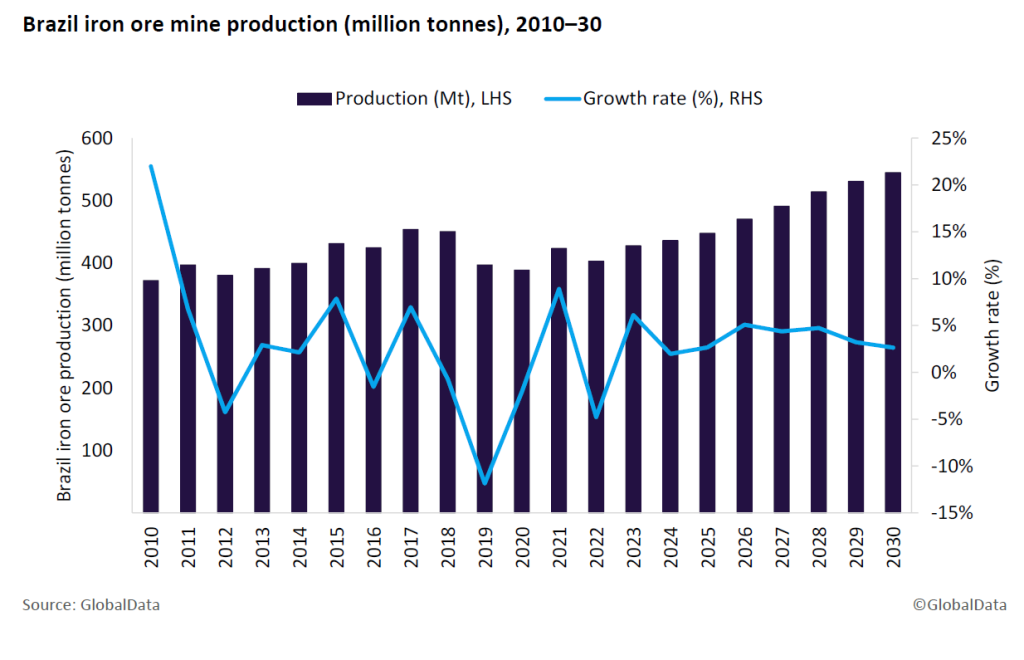

Following a strong growth of 6.1% in 2023, Brazil's iron ore mine production is projected to continue its upward trajectory, reaching 436.1 million tonnes (Mt) in 2024.

Vale, Brazil's largest iron ore producer, has been instrumental in driving the country's production growth. The company's output from mines such as S11D and Vargem Grande contributed significantly to the 4.1% increase in the company’s iron

ore output during the first half of 2024 (151.4Mt). Moreover, Vale's ambitious expansion plans, including the target of producing between 340 and 360Mt by 2026, position it for continued growth in the coming years.

Beyond Vale, other companies are also contributing to Brazil's iron ore production growth. The planned commencement of the Horizonte Minerals' Araguaia project and the expansion of CSN Mineração's capacity are expected to further boost the country's output.

Looking ahead, Brazil's iron ore production is forecast to grow at a compound annual growth rate (CAGR) of 3.8% over the forecast period (2024 to 2030). This growth will be fuelled by ongoing mine developments, including the Capanema, Amapa, Morro do Pilar and Colomi projects. By 2030, Brazil's iron ore production is expected to reach 544.6Mt.

However, the Brazilian iron ore industry faces numerous challenges including environmental concerns, including deforestation and water pollution, and infrastructure bottlenecks, hindering transportation and exports. Social conflicts,

including land disputes and indigenous rights violations, have also marred the industry's reputation.

Despite these hurdles, Brazil's iron ore industry is well-positioned for continued growth, driven by the country's abundant reserves and the expansion plans of leading producers.