Canadian exploration company Faraday Copper has announced a C$20m ($15m) bought deal financing, with Ventum Financial, Canaccord Genuity and TD Securities serving as its underwriters.

As per their agreement, the underwriters will purchase 25 million common shares of Faraday at C$0.80 per share.

Additionally, the underwriters have also been granted an option to acquire an additional 3.75 million common shares to cover over-allotments, if any, and for market stabilisation purposes.

This option is priced at C$0.80 per share, potentially raising additional gross proceeds of up to C$3m.

The option is exercisable at any time up to 30 days after the closing date, which is anticipated to be on or about 30 May 2024.

The closing of the offering is subject to various conditions, including necessary regulatory and other approvals, such as those from the Toronto Stock Exchange and securities regulatory authorities.

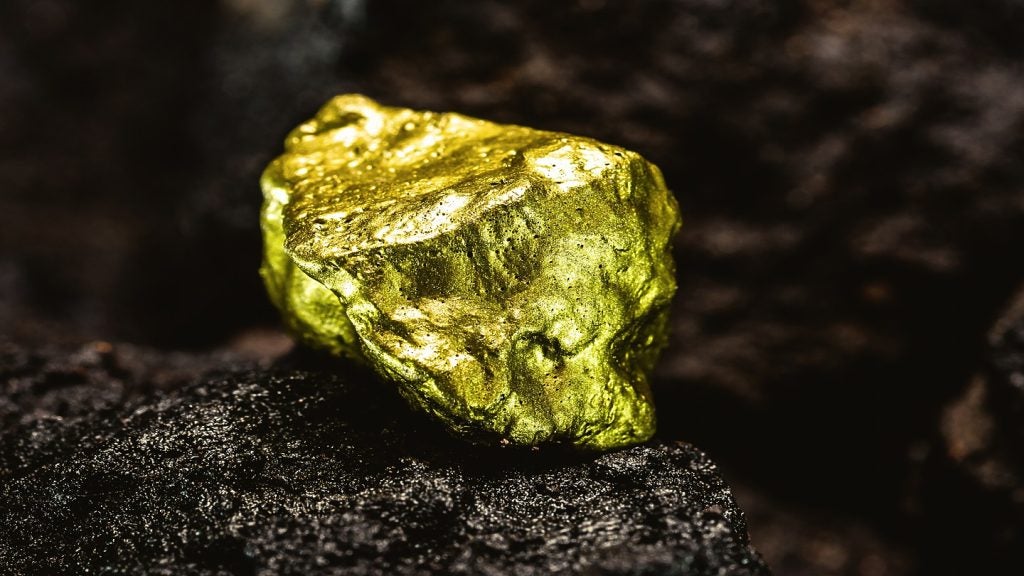

Net proceeds from the offering are earmarked for the exploration and development of the Copper Creek Project and for general working capital purposes.

The Copper Creek Project is a significant porphyry copper deposit spanning 3km in length and is situated in Pinal County, less than two hours north-east of Tucson, Arizona.

It is strategically located at the intersection of two major copper belts, one trending north-west, which includes the Miami-Globe and Ray mining districts, and another trending east-north-east, highlighted by the former BHP Kalamazoo Mine in San Manuel, Arizona.

The project encompasses approximately 65km² and includes both patented and unpatented claims with a history of exploration and mining.

The site has undergone extensive exploration efforts, with more than 560 drill holes and over 200,000m of drilling conducted to date.

These efforts have identified multiple breccia and porphyry copper deposits within the project area.