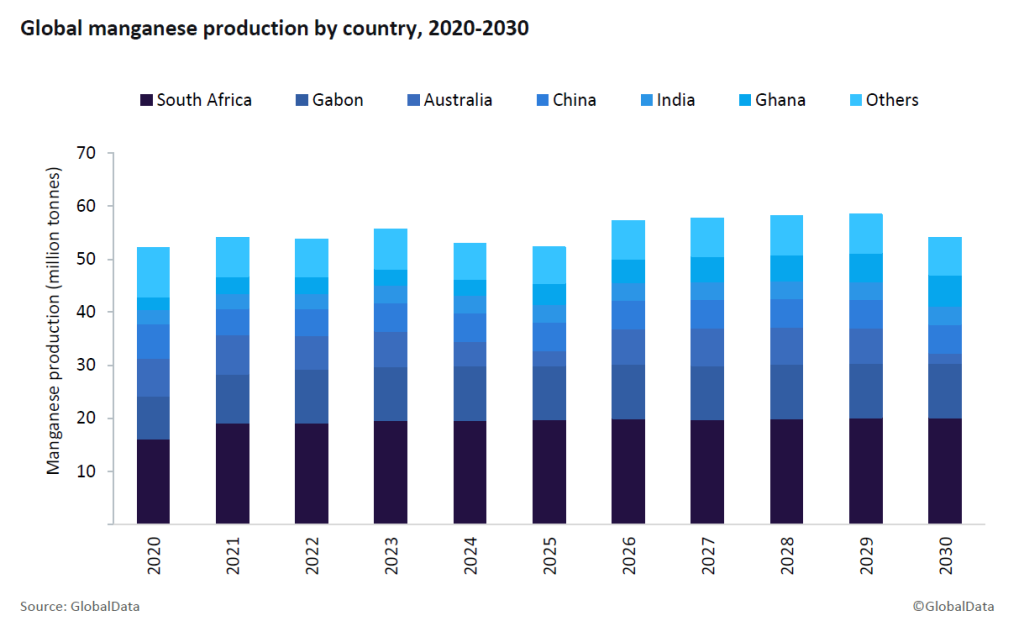

In 2024, global manganese production was estimated to have experienced a decline of 4.9% due to several significant disruptions. The temporary halt of high-grade ore exports from the Groote Eylandt mine in Australia following Cyclone Megan, coupled with the cessation of operations at Kazakhstan's Kazmarganets mine and the ongoing conflict in Ukraine, significantly tightened global supply.

While production in Australia is expected to gradually recover with the implementation of recovery measures, including South32’s $125m capital expenditure towards repair and infrastructure installations, the scheduled closure of the Groote Eylandt mine in 2029 will likely lead to a long-term decline in Australian production.

Despite these challenges, major producers such as South Africa, Gabon, Brazil, China, India, and Ghana are anticipated to maintain relatively stable production levels. South Africa, the leading producer, witnessed modest growth in 2024 driven by rising manganese prices amid supply disruptions. However, the lack of major new projects suggests that South African production will likely remain relatively stable in the foreseeable future.

Gabon, the second-largest producer, is also projected to maintain stable production, despite a temporary operational suspension at the Moanda mine due to oversupply concerns.

The cessation of operations at Kazakhstan's Kazmarganets mine due to depleting reserves significantly impacted global production in 2024. Furthermore, the ongoing conflict in Ukraine has severely disrupted manganese mining in the country, with key producers suspending operations.

Overall, global manganese production is expected to exhibit modest growth in the coming years, with a projected CAGR of 2.0% reaching 54.1 million tonnes by 2030. While supply chain disruptions and geopolitical uncertainties pose challenges, continued demand from key industries such as steelmaking and battery manufacturing will likely support moderate growth in the global manganese market.