Multinational mining company Glencore has reported mixed financial results for the first half (H1) of 2024.

Net income was $1.5bn (SFr1.29bn), with the company posting a net loss of $233m after recognising $1.7bn of significant items, including $1bn of impairment charges.

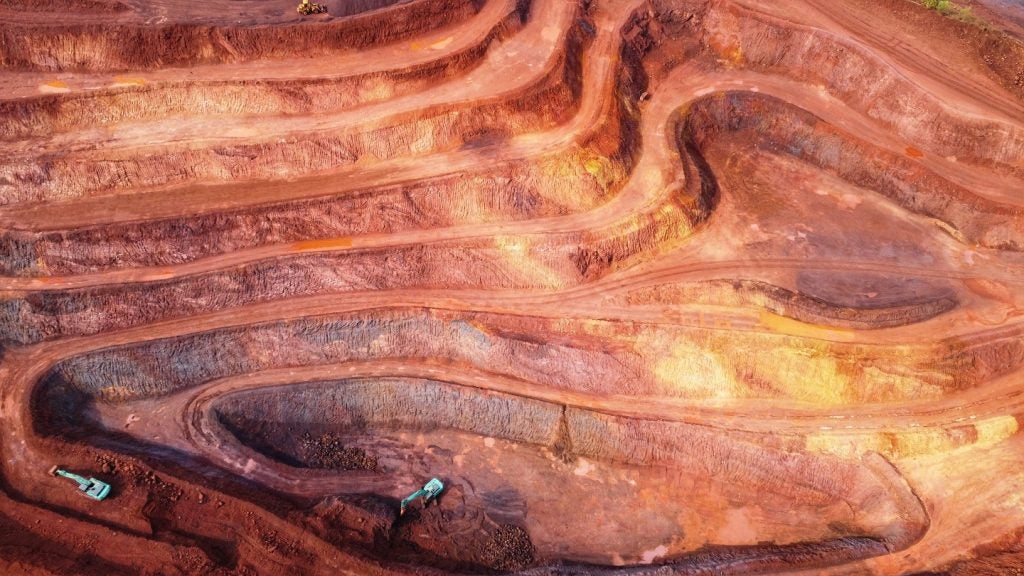

The company’s adjusted earnings before interest, taxes, depreciation and amortisation (EBITDA) was $6.3bn, with the 33% decrease explained by the “lower average prices for many key commodities during the period, particularly thermal coal”.

Marketing adjusted EBITDA fell 16% period-on-period to $1.5bn, tracking on an annualised basis at $3bn. The company’s lower energy contribution was partially offset by a strong metals performance in H1 2024.

Glencore’s adjusted EBITDA mining margins were 28% in metals operations and 31% in energy operations. The company’s 2024 production guidance has been maintained.

Glencore CEO Gary Nagle commented: “The strength of our diversified business model across marketing and industrial has proven itself adept in a range of market conditions, giving us a solid foundation to successfully navigate the near-term macroeconomic uncertainty.”

Glencore’s coal and carbon steel materials business

As Glencore completed its acquisition of a 77% interest in Canadian mining company Elk Valley Resources on 11 July, the company’s shareholders and board have voted to retain the coal and carbon steel materials business.

Glencore chair Kalidas Madhavpeddi explained: “The expected cash generative capacity of the coal and carbon steel materials business significantly enhances the quality of our portfolio, by commodity and geography, and broadens our ability to fund our strong portfolio of copper growth options as well as accelerate shareholder returns.”

Following the decision, the company’s previous net debt cap has been reset to around $10bn, excluding marketing-related lease liabilities.

On 6 August, criminal investigations closed into bribery allegations in the Democratic Republic of Congo connected to Glencore’s operations in the country.