Agnico Eagle Mines has committed to a C$55m ($40m) investment in ATEX Resources, subscribing for 33. 86 million units at C$1.63 each in a significant private placement in Canada.

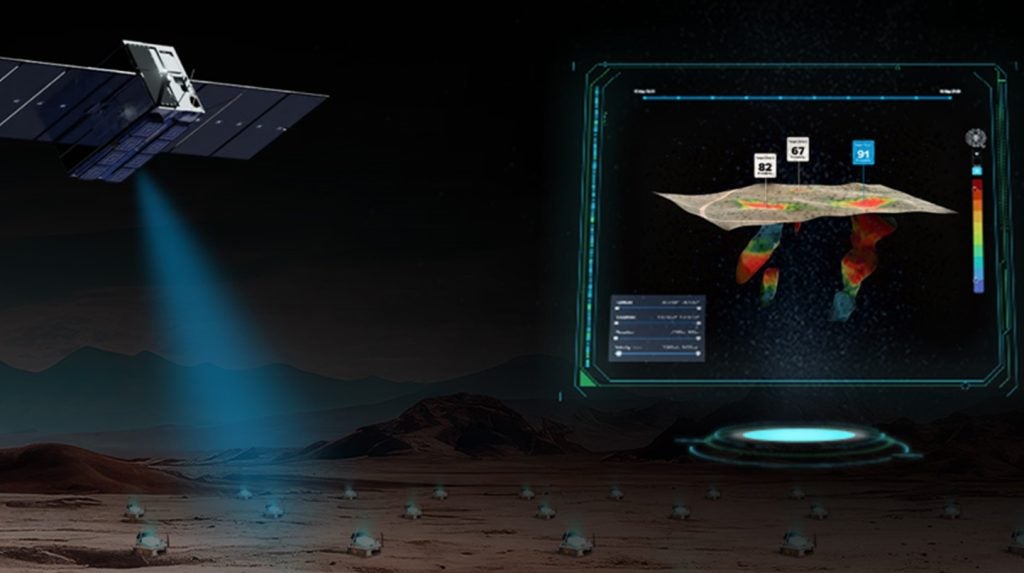

ATEX intends to allocate the proceeds towards the exploration activities of the Valeriano copper-gold project in the Atacama Region, Chile, and for general corporate purposes.

Each unit offered by ATEX includes one common share and half of one common share purchase warrant, with each warrant allowing the acquisition of an additional common share at C$2.50 within a five-year period post-closing, subject to certain conditions.

The expected closing date is on or about 30 October 2024, contingent on predefined conditions.

Furthermore, ATEX has announced plans to repay its credit facility's outstanding balance by issuing equity.

Upon closing, Agnico Eagle will also secure investor rights in ATEX, conditional upon maintaining specific ownership levels.

ATEX president and CEO Ben Pullinger said: “We are excited to welcome Agnico as a strategic investor. Agnico is recognised as one of the preeminent mining companies in the world, and importantly, has significant large-scale underground operating experience.

“This transaction results in ATEX being well-capitalised through 2025 to execute on our future drill programmes and to continue defining this deposit while also continuing to de-risk and conduct engineering studies.

“Agnico is a partner of choice within the mining industry, recognised globally for its leading practices, and we are proud to have them as a strategic investor.”

Located in the Huasco Province of the Atacama Region, the Valeriano project site is situated approximately 151km south-east of the City of Vallenar.

The large copper-gold porphyry deposit at the project is hosted below a near-surface oxidised epithermal gold deposit.