Glencore Canada has signed a definitive agreement for a strategic equity investment in Canadian mineral exploration company Stillwater Critical Minerals to help advance the latter’s portfolio of nickel exploration and development projects in North America.

Under the private placement agreement, Glencore will purchase C$4.94m ($3.74m) worth of Stillwater units, with each unit priced at C$0.25. Each unit will comprise one common share and 0.70 of a common share purchase warrant.

Upon completion of the private placement, Glencore will own a 9.99% equity interest in Stillwater on a non-diluted basis.

In a press statement, Stillwater Critical Minerals said: “Each full warrant shall entitle Glencore to purchase one common share at an exercise price of $0.375, providing up to approximately $5.2m additional funding, if exercised in full.”

If the warrants are fully exercised, Glencore’s stake in Stillwater will be increased to 15.87%.

Proceeds from the non-brokered private placement financing will be used by Stillwater Critical Minerals to fund its exploration and development activities at its nickel projects in North America, as well as for working capital and general and administrative expenses.

Stillwater Critical Minerals president and CEO Michael Rowley said: “This represents a major step forward for Stillwater as we advance our flagship Stillwater West project with the vision of becoming a large-scale source of battery and precious minerals that are now listed as critical in the US, and elsewhere.

“There are very few projects globally, and specially located within the United States, that offer the combination of grade and scale in a producing district that we see at Stillwater West.”

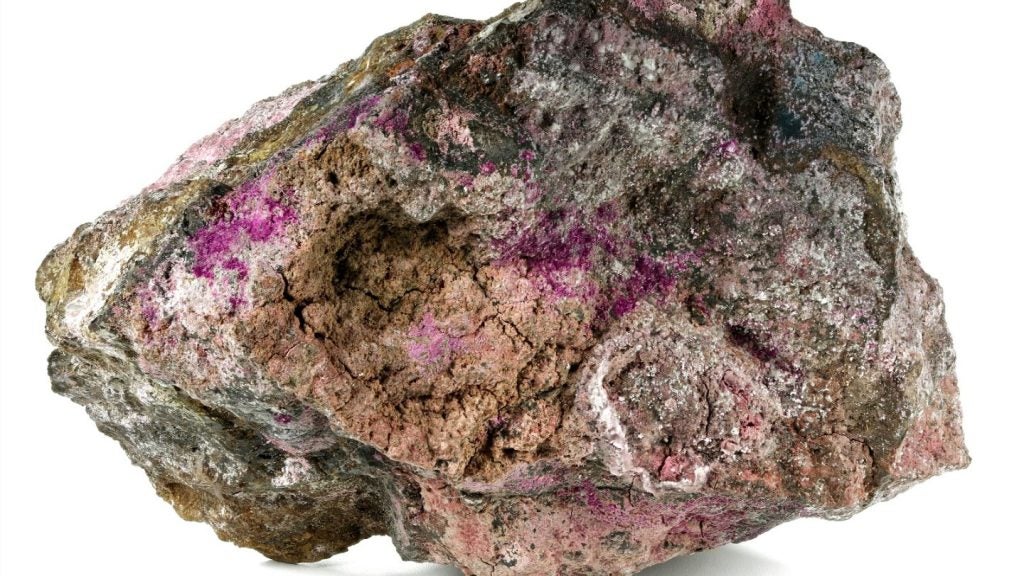

Located in Montana’s Stillwater district, the Stillwater West project is said to be one of the world’s largest and highest-grade platinum group elements-nickel-copper regions.

The company plans to carry out a 2023 drill campaign, which will focus on expanding the high-grade nickel-copper sulphides discovered in its past campaigns.