As part of its strategy to expand its copper assets, BHP intends to acquire Anglo American, recognising the significant growth potential for copper in the future, as momentum shifts towards replacing conventional fossil fuels with the increasing adoption of electric vehicles (EVs) and growing demand for its usage in construction and renewable energy projects.

The deal will also strengthen BHP’s iron ore market and provide exposure to diamond markets. Additionally, the acquisition will help BHP to access the mining industry in South America, where the company currently does not have significant presence. If the deal goes through, BHP will gain access to four of the world’s largest copper mines - Collahuasi (with ownership of 44%), Los Bronces (50.1%), El Soldado (50.1%) and Quellaveco (60%).

Why Anglo American?

Anglo American became a potential target for BHP as the former continued to post a weak top-line, even as its total debt kept increasing since 2021 as a result of the poor performance of platinum group metals (PGMs) and diamonds due to price fluctuations, geopolitical and economic situations, and other operational constraints. Amidst this, the company has reported a growth of 31.5% in copper sales from $5,599mn in 2022 to $7,360mn in 2023.

Also, at the end of Q1 2024, Anglo American’s copper production increased by 11% to 198,100 tonnes, driven by a 21% increase in output from its Quellaveco site in Peru and a 6% increase in production from Chile.

BHP will climb the rankings

Operationally, the combined entity could have a top line of more than $84bn, EBITDA of more than $34bn, and a workforce of close to 100,000, reinforcing its position as one the largest global players in the mining sector.

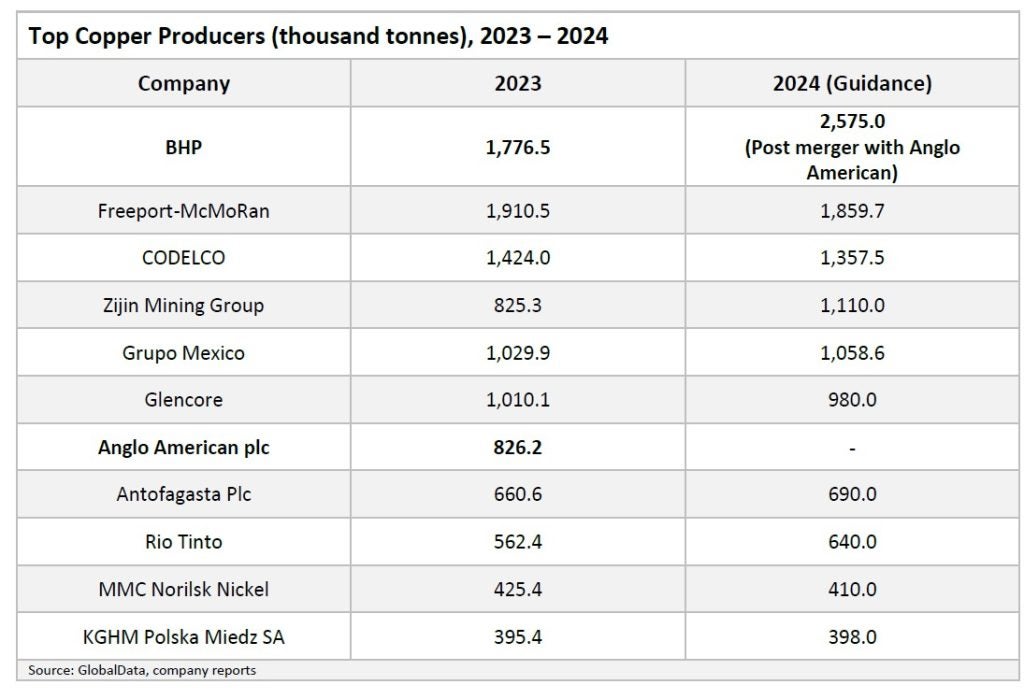

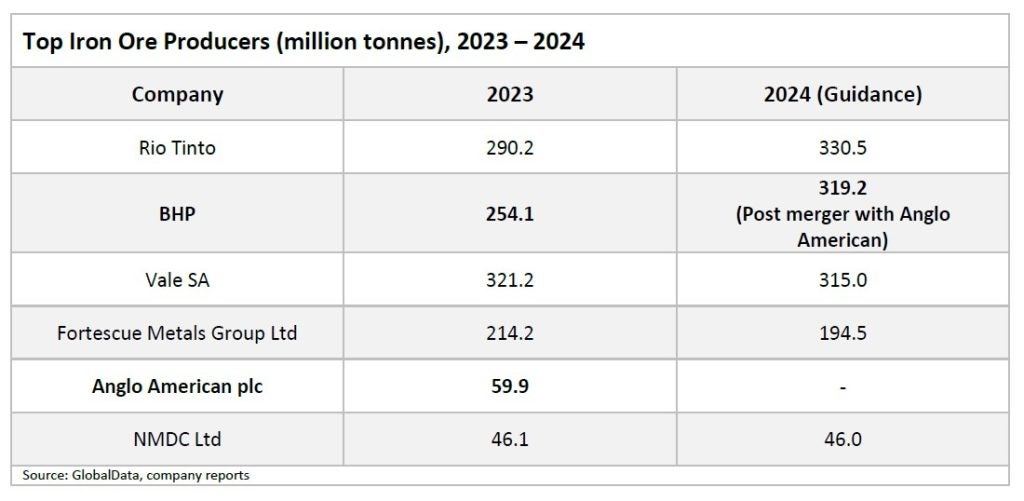

In terms of production, the combined entity has an expected output of 2.6 million tonnes of copper in 2024, ranking it first and representing 11% of global mined copper.

In iron ore it would lift BHP’s ranking from third to second, after Rio Tinto, with a share of 12% of global output, and the combined nickel production would account for 3.2% of global production, placing BHP third after MMC Norilsk Nickel and Vale SA.