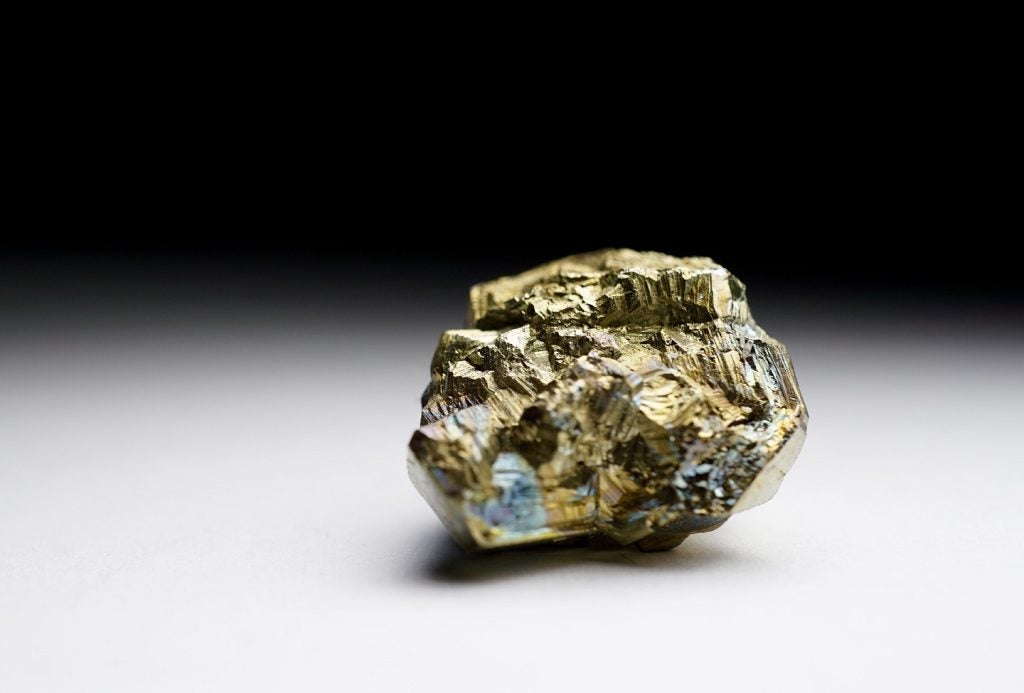

The mining industry was the main driver behind slight growth in total new capital expenditure (capex) in Australia, official figures show.

Capex in mining was up 5.6 points in the third quarter (Q3) of 2023, offsetting a 1.3% fall in non-mining industries, the Australian Bureau of Statistics said.

Overall capex rose by 0.6% in Q3 2023 to be 10.7% higher than a year ago.

Robert Ewing, ABS head of business statistics, said an increase of 5.4% in building and structures investments was driven by mining.

He said: "This industry raised its spending on iron-ore projects and battery-related mineral developments. It was offset by a fall in non-mining industries, down 2.2%.

"The construction industry was the largest contributor to the rise in equipment and machinery capex. It grew by 15% as supply chain disruptions continued to ease. This allowed businesses to take delivery of new vehicles and heavy machinery."

Western Australia (WA) had the largest rise of the states and territories, increasing 7.5% in Q3. This was offset by a large fall in Queensland, down 10.8% following large rises in Q1 and Q2.

Ewing said that new capex by states has been "very mixed" over the past 12 months, with WA and Victoria out in front, with growth of 24% and 20.1%, respectively.

“Growth in Western Australia was dominated by the mining industry, while growth in Victoria reflects a continuing recovery from steep declines during the pandemic,” Ewing said.

Overall, businesses revised up their capex expectations by 8.5% in current prices since the previous estimate three months ago.

For all the latest news and analysis across the Australian mining industry, check out GlobalData's Mine Australia bi-monthly monthly magazine. Free to read across all devices including mobile, the digital magazine offers insights into key market and commodity trends, in-depth analysis of resources and prospects, and licensing and policy decisions affecting the industry, as well as updates on the latest technologies in exploration and operations, health and safety and environmental issues.