Astral Resources has received firm commitments to raise nearly A$25m ($17.15m) through a placement to help advance its gold projects in Western Australia.

This two-tranche placement includes the issuance of around 263 million new shares at $0.095 each. The first tranche has raised A$21m, while the second, pending shareholder approval, aims to raise A$4m.

The first tranche of the placement involved issuing 221 million shares, raking in A$21m.

The second tranche will see approximately 42 million shares issued, subject to approval at the company's Annual General Meeting scheduled for 20 November 2024, to raise the remaining A$4m.

Company directors subscribed for 789,474 shares, with the issuance also pending shareholder approval.

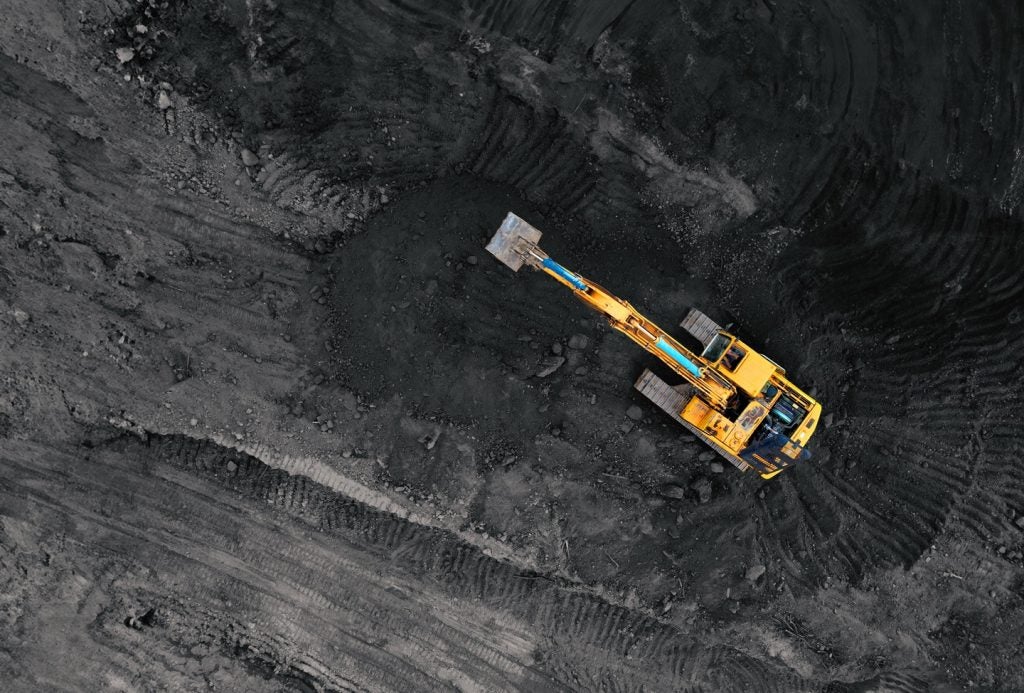

The funds from the placement will enable Astral to expedite exploration and evaluation activities at its Mandilla and Feysville Gold Projects.

These proceeds will ensure the company is financially equipped to complete the Mandilla pre-feasibility study (PFS) and definitive feasibility study (DFS).

The capital raised will also support various activities including technical work streams for the Mandilla PFS and DFS, drilling at both project sites, updates to Mineral Resource Estimates, and general working capital.

Astral managing director Marc Ducler said: “We are delighted with the strong support shown by both new and existing investors in the Placement.

“The calibre of new investors we were able to attract and the quantum of funds we were able to raise is testament to the quality of the Mandilla Gold Project as one of Australia’s best near-term gold development stories.

“Proceeds from the placement will enable Astral to accelerate exploration and evaluation activities at both Mandilla and Feysville in order to unlock the genuine potential of these projects.”