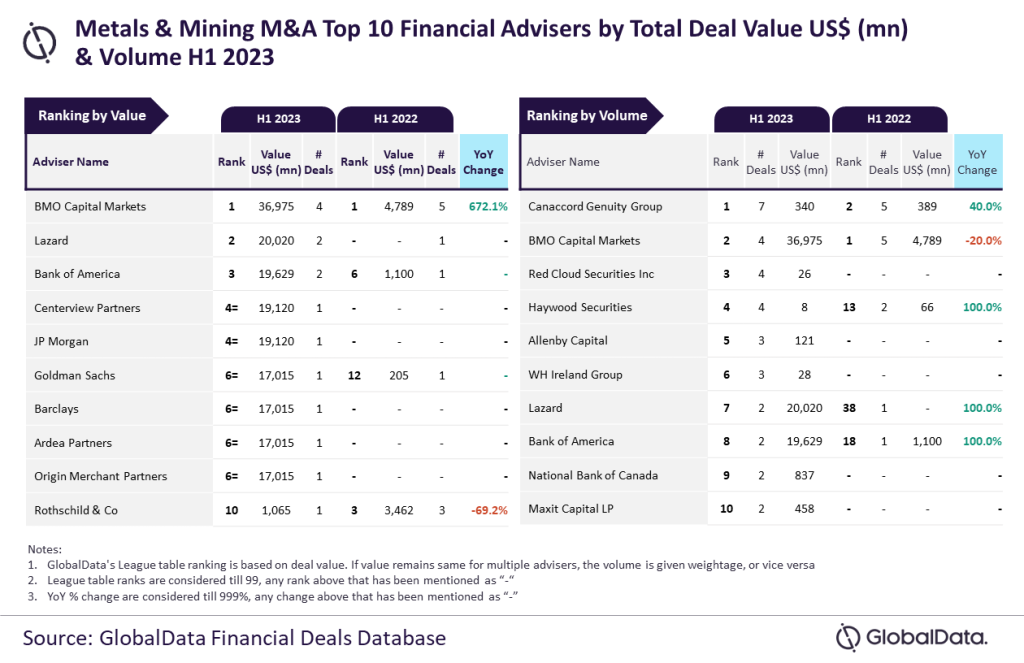

Financial services providers BMO Capital Markets and Canaccord Genuity Group were the top mergers and acquisitions (M&A) financial advisers for the mining sector during the first half (H1) of 2023 by value and volume, respectively, new data suggests.

Statistics come from the latest financial advisers league table by data and analytics company GlobalData, the parent company of Mining Technology.

Through an analysis of its financial deals database, GlobalData found that BMO Capital Markets led by value of deals overseen, advising on $37bn worth of deals in the first half of this year, up from $4.79bn from the same period last year. Canaccord Genuity Group led by volume through advising on a total of seven deals, up from five from the same period last year.

Lazard ranked second by value by advising on $20bn worth of deals, although this was achieved through just two deals, making its average deal value slightly greater than that of BMO Capital Markets. Bank of America ranked third with $19.6bn worth of deals, a huge increase from the same period last year, when the company advised on $1.1bn in deals. Centerview Partners and JP Morgan jointly occupy fourth position with $19.1bn each.

Aurojyoti Bose, lead analyst at GlobalData, said: “BMO Capital Markets advised on four deals, two of which were valued at more than $15bn. The involvement in these mega-deals helped it top the chart by value in H1 2023. Interestingly, BMO Capital Markets occupied the top position by volume as well in H1 2022 but lost it to Canaccord Genuity Group in H1 2023.”

By volume, BMO Capital Markets ranked second, advising on four deals for the half. This is tied with Red Cloud Securities and Haywood Securities, both also closing four deals, followed by Allenby Capital with three deals.

In 2022, BMO Capital Markets was also the top M&A financial adviser in the metals and mining sector by volume, advising on a total of eight deals for the year.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.