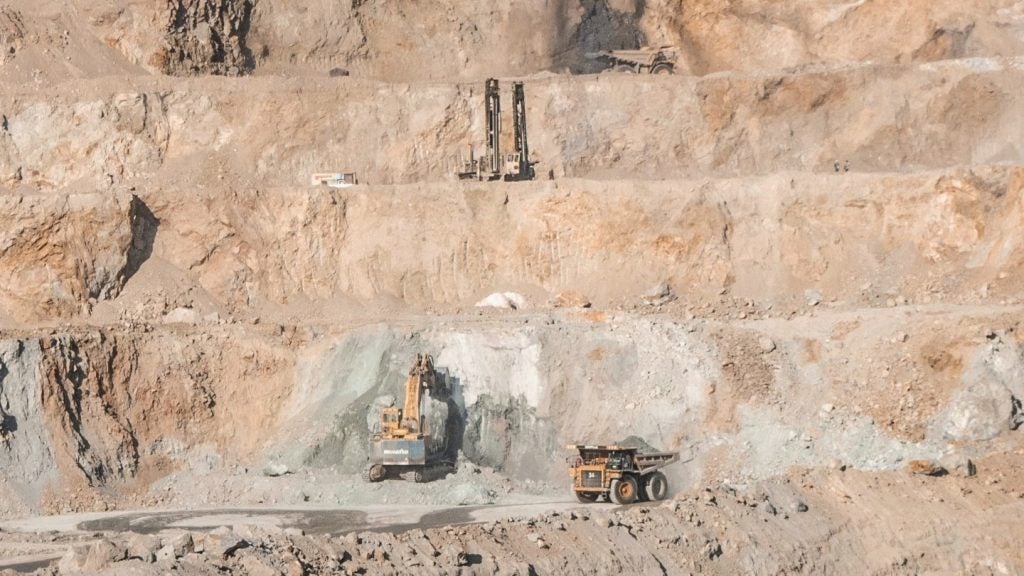

UK-based miner Aterian has entered a share purchase agreement (SPA) to acquire a 90% interest in Atlantis Metals.

Atlantis Metals holds mineral prospecting licences in the Republic of Botswana.

Aterian chairman Charles Bray said: “This announcement underscores our strategy of responsibly exploring and mining for critical minerals and metals across Africa, a region vital for a successful energy transition.

“The signing of this SPA, to acquire substantial mineral licence assets in Botswana, further expands our presence on the continent. It perfectly fits our strategy of focusing on the critical metals, copper and lithium, in stable jurisdictions.”

The agreement will see Aterian assume responsibility for funding exploration activities, subject to certain conditions, including regulatory approvals and due diligence.

The SPA is subject to several prerequisites such as the change of control approval by the relevant authorities, the completion of financial and corporate due diligence, and the transfer of shares in Atlantis to a nominated subsidiary of Aterian.

The remaining 10% stake in Atlantis is held by a private Botswana citizen, a professional geologist, who is expected to be retained on a minimum 12-month contract to provide management and exploration services.

In addition, Aterian appointed SP Angel Corporate Finance as a joint corporate broker, effective immediately.

Atlantis's assets include four licences, covering a total area of 3,516km².

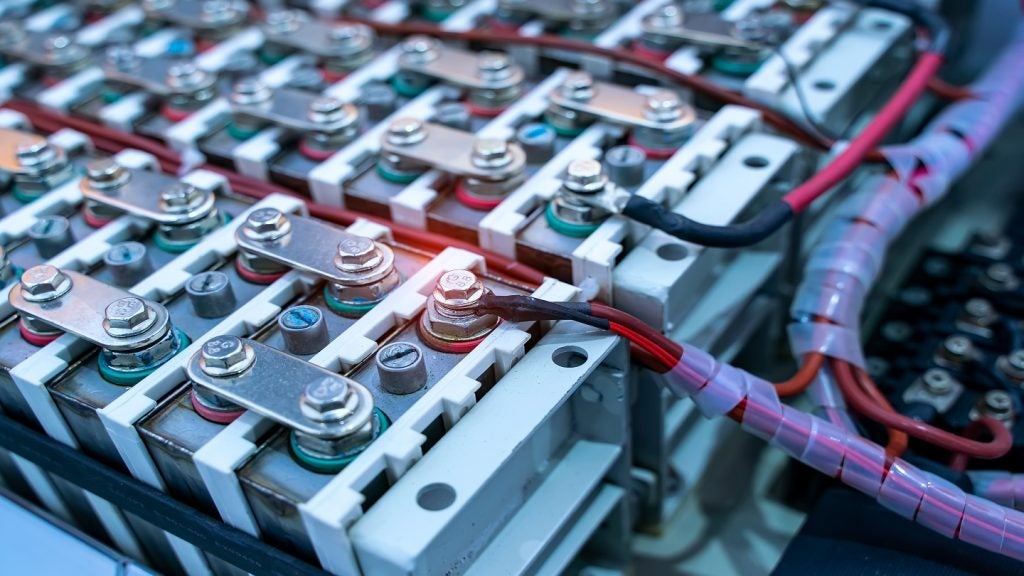

One licence is dedicated to copper exploration in the Kalahari Copperbelt, while the other three are for lithium brine exploration in the Makgadikgadi region of northern Botswana.

The Makgadikgadi Lithium Brine project, spanning 2,517km², is strategically located along the eastern and southern shores of Sua Pan in the Central District.

Bray added: “Furthermore, these new lithium brine licences in Botswana underscore our advancing lithium exploration efforts in Rwanda, where we recently announced an earn-in JV [joint venture] with Rio Tinto.

“We have been busy and look forward to updating the market on our continued exploration efforts.

“Aterian also owns copper assets in Morocco that are showing increasingly promising results and our new licence in the Kalahari Copperbelt complements this growing work to develop this critical energy transition metal.”

Last year, Aterian signed a JV and earn-in deal with Rio Tinto and Kinunga Mining to explore and develop lithium and by-products at its HCK licence in Rwanda.