In August, Argentina’s presidential primary elections gave the lead to far-right and libertarian candidate Javier Milei, who wants to install an investment regime focused mostly on mining. Runner-up Patricia Bullrich, from the centre-right coalition, has a similar view for the economy. In third place landed the centre-left candidate Sergio Massa, currently economy minister, who believes mining offers the country a great development possibility: lithium has a window of opportunity of five to seven years and then it will become “just another commodity”; copper is “much more important for the future of Argentina”.

The country has the same mineral resource potential as Chile yet exports around 16 times less minerals by value than its neighbour: $3.86bn (1.35trn pesos) versus $60.2bn in 2022. One of the elements missing in this equation is copper, which Argentina has not exported since the closure of the La Alumbrera mine in 2018.

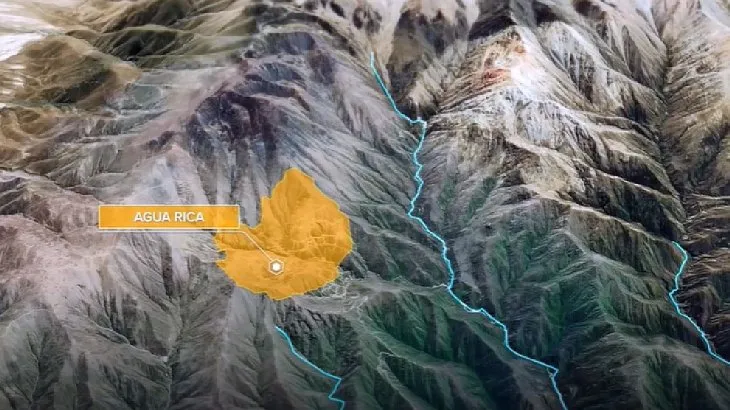

Part of the infrastructure of La Alumbrera underpins a new project: MARA (Minera Agua Rica – Alumbrera). This is expected to be three-times bigger than the closed mine. It is one of six pending large-scale copper projects in Argentina, which could together produce more than 1.2 million tonnes (mt) of copper per year before the next decade, as companies behind these projects eye a new copper industry built on demand brought about by the global energy transition. Copper demand is expected to increase by more than 40% over the next two decades.

On 31 July, Glencore International and Pan American Silver announced an agreement for Glencore to acquire Pan American’s 56.25% stake in the MARA open-pit mining project. When the transaction was completed on 20 September, Glencore became the sole owner and operator of MARA, which it expects to become a top 25 global copper producer. Glencore expects it to produce more than 200,000 tonnes of copper per year in its first ten years of operation.

Argentina's copper potential

MARA is located in the Catamarca province of Argentina and, according to Glencore, has proven and probable mineral reserves of 5.4 million tonnes of copper and 7.4 million ounces of gold contained in 1.105 billion tonnes of ore. It is expected to remain productive for 27 years.

In 2020, the raw copper trade was worth $14.4bn, and the central Andes region – Chile, Peru and Argentina – is estimated to hold 1.03 billion tonnes of copper reserves, or 40% of the world’s total.

Currently, the geological mining potential of copper in Argentina is underexploited: the start up of four of the most advanced projects – including MARA – with a combined average annual capacity of 693,000 tonnes, would place the country among the top ten producers with close to 3% of the global supply.

The current Argentine Government has made mining one of the country’s 11 "Missions" in its Productive Argentina 2030 agenda, a national development programme.

Glaciers versus mining

However, Argentina’s mining projects are not without their detractors. Open-pit mining involves the excavation of large quantities of waste rock – material not containing the target mineral – in order to extract the desired mineral ore, which is then crushed into finely ground tailings for processing with various chemicals and separation to extract the final product.

According to the government’s 2030 Agenda, mining can only be carried out in line with international standards, including an adequate socio-environmental governance framework that ensures broad participation and strict care for the environment.

In practice, MARA still needs a positive environmental impact assessment before it can formally begin operations, and one potential obstacle to that is Argentina’s National Glaciers Law, which seeks to protect these formations across the country. Another is local opposition to the project from residents who argue that the mining industry is polluting them without bringing benefits.

[Link src="https://www.energymonitor.ai/all-newsletters/" title="Keep up with Energy Monitor: Subscribe to our weekly newsletter" font-size="20px"]Catamarca was the site of Argentina’s first mega-mining project, Bajo La Alumbrera, which opened in 1997, notes Debora Cerutti, a researcher at the National Council of Science and Technology in Argentina.

“The towns of Catamarca in the region where MARA is trying to settle today are not a sacrifice zone,” Cerutti says. Despite the government and business discourse, Catamarca has industries other than mining: cattle, as well as vines, olives, quince and cotton – among others – are grown in its oases.

In addition, there were at least four publicly recognised mineral transport spills between 2004 and 2006, along the 315km long duct that transports mud, acid and diluted ore towards the port in Rosario for export, polluting the watershed system surrounding the Vis Vis community. Worries about water pollution have also created resistance to open-pit mining megaprojects in Chubut, a vast desert province that has only one river.

Presidential frontrunner Milei has proposed the appropriation of water channels by private interests. Centre-left candidate Massa has said “whoever pollutes a river has to go to prison”.

The MARA project is 1,500m below the level of and at least 2km away from the nearest glaciers, Marcelo Murua Palacio, Minister of Mining for Catamarca, told Energy Monitor in an interview. That is according to a first inventory under the National Glaciers Law by the Argentine Institute of Nivology, Glaciology and Environmental Sciences, which has advanced its work at a slow pace due to Argentina’s federal regime.

"Therefore, it is impossible for it [MARA] to have an impact [on the glaciers], since the water flows towards the lower zones, and not upwards,” he explained. In a next step, “geoforms" identified as potential glaciers must be confirmed as such, he added. For that, they must have a temperature of below zero degrees for at least two consecutive years, he said.

Cerruti argues that the lay of the land is not quite so clear cut. “The mining experts maintain that there are no glaciers in the area where it [MARA] will operate, but they do not consider that there are also 'rock glaciers', which often go unnoticed, and are extremely important for the [local] water balance,” she told Energy Monitor.

Anti-mining protests

On 15 December 2009, environmentalists in Andalgalá formed the El Algarrobo Assembly and blocked the passage of trucks with mining supplies and machinery bound to begin the exploration of the MARA project. This was in response to the disclosure of classified information, which revealed that the Catamarca Government had agreed to the possibility of expropriating homes to advance mining activity.

In 2016, Argentina’s Supreme Court ruled that the MARA project is "illegitimate" given its location next to a river that provides local residents with drinking water, says Rosita Farias, a retired former teacher and activist from Andalgalá. However, in December 2020, the local government tried to cancel the 2016 Supreme Court Ruling. MARA now operates with the endorsement of the government and the provincial justice of Catamarca.

Mariana Katz, a lawyer from the NGO Peace and Justice Service who has led the Andalgalá case since 2012, told Energy Monitor that a new chapter began in 2020 when MARA’s owners and the state company Agua de Dionisio Mining Deposits presented a new environmental impact assessment with a view to commencing advanced mineral exploration in the area and eventually obtaining authorisation for exploitation of the deposit.

Local activist Eduardo Villagra says: “During a peaceful protest against MARA in 2021, infiltrators unleashed violence against the security forces and burned down the office of the project’s former owner, Yamana Gold.” Villagra was illegally detained for more than 14 days together with 12 other people.

The UN Working Group on Business and Human Rights, at the end of its visit to Argentina in February 2023, urged the competent authorities to guarantee the right to defend human rights throughout the country and to create mechanisms for the protection of defenders.

Since the MARA project began, the inhabitants of Andalgalá say they have detected a greater presence of iron, aluminium and fluoride in their drinking water.

However, Catamarca Mining Minister Murua Palacio says mining projects also benefit local communities. “We demand 70% of local employment in each project, including subcontractors. For every $10 that enters through direct foreign investment in mining, $8 remains in Argentina, whether in royalties, salaries, input payments or national taxes,” he told Energy Monitor.

In response to a question about mining companies' social licence to operate, he said: “We also have the door open for dialogue, making a lot of information available to the community so that they can better evaluate it and place it in the hands of technicians [experts] who they deem pertinent.” He declined to comment on the alleged contamination of local drinking water or repression of local protests.

Glencore also declined Energy Monitor's requests for comment on the MARA project.

What next for copper in Argentina?

Andalgalá and other communities are unconvinced by the narrative that mining will bring development and wealth. Yet Catamarca remains one of the poorest provinces in Argentina and its government considers mining one of the few opportunities it has for development. As per article 124 of the National Constitution, the province is the sole owner of its natural resources. Governor Raúl Jalil is aiming to remain in power with the narrative that mining is an opportunity.

Murua Palacio looks to Australia as an example of good practice, with an authority for mining applications that evaluates projects and grants exploration licences, generally for periods of one-to-six years. "We want mining properties to be in the hands of people who, within the time they are given, want to invest to develop them, not just to speculate,” he says.

Sergio Martínez, from the El Algarrobo Assembly, says its goal is to “let foreign investors know that their investments here do not bring development to our towns”. "We are not going to give them the social licence they need,” he says.

Currently, Katz is preparing an extraordinary federal appeal before the Argentine Supreme Court for it to address the impact of mining on water resources and violations of human rights in Andalgalá. She is also preparing a request to the Inter-American Commission on Human Rights to analyse the conflict and determine whether the Argentine state has violated any citizen’s rights, in order to process a new international claim.

Whoever wins Argentina’s presidential election on 22 October will have their work cut out for them to turn the country’s mineral resources into reality.