ASX-listed Galan Lithium has secured firm commitments for an equity raise of A$14m ($9.3m) at A$0.23 per share, targeting institutional, sophisticated and professional investors.

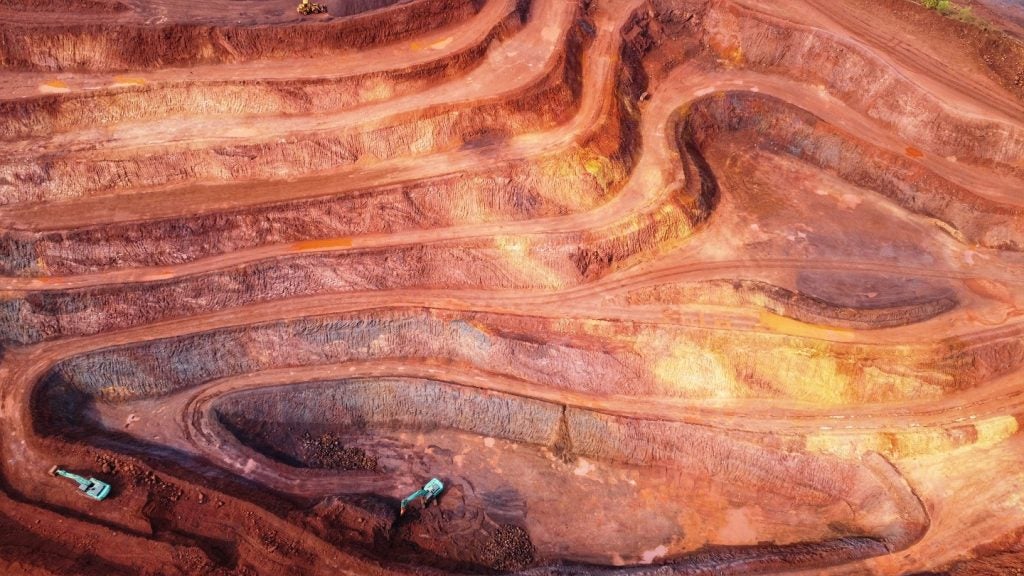

This financial move is aimed at bolstering the company's working capital and advancing the development of the Hombre Muerto West (HMW) Phase 1 lithium brine project in Argentina.

Under the placement, Galan will issue 56,521,740 fully paid ordinary shares, with the issue price marking a 20.7% discount to the stock close of A$0.29 on 15 May 2024.

Additionally, the company will issue 28,260,870 new options, contingent on shareholder approval, bringing the total funds raised to A$13m.

Galan's directors are also set to contribute, subscribing for up to 4,347,828 new shares and 2,173,914 new options, injecting an additional A$1m into the company.

This second tranche of funding is subject to the approval of shareholders.

Participants in the placement will be granted one new unlisted option for every two shares they subscribe to.

These new options will carry an exercise price of A$0.35 and will be valid for two years from the date of issue.

The equity raise was managed by Canaccord Genuity (Australia) and Petra Capital, which acted as joint lead managers and bookrunners.

The capital injection is expected to provide Galan Lithium with the necessary financial flexibility to continue the HMW Phase 1 construction while the company finalises alternative funding solutions including debt and prepayment facilities.

Proceeds from the placement are earmarked for the development costs of HMW Phase 1, as well as to cover corporate overheads, working capital needs and transaction costs associated with the equity raise.

Galan managing director Juan Pablo Vargas de la Vega said: “We are delighted with the support for the placement and welcome a number of new investors to the register. In addition, on behalf of the board of directors, I would like to thank our shareholders for their ongoing support.

“Funds raised from the placement will allow the company to further progress negotiations to complete the already advanced development of its 100%-owned Hombre Muerto West lithium brine project in Argentina. We look forward to putting investors funds to work.”