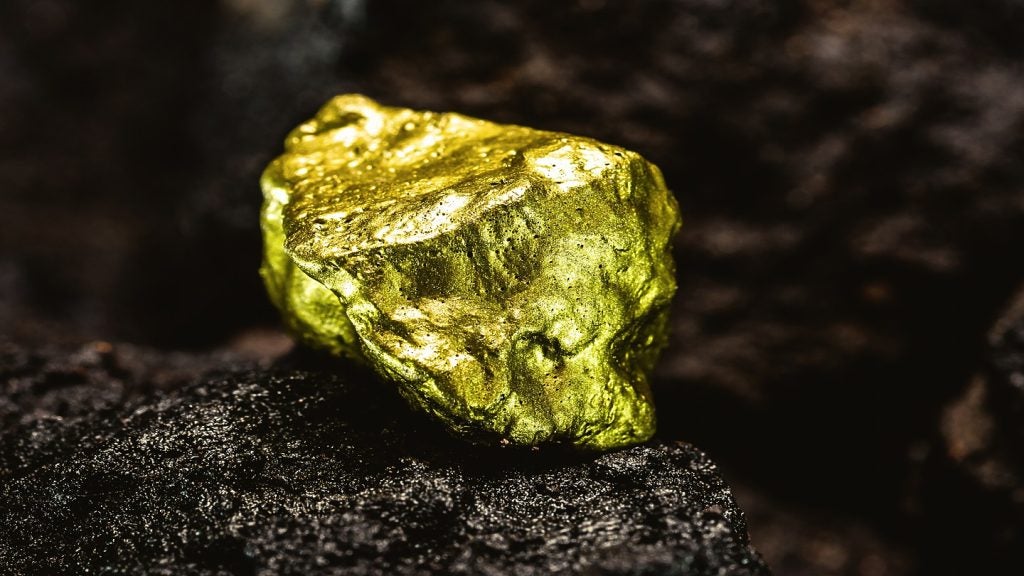

BTU Metals has announced the acquisition of a 100% interest in two gold exploration projects in the Wawa gold area of northern Ontario, Canada.

The company will purchase the Echum and Hubcap properties, which are adjacent to Alamos Gold and Red Pine Exploration, respectively.

Consideration for the acquisition includes C$25,000 ($18,201) and five million BTU treasury common shares.

Additionally, BTU has an obligation regarding assumption of four 2% net smelter royalties (NSRs) related to various parts of the property, with the option to buy down a percentage of three of these NSRs.

The fourth claim group does not have a buy-down provision but has a right of first refusal in favour of BTU, should the vendors opt to sell their NSR.

The deal is contingent on standard closing conditions, including corporate and regulatory approvals, and is expected to conclude within 60 days.

Spanning more than 16,048 hectares, the properties encompass over 750 mining claims and are situated in areas with historic gold mineralisation.

Notably, the Hubcap project includes the historic Centennial Gold Mine, which has not seen underground work since the 1930s.

Alamos Gold has been active in the region, acquiring exploration and development projects over the past two years and securing a 19.9% interest in Red Pine in late 2019.

BTU noted that the location of both projects means they have access to roads, the town of Wawa, an airport and a mining-aware labour pool.

BTU CEO Paul Wood said: “We are excited to get in the field on both the Echum and Hubcap projects as soon as possible.

“Based on previous work on the projects, which included surface exploration, drilling and, in the case of one area on the Hubcap project, mining, management believes that these are projects of considerable merit.

“We are funded and intend to start exploration this summer. At the same time Kinross continues to progress early exploration work at Dixie Halo project under the terms of the 2023 Exploration Option Agreement.”