Australian company Aurora Energy Metals has entered into an option agreement with US-based Eagle Energy Metals for the strategic sale of the Aurora Uranium Project in Oregon, US.

The agreement requires Eagle to explore the listing of the project on a US stock exchange and raise at least $6.8m in associated capital. If the option is exercised, Aurora will own approximately 40% equity in the newly US-listed company.

The move aims to leverage US capital markets, potentially enhancing the project's valuation and offering financial incentives for its development.

Aurora's strategic focus includes establishing US-based leadership for the project, maximising value through US capital markets and retaining exposure to the project's financial upside.

The transfer to a US entity also positions the project to secure US Government incentives for domestic strategic mineral production.

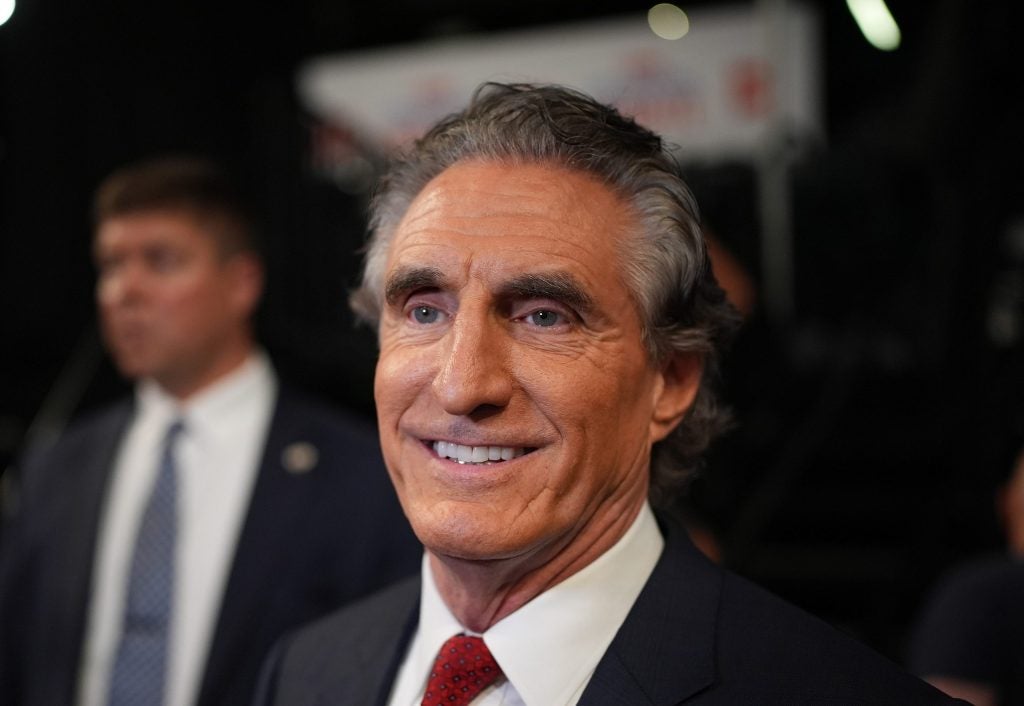

Aurora Chairman Peter Lester said: “The company has been seeking to transition the management of the Aurora Uranium Project to a US based team with strong mining and uranium experience. We believe this will progress development more effectively and maximise value.”

The Aurora Uranium Project is considered to hold the largest undeveloped measured and indicated mineable uranium resource in the US.

The project's development will be led by a local team with expertise in the US regulatory and permitting processes, as well as access to local funding channels.

Aurora stands to receive $16m in Eagle shares, with additional consideration linked to uranium spot price increases and resource estimates.

Further milestone payments comprise up to $10m in share consideration, including up to $5m on completion of a positive pre-feasibility study.

Aurora will retain a 1% net smelter royalty on the project.

During the option period, Eagle and Aurora will jointly oversee exploration and development work on the project. Eagle has committed $500,000 over the option period to fund ongoing activities related to the project.

Eagle Energy Metals CEO Mark Mukhija said: “Our option to acquire the Aurora Uranium Project represents a pivotal step in advancing America’s growing demand for clean, reliable energy. This agreement strengthens our position in the US market and aligns with our commitment to secure strategic domestic energy assets.

“With plans to list on a senior US exchange, we are excited to bring local expertise and dedicated focus to this project, which we believe will unlock significant value for both Eagle and Aurora shareholders as we move toward a clean energy future.”

The agreement is contingent on shareholder approval at a general meeting expected in December. Shareholders have been cautioned that the US listing is not guaranteed, and if Eagle does not complete it the option will not be exercised.