Chile’s copper mine production is anticipated grow by 5% to reach 5.5 million tonnes (mt) in 2024, supported by the ramp-up of Teck Resources' Quebrada Blanca mine, which is poised to be a major contributor, producing an estimated 252.5 kilotonnes (kt) of copper in 2024, up from 62.7kt in 2023.

In addition, established mines such as Escondida Los Pelambres Andina, Mantoverde, and the upcoming Rajo Inca mine are expected to contribute significantly in 2024. Collectively, their output is anticipated to rise from 1.6mt in 2023 to nearly 1.8mt in 2024, a 10.4% growth.

This will be partially offset by the declines from existing mines such as the Cerro Colorado, Los Bronces and Radomiro Tomic mines. Several disruptions have contributed to these declines, for example, a worker fatality at Radomiro Tomic in March 2024 led to a production halt due to a strike. Similarly, Cerro Colorado underwent temporary care and maintenance in December 2023. Unfavourable ore conditions in Los Bronces’ current mining area are also hindering output.

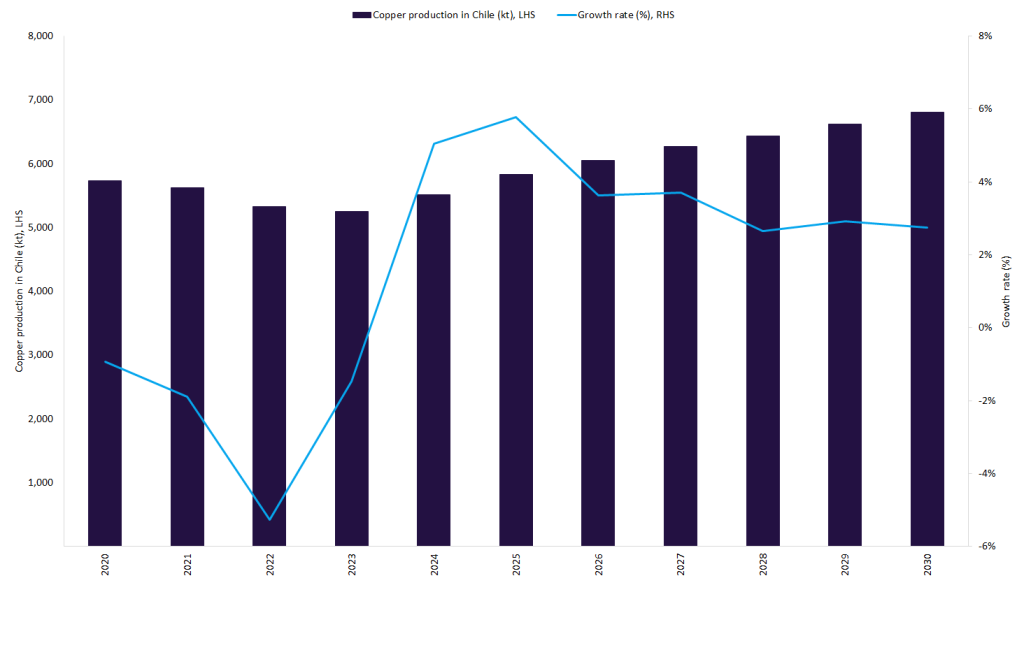

Chile is the world’s largest copper producer. In 2023, it accounted for over 24% of the market globally, but since 2019, production has declined due to a range of factors, with water scarcity across mining regions significantly impacting operations. Additionally, declining ore grades at major mines such as Chuquicamata have presented a challenge, as have rising production costs, labour shortages, and political instability. Looking ahead, Chile’s copper production is anticipated to grow by a compound annual compound growth rate (CAGR) of 3.6% to reach 6.8mt by 2030. This growth trajectory will be driven by the commissioning of new mines and capacity expansions within existing projects.