Chinese electric vehicle (EV) manufacturer BYD is looking to acquire lithium mining assets in Brazil, reported Bloomberg News.

The move comes as the company intends to secure raw material sources to facilitate the expansion of its electric car production beyond the Asian market.

Earlier this year, the Chinese company announced plans to build a new manufacturing hub in Brazil.

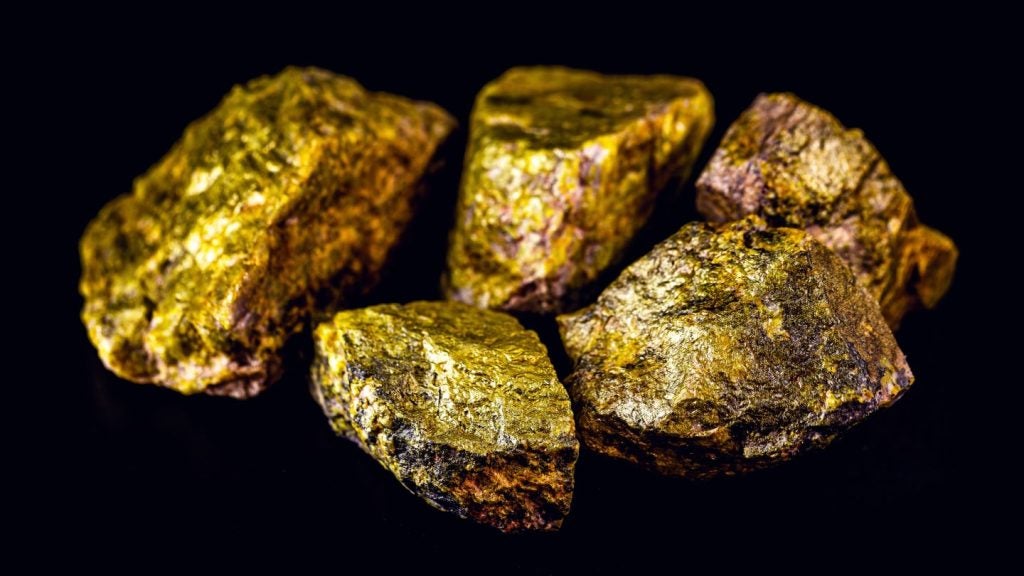

Located in the north-eastern state of Bahia, in the town of Camaçari, the planned facility will comprise three factories, of which one will be used for the processing of lithium and iron phosphate mined in Brazil for the international market.

The other two factories will be equipped to manufacture hybrid and electric cars, trucks and buses.

BYD global vice-president Stella Li said work on the Brazilian manufacturing hub is due to be completed in less than two years.

Li said in an interview: “We prefer to buy any available and affordable resource, but it needs to be competitive. At the same time, BYD also prefers to own some mining operations in Brazil.”

The Chinese company is developing its first EV plant outside Asia in Brazil, with an investment of $594m (4.34bn yuan). The plant will include a research and development centre.

Li said: “We are gonna build up this plant fast. We need to make sure in the future all cars we sell here are 100% produced here. BYD will become like a Brazilian company.”

Latin America has become a focal point for automakers due to surging demand for metals used in EVs amid the industry's transition away from fossil fuels.

In Argentina, Stellantis and mining giant Rio Tinto Group are looking to increase their financial commitments in a massive copper reserve.